Results for “department why not” 187 found

Why law associates work so hard

I have learned a new mechanism to explain the organization of knowledge-based, client-intensive partnerships:

From the property rights perspective, large law firms are poorly suited to sustaining employment relationships because they have no enforceable means of controlling the firm’s key knowledge asset–client relationships. The up-or-out partnership systems that have evolved over time in these firms offer an awkward but workable resolution to this problem. By restricting partnership size to maximize surplus per partner and by making senior attorneys residual claimants, law firms limit the opportunity for sub-groups of partners to grab and leave with the firm’s clients. This action, however, creates additional demand for inexperienced associates who serve as (imperfect) substitutes for their more experienced counterparts. The result is that more associates are hired than can be promoted into a stable partnership. Those associates who do not succeed outgoing partners will be dismissed before they acquire sufficient client knowledge to themselves pose a threat of grabbing and leaving. That law firms find it worthwhile to commit to the costly practice of firing qualified attorneys in order to retain control over client relationships points to the general importance of control over assets in more conventional employment relationships.

The property rights model, in contrast to other explanations, can explain the coincidence of up-or-out promotion rules and partnerships in large law firms. At the root of our model is the claim that law firms cannot rely upon legal mechanisms to establish control over client relationships. We demonstrate that this is, in fact, the case under U.S. law. In addition, the property rights model suggests two propositions that are supported by the available historical, institutional and econometric evidence: (1) up-or-out appeared first in large corporate law firms who specialized in delivering large scale, complex legal services to valuable, long-term clients, and (2) large law firms practice a style of law that limits contact between associates and clients. Finally, the property rights model can account for the otherwise anomalous absence of up-or-out personnel policies in government agencies and large corporate litigation departments [TC: I like this latter point].

Here is the paper. Here is another version with abstract.

Market Failure? Academic Departments

The Angry Professor describes a new budgeting system at LSU:

Several years ago LSU moved to a business model budget. Under this

model, each department has control over its own funds. We might choose,

for example, to give everyone a big raise. Or, we might choose to hire

new faculty. We might purchase equipment, or furniture.As

with all such schemes, the administration makes sure that they will get

money from somewhere to sustain their bloated salaries. Each department

pays a "tax" to the college, which is determined by enrollments and

indirects as earned in "Year Zero" (the year before the new budget took

effect). If the department fails to generate at least the enrollments

and indirects earned in this year, the college will take the shortfall

out of the departmental budget. We’re not talking about that funny fake

money that colleges usually shuffle around, but real dollars: my

raises.

Some good things have come out this arrangement:

My department and several others have taken

advantage of the new model by "firing" the custodial staff provided by

Physical Facilities and hiring a private contractor to keep the

bathrooms looking spiffy. I must say, the bathroom has never looked

cleaner, and my office carpet has been vacuumed for the first time in

several years.

But, of course, the Angry Professor is angry.

In the social sciences, every department is trying to offer

statistics courses in house, so we now have about 8 courses titled

"Introduction to Statistics in [insert department name here]."

But why doesn’t the Coase Theorem and comparative advantage apply? The problem here can’t be the budgeting. I suspect a lack of property rights.

Each department is now in direct competition with every other for undergraduate enrollments.

Sounds good to me but the Angry Professor has a rebuttal:

The marginal departments, the ones with the

lowest possible academic standards, are pulling in vast numbers of warm

bodies and the tuition dollars associated with them. The departments that formerly only provided degrees to the football players are now thriving.

But grade inflation and the incentive to take easy courses in easy departments is nothing new, the only difference is that now the easy departments have funding commensurate with enrollments. The bottom line, therefore, is that the angry professor is angry at the students for not choosing classes more wisely.

A better grading system that takes into account the fact that some departments and professors grade easier than others would help students to make better choices. It’s not obvious to me, however, that on the whole the students aren’t making rational choices.

Thanks to Tom Slee for the pointer. I hope to say more about his interesting new book, No one Makes You Shop at Wal-Mart, in the future. Contrary to the title it’s about how markets fail, not a defense of Wal-Mart!

Futures markets in everything, NOT

A Wall Street lawyer gave new meaning to the term

"futures market" when he tried to auction his future Social Security

checks – money did doesn’t now have – on eBay for $200,000 so he could

use the cash for a down payment on a Manhattan apartment."I’ve put a lot of money into the Social Security system, so why can’t I sell it to someone else?" mused Thaddeus Wojcik.

File that under "Department of HA!." Ebay yanked the auction. Here is the full story, and thanks to Chris D. for the pointer.

Department of Yikes

Two teams of federal and university scientists announced today that they had resurrected the 1918 influenza virus, the cause of one of history’s most deadly epidemics, and had found that unlike the viruses that caused more recent flu pandemics of 1957 and 1968, the 1918 virus was actually a bird flu that jumped directly to humans.

The work, being published in the journals Nature and Science, involved getting the complete genetic sequence of the 1918 virus, using techniques of molecular biology to synthesize it, and then using it to infect mice and human lung cells in a specially equipped, secure lab at the Centers for Disease Control and Prevention in Atlanta.

The findings, the scientists say, reveal a small number of genetic changes that may explain why the virus was so lethal. The work also confirms the legitimacy of worries about the bird flu viruses that are now emerging in Asia.

The new studies find that today’s bird flu viruses share some of the crucial genetic changes that occurred in the 1918 flu. The scientists suspect that with the 1918 flu, changes in just 25 to 30 out of about 4,400 amino acids in the viral proteins turned the virus into a killer. The bird flus, known as H5N1 viruses, have a few, but not all of those changes.

Here is the full story, which contains many other points of interest, including whether the sequencing should have been done in the first place. In case you forgot, 1918 was the flu pandemic which killed 50 to 100 million people, and don’t think we are so much better protected in 2005. Today I started writing my piece on what we should do about avian flu.

Why do intellectuals oppose capitalism?

This essay by the deceased Robert Nozick has a few years on it, but I never knew there was an on-line version. It is the best piece I know on why so many intellectuals oppose capitalism. See my earlier blog post on the inability of some researchers to find a single registered Republican within some departments of MIT and other universities (of course Republicans commonly fail capitalism but I suspect that is not the objection of the MIT faculty). With thanks to Cato, Newmarksdoor, and BrianMicklethwait.com.

Here is one excellent sentence of many:

“The intellectual wants the whole society to be a school writ large.”

Get Out of Jail Cards, 2

“Courtesy cards,” are cards given out by the NYC police union (and presumably elsewhere) to friends and family who use them to get easy treatment if they are pulled over by a cop. I was stunned when I first wrote about these cards in 2018. I thought this was common only in tinpot dictatorships and flailing states. The cards even come in levels, gold, silver and bronze!

A retired police officer on Quora explains how the privilege is enforced:

The officer who is presented with one of these cards will normally tell the violator to be more careful, give the card back, and send them on their way.

…The other option is potentially more perilous. The enforcement officer can issue the ticket or make the arrest in spite of the courtesy card. This is called “writing over the card.” There is a chance that the officer who issued the card will understand why the enforcement officer did what he did, and nothing will come of it. However, it is equally possible that the enforcement officer’s zeal will not be appreciated, and the enforcement officer will come to work one day to find his locker has been moved to the parking lot and filled with dog excrement.

A NYTimes article discusses the case of Mathew Bianchi, a traffic cop who got sick of letting dangerous speeders go when they presented their cards.

By the time he pulled over the Mazda in November 2018, drivers were handing Bianchi these cards six or seven times a day. (!!!, AT)

…[He gives the ticket]…The month after he stopped the Mazda, a high-ranking police union official, Albert Acierno, got in touch. He told Bianchi that the cards were inviolable. He then delivered what Bianchi came to think of as the “brother speech,” saying that cops are brothers and must help each other out. That the cards were symbols of the bonds between the police and their extended family and friends.

Bianchi was starting to view the cards as a different kind of symbol: of the impunity that came with knowing someone on the force, as if New York’s rules didn’t apply to those with connections. Over the next four years, he learned about the unwritten rules that have come to hold sway in the Police Department.

Bianchi is reassigned, given shit jobs, isn’t promoted etc. Mayor Adams and police chief Chief Maddrey protect this utterly corrupt system.

Top MR Posts of 2023

This was the year of AI; including the top post from Tyler, Existential risk, AI, and the inevitable turn in human history but also highly ranked were my posts AGI is Coming and AI Worship and Tyler’s GPT and my own career trajectory. Also our paper, How to Learn and Teach Economics with Large Language Models, Including GPT has now been downloaded more than ten thousand times.

2. Second most popular post was The Extreme Shortage of High IQ Workers

5. *GOAT: Who is the Greatest Economist of all Time, and Why Does it Matter?*

6. Matt Yglesias on depression and political ideology which pairs well with another highly-ranked Tyler post, So what is the right-wing pathology then? and also Classical liberals are increasingly religious.

7. Can the SVB crisis be solved in the longer run?

8. Substitutes Are Everywhere: The Great German Gas Debate in Retrospect

9. My paean to Costco.

10. Is Bach the greatest achiever of all time?

11. The Real Secret of Blue Zones

12. SpaceX Versus the Department of Justice

13. What does it mean to understand how a scientific literature is put together?

14. In Praise of the Danish Mortgage System

15. Great News for Female Academics!

Finally, don’t forget Tyler’s posts Best non-fiction books of 2023, Favorite fiction books of 2023, and Favorite non-classical music.

What were your favorite posts/articles/books/music/movies of 2023?

The University presidents

Here is three and a half minutes of their testimony before Congress. Worth a watch, if you haven’t already. I have viewed some other segments as well, none of them impressive. I can’t bring myself to sit through the whole thing.

I don’t doubt that I would find their actual views on world affairs highly objectionable, but that is not why I am here today. Here are a few other points:

1. Their entire testimony is ruled by their lawyers, by their fear that their universities might be sued, and their need to placate internal interest groups. That is a major problem, in addition to their unwillingness to condemn various forms of rhetoric for violating their codes of conduct. As Katherine Boyle stated: “This is Rule by HR Department and it gets dark very fast.”

How do you think that affects the quality of their other decisions? The perceptions and incentives of their subordinates?

2. They are all in a defensive crouch. None of them are good on TV. None of them are good in front of Congress. They have ended up disgracing their universities, in front of massive audiences (the largest they ever will have?), simply for the end goal of maintaining a kind of (illusory?) maximum defensibility for their positions within their universities. At that they are too skilled.

How do you think that affects the quality of their other decisions? The perceptions and incentives of their subordinates?

What do you think about the mechanisms that led these particular individuals to be selected for top leadership positions?

3. Not one came close to admitting how hypocritical private university policies are on free speech. You can call for Intifada but cannot express say various opinions about trans individuals. Not de facto. Whether you think they should or not, none of these universities comes close to enforcing “First Amendment standards” for speech, even off-campus speech for their faculty, students, and affiliates.

What do you think that says about the quality and forthrightness of their other decisions? Of the subsequent perceptions and incentives of their subordinates?

What do you think about the mechanisms that led this particular equilibrium to evolve?

Overall this was a dark day for American higher education. I want you to keep in mind that the incentives you saw on display rule so many other parts of the system, albeit usually invisibly. Don’t forget that. These university presidents have solved for what they think is the equilibrium, and it ain’t pretty.

Malthus was smarter than you think, vice and prostitution edition

That is a passage from my new book GOAT: Who is the Greatest Economist of all Time and Why Does it Matter?

So one way to read Malthus is this: if a society is going to have any prosperity at all, the people in that society either will be morally quite bad, or they have to be morally very, very good, good enough to exercise that moral restraint. Alternatively, you can read Malthus as seeing two primary goals for people: food and sex. His accomplishment was to show that, taken collectively, those two goals could not easily be obtainable simultaneously in a satisfactory fashion. In late Freudian terms, you could say that eros/sex amounts to the death drive, but again painted on a collective canvas and driven by economic mechanisms.

Malthus also hinted at birth control as an important social and economic force, especially later in 1817, putting him ahead of many other thinkers of his time. Birth control was widely practiced for centuries through a variety of means, and Malthus unfortunately was not very specific. He did call it “unnatural,” and the mainstream theology of his Anglican church condemned it, as did many other churches. But what did he really think? Was this unnatural practice so much worse than the other alternatives of misery and vice that his model was putting forward? Or did Malthus simply fail to see that birth control could be so effective and widespread as it is today? It doesn’t seem we are ever going to know.

From Malthus’s tripartite grouping of vice, moral restraint, and misery, two things should be clear immediately. The first is why Keynes found Malthus so interesting, namely that homosexual passions are one (partial) way out of the Malthusian trap. The second is that there is a Straussian reading of Malthus, namely that he thought moral restraint, while wonderful, was limited in its applicability. So maybe then vice wasn’t so bad after all? Is it not better than war and starvation?

I don’t buy the Straussian reading as a description of what Malthus really meant. But he knew it was there, and he knew he was forcing you to think about just how bad you thought vice really was. Malthus for instance is quite willing to reference prostitution as one possible means to keep down population. He talks about “men,” and “a numerous class of females,” but he worries that those practices “lower in the most marked manner the dignity of human nature.” It degrades the female character and amongst “those unfortunate females with which all great towns abound, more real distress and aggravated misery are perhaps to be found, than in any other department of human life.”

How bad are those vices relative to starvation and population triage? Well, the modern world has debated that question and mostly we have opted for vice. You thus can see that the prosperity of the modern world does not refute Malthus. We faced the Malthusian dilemma and opted for one of his options, namely vice. It’s just that a lot of us don’t find those vices as morally abhorrent as Malthus did. You could say we invented another technology that (maybe) does not suffer from diminishing returns, namely improving the dignity and the living conditions those who practice vice. Contemporary college dorms seem pretty comfortable, and they have plenty of birth control, and of course lots of vice in the Malthusian sense. While those undergraduates might experience high rates of depression and also sexual violation, that life of vice still seems far better than life near the subsistence point. I am not sure what Malthus would think of college dorm sexual norms (and living standards!), but his broader failing was that he did not foresee the sanitization and partial moral neutering of what he considered to be vice.

Written by me, recommended, and open source at the above link.

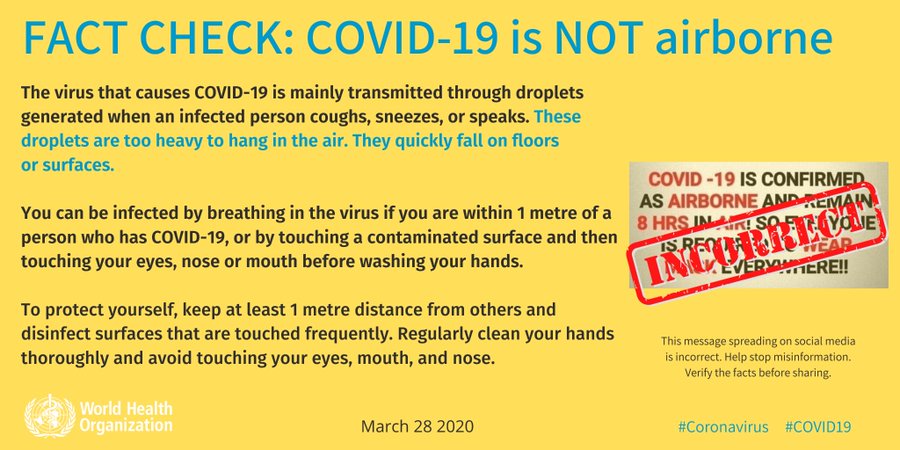

A Genius Award for Airborne Transmission

One of the strangest aspects of the pandemic was the early insistence by the WHO and the CDC that COVID was not airborne. “FACT: #COVID19 is NOT airborne.” the WHO tweeted on March 28, 2020, accompanied by a large graphic (at right). Even at that time, there was plenty of evidence that COVID was airborne. So why was the WHO so insistent that it wasn’t?

One of the strangest aspects of the pandemic was the early insistence by the WHO and the CDC that COVID was not airborne. “FACT: #COVID19 is NOT airborne.” the WHO tweeted on March 28, 2020, accompanied by a large graphic (at right). Even at that time, there was plenty of evidence that COVID was airborne. So why was the WHO so insistent that it wasn’t?

Ironically, some of the resistance to airborne transmission can be traced back to a significant achievement in epidemiology. Namely, John Snow’s groundbreaking arguments that cholera was spread through water and food, not bad air (miasma). Snow’s theory took time to be accepted but when the story of germ theory’s eventual triumph came to be told, the bad air proponents were painted as outdated and ignorant. This sentiment was so pervasive among physicians and health officials that anyone suggesting airborne transmission of disease was vaguely suspect and tainted. Hence, the WHOs and CDCs readiness to label airborne transmission as dangerous, unscientific “misinformation” promulgated on social media (see the graphic). In reality, of course, the two theories were not at odds as one could easily accept that some germs were airborne. Indeed, there were experts in the physics of aerosols who said just that but these experts were siloed in departments of physics and engineering and not in medicine, epidemiology and public health.

As a result of this siloing, we lost time and lives by telling people that they were fine if they kept to the 6ft “rule” and washed their hands, when what we should have been telling them was open the windows, clean the air with UVC, and get outside. Windows not windex.

Linsey Marr at Virginia Tech was one of the aerosol experts who took a prominent role in publicly opposing the WHO guidance and making the case for aerosol transmission (Jose-Luis Jimenez was another important example). Thus, it’s nice to see that Marr is among this year’s MacArthur “genius” award winners. A good interview with Marr is here.

It didn’t take a genius to understand airborne transmission but it took courage to put one’s reputation on the line and go against what seemed like the scientific consensus. Marr’s award is thus an award to a scientist for speaking publicly in a time of crisis. I hope it encourages others, both to speak up when necessary but also to listen.

Addendum: I didn’t take part in the aerosol debates but my wife, who has done research in aerosols and germs, told me early on that “of course COVID is airborne!” Wisely, I chose to take the word of my wife over that of the WHO and CDC.

Disputes over China and structural imbalances

There has been some pushback on my recent China consumption post, so let me review my initial points:

There exists a view, found most commonly in Michael Pettit (and also Matthew Klein), that suggests economies can have structural shortfalls of consumption in the long run and outside of liquidity traps.

My argument was that this view makes no sense, it is some mix of wrong and “not even wrong,” and it is not supported by a coherent model. If need be, relative prices will adjust to restore an equilibrium. If relative prices are prevented from adjusting, the actual problem is not best understood as a shortfall of consumption, and will not be fixed by a mere expansion of consumption.

Note that people who promote this view love the word “absorb,” and generally they are reluctant to talk much about relative price adjustments, or even why those price adjustments might not take place.

You will note Pettis claims Germany suffers from a similar problem, America too though of course the inverse version of it. So whatever observations you might make about China, the question remains whether this model makes sense more generally. (And Australia, which ran durable trade deficits from the 1970s to 2017, while putting in a strong performance, is a less popular topic.)

Pettis even has claimed that “US business investment is constrained by weak demand rather than costly capital”, and that is from April 4, 2023 (!).

It would take me a different blog post to explain how someone might arrive at such a point, with historic stops at Hobson, Foster, and Catchings along the way, but for now just realize we’re dealing with a very weird (and incorrect) theory here. I will note in passing that the afore-cited Pettis thread has other major problems, not to mention a vagueness about monetary policy responses, and that rather simply the main argument for current industrial policy is straightforward externalities, not convoluted claims about how foreign and domestic investment interact.

Pettis also implicates labor exploitation as a (the?) major factor behind trade surpluses, and furthermore he considers this to be a form of “protectionism.” Now you can play around with scholar.google.com, or ChatGPT, all you want, and you just won’t find this to be the dominant theory of trade surpluses or even close to that. As a claim, it is far stronger than what a complex literature will support, noting there is a general agreement that lower real wages (ceteris paribus) are one factor — among many — that can help exports. This point isn’t wrong as a matter of theory, it is simply a considerable overreach on empirical grounds. Of course, if Pettis has a piece showing statistically that a) there is a meaningful definition of labor exploitation here, and b) it is a much larger determinant of trade surpluses than the rest of the profession seems to think…I would gladly read and review it. Be very suspicious if you do not see such a link appear!

Another claim from Pettis that would not generate widespread agreement is: “…in an efficient, well-managed, and open trading system, large, persistent trade imbalances are rare and occur in only a very limited number of circumstances.” (see the above link) That is harder to test because arguably the initial conditions never are satisfied, but it does not represent the general point of view, which among other things, considers persistent differences in time preferences and productivities across nations.

Now, it does not save all of this mess to make a series of good, commonsense observations about China, as Patrick Chovanec has done (Say’s Law does hold in the medium-term, however). And as Brad Setser has done.

In fact, those threads (and their citation) make me all the more worried. There is not a general realization that the underlying theory does not make sense, and that the main claim about the determinants of trade surpluses is wrong, and that it requires a funny and under-argued tracing of virtually all trade imbalances to pathology. And to be clear, this is a theory that only a small minority of economists is putting forward. I am not the dissident here, rather I am the one delivering the bad news.

So the theory is wrong, and don’t let commonsense, correct observations about China throw you off the scent here.

Great News for Female Academics!

For decades female academics have been told that the deck is stacked against them by discrimination in hiring, funding, journal acceptances, recommendation letters and more. It’s dispiriting to be told that your career is not under your control and that, no matter what you do, you face an unfair, uphill battle. Why would any woman want to be a scientist when they are told things like this:

A vast literature….shows time after time, women in science are deemed to be inferior to men and are evaluated as less capable when performing similar or even identical work. This systemic devaluation of women women results in an array of real consequences: shorter, less praise-worth letters of recommendation, fewer research grants, awards and invitations to speak at conferences; and lower citation rates for their research…

The good news is that this depressing and dispiriting story isn’t true! In an extensive survey, meta-analysis, and new research, Ceci, Kahn and Williams show that the situation for women in academia is in many domains good to great. For example, in hiring for tenure the evidence is strong that women are advantaged. Moreover, women are advantaged especially in fields where they have relatively low representation (GEMP: geosciences, engineering, economics, mathematics/computer science, and physical science).

Among political scientists, Schröder et al. (2021) found that female political scientists had a 20% greater likelihood of obtaining a tenured position than comparably accomplished males in the same cohort after controlling for personal characteristics and accomplishments (publications, grants, children, etc.). Lutter and Schröder (2016) found that women needed 23% to 44% fewer publications than men to obtain a tenured job in German sociology departments.

…In summary, all of the seven administrative reports reveal substantial evidence that women applicants were at least as successful as and usually more successful than male applicants were—particularly in GEMP fields.

…In a natural experiment, French economists used national exam data for 11 fields, focusing on PhD holders who form the core of French academic hiring (Breda & Hillion, 2016). They compared blinded and nonblinded exam scores for the same men and women and discovered that women received higher scores when their gender was known than when it was not when a field was male dominant (math, physics, philosophy), indicating a positive bias, and that this difference strongly increased with a field’s male dominance. Specifically, women’s rank in male-dominated fields increased by up to 40% of a standard deviation. In contrast, male candidates in fields dominated by women (literature, foreign languages) were given a small boost over expectations based on blind ratings, but this difference was small and rarely significant.6

The situation is also very good in grant funding and journal acceptance rates which are either not biased or biased towards women. Similarly, “no persuasive evidence exists for the claim of antifemale bias in academic letters of recommendation.”

There is evidence of bias in student evaluations. Both female and male students rate male professors higher, even in situations where names are known but actual gender is blinded. Male students are more likely to write nasty comments. Most research universities, in my experience, don’t put much weight on student teaching evaluations, beyond do you pass a fairly low bar, but it can be disconcerting to get nasty comments.

There is also mild evidence of differences in salary, although less so when productivity is taken into account.

Some critics will say, but the real discrimination happens before a women applies for a tenure track job! Maybe so but that is a shifting of goal posts and we should take pride in the fact that in the United States today (and most developed countries) there is very little bias against women in high stakes, important decisions in tenure track hiring, journal acceptances, grant funding and so forth. This is a major accomplishment.

It should be noted that the Ceci, Kahn and Williams paper is an adversarial collaboration; Ceci and Williams have published previous work showing that women are, generally speaking, not discriminated against in academia while:

Kahn has a long history of revealing gender inequities in her field of economics, and her work runs counter to Ceci and Williams’s claims of gender fairness. Kahn was an early member of the American Economics Association’s Committee on the Status of Women in the Economics Profession (CSWEP). Articles of hers in the American Economics Review (Kahn, 1993) and in the Journal of Economic Perspectives (Kahn, 1995) were the first publications on the status of women in the economics profession. She was the first to identify gender inequities as a concern in economics, something she has revisited every decade since then in her publications. In 2019, she co-organized a conference on women in economics, and her most recent analysis in 2021 found gender inequities persisting in tenure and promotion in economics (Ginther & Kahn, 2021). In short, gender bias in academia has been a long-standing passion of Kahn’s. Her findings diverge from Ceci and Williams’s, who have published a number of studies that have not found gender bias in the academy, such as their analyses of grants and tenure-track hiring in Proceedings of the National Academy of Sciences (PNAS; Ceci & Williams, 2011; Williams & Ceci, 2015).

The Ceci, Kahn, and Williams paper covers much more material than I can cover here and is nuanced so read the whole thing but do also shout the good news from the rooftops!

My Conversation with Glenn Loury

Moving throughout, here is the audio, video, and transcript. Here is part of the summary:

Economist and public intellectual Glenn Loury joined Tyler to discuss the soundtrack of Glenn’s life, Glenn’s early career in theoretical economics, his favorite Thomas Schelling story, the best place to raise a family in the US, the seeming worsening mental health issues among undergraduates, what he learned about himself while writing his memoir, what his right-wing fans most misunderstand about race, the key difference he has with John McWhorter, his evolving relationship with Christianity, the lasting influence of his late wife, his favorite novels and movies, how well he thinks he will face death, and more.

Here is one excerpt:

COWEN: What’s your favorite Thomas Schelling story?

LOURY: [laughs] This is a story about me as much as it is about Tom Schelling. The year is 1984. I’ve been at Harvard for two years. I’m appointed a professor of economics and of Afro-American studies, and I’m having a crisis of confidence, thinking I’m never going to write another paper worth reading again.

Tom is a friend. He helped to recruit me because he was on the committee that Henry Rosovsky, the famous and powerful dean of the college of the Faculty of Arts and Sciences at Harvard, who hired me — the committee that Rosovsky put together to try to find someone who could fill the position that I was hired into: professor of economics and of Afro-American Studies. They said Afro-American in those years.

Tom was my connection. He’s the guy who called me up when I was sitting at Michigan in Ann Arbor in early ’82, and said, “Do you think you might be interested in a job out here?” He had helped to recruit me.

So, I had this crisis of confidence. “Am I ever going to write another paper? I’m never going to write another paper.” I’m saying this to Tom, and he’s sitting, sober, listening, nodding, and suddenly starts laughing, and he can’t stop, and the laughing becomes uncontrollable. I am completely flummoxed by this. What the hell is he laughing at? What’s so funny? I just told him something I wouldn’t even tell my wife, which is, I was afraid I was a failure, that it was an imposter syndrome situation, that I could never measure up.

Everybody in the faculty meeting at Harvard’s economics department in 1982 was famous. Everybody. I was six years out of graduate school, and I didn’t know if I could fit in. He’s laughing, and I couldn’t get it. After a while, he regains his composure, and he says, “You think you’re the only one? This place is full of neurotics hiding behind their secretaries and their 10-foot oak doors, fearing the dreaded question, ‘What have you done for me lately?’ Why don’t you just put your head down and do your work? Believe me, everything will be okay.” That was Tom Schelling.

COWEN: He was great. I still miss him.

And the final question:

COWEN: Very last question. Do you think you will do a good job facing death?

Interesting and revealing throughout.

Are macroeconomic models true only “locally”?

That is the theme of my latest Bloomberg column, here is one excerpt:

It is possible, contrary to the predictions of most economists, that the US will get through this disinflationary period and make the proverbial “soft landing.” This should prompt a more general reconsideration of macroeconomic forecasts.

The lesson is that they have a disturbing tendency to go wrong. It is striking that Larry Summers was right two years ago to warn about pending inflationary pressures in the US economy, when most of his colleagues were wrong. Yet Summers may yet prove to be wrong about his current warning about the looming threat of a recession. The point is that both his inflation and recession predictions stem from the same underlying aggregate demand model.

You will note that yesterday’s gdp report came in at 2.9%, hardly a poor performance. And more:

It is understandable when a model is wrong because of some big and unexpected shock, such as the war in Ukraine. But that is not the case here. The US might sidestep a recession for mysterious reasons specific to the aggregate demand model. The Federal Reserve’s monetary policy has indeed been tighter, and disinflations usually bring high economic costs.

It gets more curious yet. Maybe Summers will turn out to be right about a recession. When recessions arrive, it is often quite suddenly. Consulting every possible macroeconomic theory may be of no help.

Or consider the 1990s. President Bill Clinton believed that federal deficits were too high and were crowding out private investment. The Treasury Department worked with a Republican Congress on a package of fiscal consolidation. Real interest rates fell, and the economy boomed — but that is only the observed correlation. The true causal story remains murky.

Two of the economists behind the Clinton package, Summers and Bradford DeLong, later argued against fiscal consolidation, even during the years of full employment under President Donald Trump [and much higher national debt]. The new worry instead was secular stagnation based on insufficient demand, even though the latter years of the Trump presidency saw debt and deficits well beyond Clinton-era levels.

The point here is not to criticize Summers and DeLong as inconsistent. Rather, it is to note they might have been right both times.

And what about that idea of secular stagnation — the notion that the world is headed for a period of little to no economic growth? The theory was based in part on the premise that global savings were high relative to investment opportunities. Have all those savings gone away? In most places, measured savings rose during the pandemic. Yet the problem of insufficient demand has vanished, and so secular stagnation theories no longer seem to apply.

To be clear, the theory of secular stagnation might have been true pre-pandemic. And it may yet return as a valid concern if inflation and interest rates return to pre-pandemic levels. The simple answer is that no one knows.

Note that Olivier Blanchard just wrote a piece “Secular Stagnation is Not Over,” well-argued as usual. Summers, however, has opined: “we’ll not return to the era of secular stagnation.” I was not present, but I can assume this too was well-argued as usual!

The culture that is New Jersey

The digital alerts that debuted on Garden State highway signs last month may have displayed a bit too much Jersey attitude.

As of Wednesday afternoon, messages such as “Get your head out of your apps” and “mash potatoes — not your head” are no longer visible on the New Jersey Department of Transportation’s network of 215 permanent digital alert signs throughout the state. Similar messages have been used in other states, including Utah, Pennsylvania, Delaware, California, and Tennessee.

“The FHWA [Federal Highway Administration] has instructed us to cease posting these creative safety messages,” Stephen Schapiro, NJDOT’s press manager, said in an email Wednesday afternoon.

In a statement, the FHWA said that it “is aware of the changeable message signs and has reached out to NJDOT.” Representatives from FHWA did not comment on why New Jersey was told to stop using the messages.

Here is the full story, via Mike Doherty.