Results for “cuba” 191 found

Friday assorted links

1. Should we have a new national holiday, Freedom Day?

2. Airbnb is now available in Cuba, how is it looking for New York City?

3. There is no great Easter bunny stagnation.

4. Jose da Silva Lopes has passed away, good jokes at the Krugman link too, befitting the man’s sense of humor.

Happy New Year!

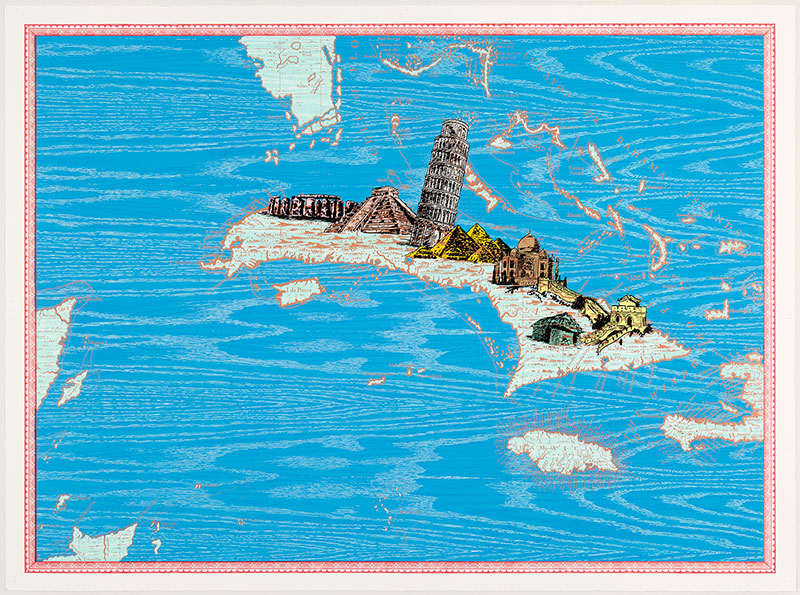

The piece is by Ibrahim Miranda. Here is a painting by Ruperto Jay Matamoros, my favorite Cuban painter. Here are further paintings by Matamoros. Here is an on-line gallery of Cuban art.

Pakistan’s burgeoning tech scene

Just two months ago, e-commerce company Markhor, which works with local artisans to produce high-quality men’s leather shoes, became Pakistan’s most successful Kickstarter campaign, raising seven times more than its intended goal, catching the attention of Seth Godin and GOOD Magazine.

There is no greater evidence of this positive change than in Pakistan’s burgeoning technology ecosystem. In a new report released by my company, Invest2Innovate – which was commissioned by the World Bank’s Consultative Group to Assist the Poor (CGAP) – we mapped the number of startup competitions, incubators, university programs, coworking spaces and forums, and analyzed the gaps and challenges entrepreneurs continue to face in the country.

Three years ago, the ecosystem was relatively nascent, with just a handful of organizations. Today, the space is unrecognizable and brimming with constant energy and activity.

That is from Kalsoom Lakhani, there is more of interest here. Here is my earlier post on Pakistan as an underrated economy.

Assorted links

1. Don’t let your Texas plumber truck end up in the Syrian war.

2. An outsider looks at the upcoming AEA job market. And Yakut ponies are cold.

3. The best book covers of 2014?

4. Vera Te Velde says visit Cuba now. And Daniel Drezner on Cuba.

5. Mobile phone data and African food consumption.

6. “There is such negativity about clouds written into our language…” And don’t be too shocked: “Half of Cloud Appreciation Society members – the group celebrates its 10th anniversary next year – are British.”

7. Jonathan R. Macey on the Bebchuk/SEC kerfluffle (I agree with him).

Digital Non-Cash

In the United States we are using advanced technology like fingerprint scans to pay for goods. In Venezuela they are using advanced technology like fingerprint scans to ration goods. Here is the WSJ:

Amid worsening shortages, Venezuela recently reached a milestone of dubious distinction: It has joined the ranks of North Korea and Cuba in rationing food for its citizens.

…Under the system in place here, basic price-controlled items—including milk, rice, coffee, toothpaste, chicken and detergent—are rationed, with the fingerprinting machine used to ensure that a shopper doesn’t return over and over to stock up.

The stark contrast between our advanced technology and our primitive ethics has often been noted. Our advanced technology also stands in stark contrast to our primitive economics. Sadly, the problem is not only in Venezuela. Here is the WSJ (!) “explaining” the shortages:

Venezuela is turning to rationing because of shortages caused by what economists call a toxic mix of unproductive local industry—hamstrung by nationalizations and government intervention—and a complex currency regime that is unable to provide the dollars importers need to pay for basics.

No, no, no, a thousand times no! (And I very much doubt that is what the economists told the reporter.) Nationalizations, the currency regime, unproductive industry, Venezuela has many problems but shortages are caused by price controls.

Check out this wonderful photograph and the face of the customer.

What I’ve been listening to

Here is what has been sticking with me most so far this year, this list is drawn from full recordings rather than individual songs:

1. Sd Laika, That’s Harakiri, a new sound world, best on vinyl.

2. Calypso: Musical Poetry in the Caribbean 1955-1969, best on vinyl.

3. Shostakovich string quartets, Pacifica Quartet. The best versions of these ever? Very Soviet-sounding, muscular in approach, totally bleak.

4. Complete Haydn string quartets, Mosaiques Quartet. My favorite of all the complete recordings of these.

5. Mala, Mala in Cuba. Think Buena Vista Social Club for dubstep fans.

6. Deafheaven, Sunbather. “Black metal for people who don’t like black metal.” Alternatively, “Serving as an artistic lucid dream of warmth despite the stinging pain of life’s cruel idealism.”

7. Dick Hyman’s Century of Jazz Piano, five CDs, quite familiar music, some of it corny even, nonetheless these remain remarkable pieces and they are impeccably played. A joy of rediscovery.

Lots more Benjamin Britten, including String Quartet #3, and many versions of Mahler’s Sixth.

Facts about Latino children

Accepting 60,000 children in a population of 317.2 million — less than two hundred-tenths of 1 percent (.02 percent) of our population — would hardly be straining our resources.

Despite the vast differences in wealth and resources between our country and those of Lebanon, Jordan and even Iran, which currently has one of the world’s largest refugee populations, the end-of-the-world scenarios proffered by some ring of hyperbole.

At a time when we were a more generous, caring nation, we brought 14,000 children into the United States from Cuba under Operation Peter Pan. In 1966, we flew 266,000 Cuban men, women and children into the United States from the Port of Camarioca. At the time, those 266,000 Cubans represented .14 percent of our population, seven times the number of migrants we are talking about today.

That is from Ira Kurzban, via Timothy Ogden.

Facts about fame (in praise of college towns)

From Seth Stephens-Davidowitz in today’s NYT:

Roughly one in 2,058 American-born baby boomers were deemed notable enough to warrant a Wikipedia entry. About 30 percent made it through art or entertainment, 29 percent through sports, 9 percent through politics, and 3 percent through academia or science.

…Roughly one in 1,209 baby boomers born in California reached Wikipedia. Only one in 4,496 baby boomers born in West Virginia did. Roughly one in 748 baby boomers born in Suffolk County, Mass., which contains Boston, made it to Wikipedia. In some counties, the success rate was 20 times lower.

…I closely examined the top counties. It turns out that nearly all of them fit into one of two categories.

First, and this surprised me, many of these counties consisted largely of a sizable college town. Just about every time I saw a county that I had not heard of near the top of the list, like Washtenaw, Mich., I found out that it was dominated by a classic college town, in this case Ann Arbor, Mich. The counties graced by Madison, Wis.; Athens, Ga.; Columbia, Mo.; Berkeley, Calif.; Chapel Hill, N.C.; Gainesville, Fla.; Lexington, Ky.; and Ithaca, N.Y., are all in the top 3 percent.

Why is this? Some of it is probably the gene pool: Sons and daughters of professors and graduate students tend to be smart. And, indeed, having more college graduates in an area is a strong predictor of the success of the people born there.

But there is most likely something more going on: early exposure to innovation. One of the fields where college towns are most successful in producing top dogs is music. A kid in a college town will be exposed to unique concerts, unusual radio stations and even record stores. College towns also incubate more than their expected share of notable businesspeople.

African-Americans who grew up around Tuskegee did very well in achieving Wikipedia fame. Yet how much a state spends on education does not seem to matter. And this:

…there was another variable that was a strong predictor of Wikipedia entrants per birth: the proportion of immigrants. The greater the percentage of foreign-born residents in an area, the higher the proportion of people born there achieving something notable. If two places have similar urban and college populations, the one with more immigrants will produce more notable Americans.

The piece is fascinating throughout, and you will note that Seth is a Google data scientist with a Ph.d. in economics from Harvard. His other writings are here. Some of you may wish to see my book What Price Fame?

The Travel Arbitrage Challenge

Chris, a loyal reader (natch), poses the following challenge. He is planning to travel, perhaps to Venezuela, but other countries are open. He’d like to profit from an arbitrage opportunity which could be due to official and un-official exchange rates or it could be a goods-based arbitrage. At one point, for example, you could do quite well bringing condoms to Russia but no longer. Nothing illegal especially on the import side or nothing too illegal. I get the feeling he would go for bringing in Cuban cigars if that were his best bet.

Thus, MR readers, the challenge. What country and what arbitrage?

As for me, I always eat well and get a haircut when I’m in a poor country (thanks Bela Balassa) but that arbitrage won’t pay for the trip. Can you do better?

Why don’t they eat more fish in the Caribbean?

David Lomita, a loyal MR reader, asks me:

I have often wondered why, given that they are a bunch of small islands, that so many of the more famous dishes of Caribbean countries are meat and not fish. The woman of this house is Jamaican and she is much more proud of jerk than of escabeche fish. Puerto Rico has its lechon, Cuban food has ropa de viejo and so on.

I don’t have any data here (though try the incomplete Table 7 in this pdf), but independently I have wondered about a similar question. I see a few possible factors:

1. Often fish are available, and excellent, immediately right near the ocean. Transport and adequate refrigeration are not to be taken for granted. In any case, those dishes won’t always become iconic national recipes. Note also that a lot of the fish consumed will be boiled, spiced, and salted, presumably for health and storage reasons.

2. Food is an energy source, and meat is often superior to fish in this regard, especially for diets which may otherwise lack calories. For the same reason such meals also can be more carbohydrate-heavy than the typical daily diet.

3. Cows, chickens, and pigs are media for savings. Fish are not. Why not invest in some insurance while you are planning your food supply? Keep in mind that local banking systems often do not serve the poor very well. Furthermore it may be easier to own a chicken than to catch a fish. Fishing is low-productivity in many parts of the Caribbean, due to poor knowledge and implementation of aquaculture.

4. Which countries are we talking about? In the wealthier Trinidad and Jamaica, retail fish shops are common (that link is useful more generally) In Barbados, U.S. Virgin Islands, and the Cayman Islands, culinary infrastructure is quite good and there is plenty of wealth. In Haiti and Cuba, the two most populous nations in the Caribbean, economic conditions are dire.

5. Never overlook the heavy hand of government, plus a lack of resource management expertise: “Most of the governments of the islands aim at self-sufficiency in fish production. Some, such as Antigua, try to prohibit exports; others, such as Jamaica and Trinidad, limit imports. All of them are giving more attention to post-harvest practices both at sea and on shore, processing and storage, and to improved marketing and distribution. Many are now more interested in assessment of their resources, and collecting statistics to determine the best management practices to sustain the stocks.”

By the way, here is a very good recent piece on the rising cost of food imports in the Caribbean, especially Jamaica.

Assorted links

1. “Fill the Void” is an excellent social science movie and an excellent movie flat out.

2. Markets in everything: what do you think an LBJ tweet goes for?

3. Is grandpa better off not living with the kids?

4. Update on the German constitutional court and OMT.

5. Cuban funds flopping study.

Immigration, production, and the Rybczynski theorem

Two of the assumptions of some of the pro-immigration arguments, when combined together, strike me as a bit odd. It is commonly claimed for instance that migration to the United States does not lower American wages much if any (I agree by the way, as do most economists). It also is claimed that migration will help us boost our production of capital-intensive goods, such as tech products. Therein lies the tension.

Enter the Rybczynski theorem. The sequence here is as follows. An influx of labor does not lower wages, but it does cause both labor and capital to flow out of the capital-intensive sector and into the labor-intensive sector. Labor-intensive production will rise but capital-intensive production will fall. (If you are wondering about the intuition, consider that prices and wages are remaining fixed. All of the adjustment must take place in terms of quantities, and equalizing marginal product and wage, following the influx of new labor, requires more capital in the labor-intensive sector, thus draining some production from the capital-intensive sector.)

In other words, the core model for constant or near-constant wages, following immigration, also implies that capital-intensive production should fall, following an exogenous influx of labor.

You will note that immigration remains welfare-improving in this model. Still, it is not exactly the deal which has been promised. You also can imagine someone taking a more dynamic perspective and fearing the long-term growth consequences of losing output in the capital-intensive sector. You also now have liberty to wonder if a negative wage effect might mean a stronger rather than weaker case for immigration, given that the capital-intensive sector in the U.S. arguably produces global public goods.

Here is one empirical study of the matter, by Slaughter and Hanson. It supports the predictions of the Rybczynski theorem. Ethan Lewis (pdf) considers the famous Cuban boat lift example, when the influx of immigrants did not lower wages, but he also finds it may have hurt capital goods production in the Miami area. Those results are hardly dispositive, but they don’t exactly throw out the Rybczynski framework either.

To be sure, the Rybczynski theorem is far from self-evidently correct. Prices and wages need not be fixed, especially for a country as large on the global stage as the United States. 2 x 2 x 2 models do not adequately capture the heterogeneity of labor. Even defining “labor-intensive” and “capital-intensive” is fraught with ambiguity when countries do not share all of the same technologies, as illustrated by the debates over the Heckscher-Ohlin theorem (to measure labor-intensity, are we adding up the number of bodies or instead measuring their “effectiveness”?, in which case labor and capital blur together because capital makes labor more effective).

Still, models are useful in organizing our thoughts, and this is a model which I do not see getting much attention. I typically have applied comparative advantage to this question (if more immigrants come, high-skilled citizens are freed up to produce more capital goods), but perhaps the Rybczynski model is also relevant.

I also note that I do not view the primary purpose of this blog as hammering home specific policy conclusions, I would rather put doubts and thought processes on the table. Anyway, maybe this model provides some structure for a better understanding of the trade-offs involved with immigration policy.

I look forward to reading your comments on this issue.

Taxis and the shortest route home (from my email)

I used to drive a taxi. I made a lot of money doing it. I learned very early on to never drive someone to their destination if it was a route they drove themselves, say to their home from the airport, or from their home to work or vice versa. Everyone prides themselves on driving the shortest route but they rarely do. Often people develop a route that is based on need -say going by the day care, or avoiding an intersection where they once had an accident or to avoid driving by an ex’s house or skirting road construction long since resolved- but as they become habituated to it, they fail to reorganize their strategy when their needs change. When I first started driving a cab, I drove the shortest route –always, I’m ethical- but people would accuse me of taking the long way because it wasn’t the way they drove. So, I learned to go their way ending up with a lot less grief and a lot more money. If you’ve ever wondered why a seeming professional cab driver will ask you how to get to your destination, this is why. Going your way means they’ll make more money and they won’t be accused of ripping you off. Not to say that in the beginning, I wasn’t stupid. I’d try to show the customer the route on a map but they’d usually be offended that I was contradicting them. It was to their house, if I’d never been there, how could I possibly know better than they did? In the end, experts they consider themselves to be, people are a tangle of unexamined emotional impulses and illogical responses.

You can read more about quite different topics here. And here is another point:

Oh, and here’s a tip I hope you never need: if your car is ever stolen, your first calls should be to every cab company in the city. You offer a $50 reward to the driver who finds it AND a $50 reward to the dispatcher on duty when the car is found. The latter is to encourage dispatchers on shift to continually remind drivers of your stolen car. Of course you should call the police too but first things first. There are a lot more cabs than cops so cabbies will find it first -and they’re more frequently going in places cops typically don’t go, like apartment and motel complex parking lots, back alleys etc. Lastly, once the car is found, a swarm of cabs will descend and surround it because cabbies, like anyone else, love excitement and want to catch bad guys. Cabbies know a lot of stuff*. I found a traveling shoplifting ring in Phoenix once. Professional shoplifters always take cabs. So do strippers going to work but that’s another story.

Albert O. Hirschman: Life and Work

Albert O. Hirschman has passed away. Hirschman was a deep thinker whose work has been influential in many fields. Most famously with the must-read Exit, Voice and Loyalty. I am also a fan of The Passions and the Interests his study of ideological transformations in the 17th and 18th century which promoted the pursuit of material interests as a way to tame the passions and thus opened the way to capitalism (profitably read alongside McCloskey’s Bourgeois Virtues). Hirschman’s early work in development, on backwards and forwards linkages, is now being rediscovered and formalized. Tyler looks at Hirschman’s work as it relates to development in a video at MRUniversity. Tyler also wrote in 2006:

Albert Hirschman deserves a Nobel Prize in economics. His early work on the unbalanced nature of economic development was pathbreaking. The Rhetoric of Reaction is a brilliant study in intellectual self-deception. As a historian of thought he integrates wonderfully, such as in his study of how commerce shapes mores.

But he would win the Prize for focusing the attention of economists and political scientists on the phenomenon of voice: the ability of consumer or voter complaints to induce improvements in supply. Hirschman was the first modern social scientist to think about this mechanism systematically.

Hirschman first suggested voice gets stronger and more effective when exit is limited. In his (earlier) vision, if you can leave you won’t complain. Fidel Castro understood this and let many Cubans go, although of course they complained from Florida. It is sometimes suggested that in a world of school vouchers fewer parents would show up at the school board meeting. Don’t yap, just yank your kid.

In reality voice often works best when competitive pressures are strong. HBO is more responsive than was East Germany. You are not wasting your time to complain at Wegman’s, or for that matter at this blog. Competition and voice are more likely complements than substitutes. Hirschman admitted and indeed emphasized this point in his later writings.

Here is Paul Krugman on Hirschman….Here is Alex on the topic of voice.

Hirschman also led a fascinating life. He became a professor only late in life after fighting in the Spanish Civil War, volunteering in the French Army and working in Marseilles to help refugees escape the Nazis. His work in development economics was based on field work when field work still meant working in fields.

As he once said of his work and perhaps also of his life:

Attempts to confine me to a specific area make me unhappy.

Daniel Drezner at the FP annually gives out an award he affectionately calls the Albie. It’s an award for

…any book, journal article, magazine piece, op-ed, or blog post published in the [last] calendar year that made you rethink how the world works in such a way that you will never be able “unthink” the argument.

It’s a fitting award to be named for Albert Hirschman whose simple but powerful ideas do indeed cause you to rethink the world and never to see it the same again.

Baumol’s new book on the cost disease

It is self-recommending, here are a few points of relevance:

1. There has been a clear cost disease in most kinds of education and many kinds of medicine, but I blame institutions and laws as much as the intrinsic nature of the product.

2. I do not see the arts as subject to the cost disease very much at all. As for the “live performing arts,” the disease seems to afflict the older and less innovative sectors, such as opera and the symphony. There is plenty of live music these days, it is offered in innovative ways, and much of it is free.

3. Even “the live performing arts” can be broken down into underlying characteristics, many of which show a great deal of recent innovation. For instance the supply of “musical immediacy” has been non-stagnant through YouTube, which often gives you a better glimpse of the performer than you get through nosebleed seats and giant screens. YouTube isn’t “live,” but there is no particular reason to break down the analysis at that level and certainly it is not a sacred category for consumers.

4. In many sectors of the arts, especially music, consumers demand constant turnover of product. Old music becomes “obsolete” — for whatever sociological reasons — and in this sense the sector is creating lots of new value every year. From an “objectivist” point of view they are still strumming guitars with the same speed, but from a subjectivist point of view — the relevant one for the economist – they are remarkably innovative all the time in the battle against obsolescence. A lot of the cost disease argument is actually an aesthetic objection that the art forms which have already peaked — such as Mozart — sometimes have a hard time holding their ground in terms of cost and innovation.

5. In general “cost disease” sectors do not remain constant over time. Agriculture has been unusually stagnant for the last twenty or so years, but it is hardly obvious that this trend will continue for the next century to come and it certainly was not the case for the period 1948-1990, quite the contrary.

6. The stagnancy of one sector may depend on the stagnancy of other sectors in non-transparent ways. “Live music” may seem like it doesn’t change much, but lifting the embargo on Cuba would boost the quantity and quality of my consumption of spectacular concert experiences, as would a non-stop flight to Haiti.

You can buy the book here.

Addendum: Matt Yglesias comments.