Chicago fact of the day

Chicago in 1850 was a muddy frontier town of barely 30,000 people. Within two decades, it was 10 times that size. Within another two decades, that number had tripled. By 1910, Chicago — hog butcher for the world, headquarters of Montgomery Ward, the nerve center of the nation’s rail network — had more than two million residents.

That is Emily Badger on what happened to American boomtowns, via David Levine. p.s. this doesn’t happen any more.

Friday assorted links

1. San Francisco puts strict limits on street delivery robots.

2. How LeBron James is still getting better.

3. A critical look at implicit bias tests.

4. Bryan Caplan argues that education is socially overvalued.

5. Three volumes of David Gordon’s essays and reviews.

*Wonder Beyond Belief: On Christianity*

Imagine a German-born, ethnically Iranian (Sunni?) Muslim — Navid Kermani — wandering around the religious art of Western Europe and telling you what he really thinks, in fairly analytical terms. I am very much enjoying this book, here is one excerpt:

One reason why the zest that Catholic art has for Jesus’s suffering leaves such a bad taste in my mouth is no doubt because I am familiar wit it, and unfamiliar with it, from Shia. I am familiar with it because the celebration of martyrdom in Shia is just as excessive, bordering on the pornographic, and I am unfamiliar with it because, in my grandfather’s faith, which was more influential than any other point of reference in my own religious upbringing, precisely this aspect of Shia played no part, indeed was rejected as folk belief and superstitition, a dissuasion from making the world a better place instead of just lamenting its condition. [Guido] Reni does not glorify pain; he doesn’t show it at all. He accomplishes what other crucifixion scenes only suggest: he transposes suffering from the physical to the metaphysical.

And this:

If the Greatest Master of Sufism claims that the contemplation of God is most perfect in women, the Christians’ images confirm it.

Definitely recommended (for some of you), and I have ordered many more of Kermani’s books.

Favorite popular music from 2017

It’s wrong to call this “popular music,” because most of it isn’t that popular, but we certainly can’t call it rock and roll any more, can we?

First, here are the ones that everyone else recommends too:

Run the Jewels 3, not a let down.

Kendrick Lamar, Damn, a common pick for best of the year.

Tyler the Creator, the album has an obscene name, which I won’t reproduce, but I can list the name of the Creator.

King Krule, Ooz, “The world is a filthy, utterly debased place, his music suggests, but there are rewards of sorts for those determined to survive it. In this spirit, The OOZ drops at our feet like a piece of poisoned fruit, a masterpiece of jaundiced vision from one of the most compelling artists alive.”

Migos, Culture, rap from Atlanta.

Vince Staples, Big Fish Theory, but not theory as they do it as Northwestern.

SZA- Cntrl, from New Jersey, “Her forebears are more Keyshia Cole and Mary J. Blige, who have hurt and have been fearless enough to sing about that hurt…”

Lorde, Melodrama, “the New Zealand century” is gaining on “the Norwegian century.”

Taylor Swift, Reputation. This one is kind of popular.

Perfume Genius, No Shape, “The body has become sturdier, less despotic.”

My summary remark is that I didn’t intend to listen to so much rap/hip-hop, but it remains the most vital genre.

Here are some more original selections:

Jlin, Black Origami, “…a gorgeous and overwhelming piece of musical architecture, an epic treatise on where rhythm comes from and where it can go.”

Juana Molina, Halo. Argentina, avant-garde songstress, vivid vocal and instrumental textures, she has almost abolished lyrics.

The Secret Sisters, You Don’t Own Me Any More, folk for 2017, “They went from opening shows for Bob Dylan and Paul Simon to cleaning houses to make ends meet.”

Django Bates, Saluting Sgt. Pepper. A jazzy, big band, music hall take on the album, works surprisingly well, one of the freshest takes on the Beatles since Laibach.

Paul McCartney, Flowers in the Dirt, remastered, an underrated album to begin with, this release also includes the previously unavailable acoustic demo tapes with Elvis Costello.

Death Grips, Bottomless Pit. Has the information density and partial unpleasantness of the old Skinny Puppy recordings, “seesawing from grit to gloss to back again.”

Beach Boys, Wild Honey, titled 1967 — Sunshine Tomorrow. This remix brings out what was supposed to be just a “blues/soul/Brian cooling his heels” album as an acoustic masterpiece and proper successor to Pet Sounds and Smile.

Philip Glass, Piano Works, by Víkingur Ólafsson. One of the two or three best Glass recordings I know, here is an interview with the pianist.

Overall, if I had to push any of these on you it would be the last two. Soon I’ll cover jazz and world music.

Thursday assorted links

1. “And the real Dr. Ashkin wrote to his doppelganger in Utah with a remarkably generous offer. He said he would find a place for Hewitt in an actual physics program where he could quickly earn an actual Ph.D. and relieve himself of the stress of being an imposter. Hewitt declined and the university quietly dismissed him.” Link here.

2. “For those unfamiliar with it, Dynamicland (from what I know of it, at least) is a computing environment at room / space scale. The room is the computer, and as much as possible, computing happens with physical objects. This enables you to interact with your whole body, to see systems by picking them up, and to share computing space with multiple people (compare this to traditional computing with a mouse and keyboard, with 1 person per computer and minimal sharing).

For starters, there’s a newly active twitter account showing off things…” Source link here.

3. Books Mises wanted to see written: most of them still have not been done…get to work! And the silent comedy of Jackie Chan.

4. Matt Notowodigdo recommends some favorite economics articles from the year, very good list.

5. Is the Republican tax plan raising the effective capital gains rate? And for homes?

6. The game theory of recognizing Jerusalem, by Noah Feldman.

Adam Smith on Occupational Licensing

Adam Smith warned that “People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public, or in some contrivance to raise prices.” Although Smith’s warning is often quoted, few people know that what Smith was talking about was occupational licensing. At the time Smith wrote, tradesmen such as weavers, hatters, and cutlers (metalworkers) monopolized their industries by limiting entry to students who had served long apprenticeships under a master, and tradesmen also limited the number of students a master could teach. Seven-year apprenticeships had been required in Britain since the 1563 Statute of Artificers. In Smith’s time, however, occupational licensing was beginning to fall apart because the 1563 law had been interpreted to apply only to the trades listed in 1563 and not to the new trades then arising with the Industrial Revolution. The act was finally repealed in 1813, in part because of Smith’s influential attack.

Occupational licensing is also undergoing great changes in the United States today—but in the opposite direction of those in Smith’s time.

That is the introduction to the Undertaker’s License a Cato Research Brief on my paper with Brandon Pizzola on occupational licensing in the funeral services industry.

India marriage markets in everything

India’s government has expanded a scheme offering payment incentives to Hindus who marry members of the country’s poorest and most oppressed caste, the Dalits.

A scheme introduced in 2013 offered 250,000 rupees (£2,900) to encourage Hindus from higher castes to marry members of the “untouchable” community, in the hope that it would help to remove the stigma of intercaste marriage and foster greater social cohesion.

To qualify, the annual income of the spouse from the high caste had to be less than 500,000 rupees (£5,800).

The government envisaged about 500 such marriages annually, but less than 100 have taken place each year.

On Wednesday, the Ministry of Social Justice and Empowerment announced it would scrap the income ceiling, and said all couples in which one spouse is from the Dalit caste would receive the cash incentive.

Here is the article, via Eric D., also read the last few paragraphs.

The Age of the Centaur is *Over* Skynet Goes Live

“Mastering Chess and Shogi by Self-Play with a General Reinforcement Learning Algorithm”

The game of chess is the most widely-studied domain in the history of artificial intelligence. The strongest programs are based on a combination of sophisticated search techniques, domain-specific adaptations, and handcrafted evaluation functions that have been refined by human experts over several decades. In contrast, the AlphaGo Zero program recently achieved superhuman performance in the game of Go, by tabula rasa reinforcement learning from games of self-play. In this paper, we generalise this approach into a single AlphaZero algorithm that can achieve, tabula rasa, superhuman performance in many challenging domains. Starting from random play, and given no domain knowledge except the game rules, AlphaZero achieved within 24 hours a superhuman level of play in the games of chess and shogi (Japanese chess) as well as Go, and convincingly defeated a world-champion program in each case.

In other words, the human now adds absolutely nothing to man-machine chess-playing teams. That’s in addition to the surprising power of this approach in solving problems.

Here is the link, via Trey Kollmer, who writes “Stockfish Dethroned.” Here is coverage from Wired. Via Justin Barclay, here is commentary from the chess world, including some of the (very impressive) games. And it seems to prefer 1.d4 and 1.c4, loves the Queen’s Gambit, rejected the French Defense, never liked the King’s Indian, grew disillusioned with the Ruy Lopez, and surprisingly never fell in love with the Sicilian Defense. By the way the program reinvented most of chess opening theory by playing against itself for less than a day. Having the white pieces matters more than we thought from previous computer vs. computer contests. Here is the best chess commentary I have seen, excerpt:

If Karpov had been a chess engine, he might have been called AlphaZero. There is a relentless positional boa constrictor approach that is simply unheard of. Modern chess engines are focused on activity, and have special safeguards to avoid blocked positions as they have no understanding of them and often find themselves in a dead end before they realize it. AlphaZero has no such prejudices or issues, and seems to thrive on snuffing out the opponent’s play. It is singularly impressive, and what is astonishing is how it is able to also find tactics that the engines seem blind to.

Did you know that the older Stockfish program considered 900 times more positions, but the greater “thinking depth” of the new innovation was decisive nonetheless. I will never forget how stunned I was to learn of this breakthrough.

Finally, I’ve long said that Google’s final fate will be to evolve into a hedge fund.

Wednesday assorted links

1. “This Article presents the first empirical examination of giving to § 501(c)(4) organizations, which have recently become central players in U.S. politics. Although donations to a 501(c)(4) are not legally deductible, the elasticity of c(4) giving to the top-bracket tax-price of charitable giving is – 1.24, very close to the elasticity for charities.” Link here. And there is no tax break for private jets, setting the record straight.

2. Ranking generals using sabermetrics, Napoleon is #1.

3. My podcast with the excellent Jocelyn Glei on self-transformation and risk.

4. Does the estate tax affect the marginal investor?

5. Eliminating the filibuster wouldn’t help much with gridlock.

6. Animal mutualism and personality (NYT).

7. ““The pending transactions on the Ethereum blockchain have spiked in the last 24 hours, mostly from CryptoKitties traffic,” CoinDesk director of research Nolan Bauerle said in an e-mail.

In the game, players buy cartoon kittens and then breed them with other cats. More than 22,000 cats have been sold so far for a total of US$3 million, according to Crypto Kitty Sales.

One of the cats went for US$117,712, although average sales price hovers about US$109, according to the sales tracker.” Link here.

I Hate Flexible Spending Accounts

I hate “flexible” spending accounts, i.e. those accounts where you put say $1000 in tax-free but you then must submit a bunch of health or education receipts to claim the money–and the “benefits manager” tells you half of the receipts you submitted are no good so you have to trawl through your files to find more–or lose the money. The whole process is demeaning. My hatred of this process, however, pales in comparison to that of Scott Sumner who gives a correct analogy:

Imagine a government that took 10% of each person’s income, and put in in a wooden box. The box was placed at the end of a 10-mile gravel road. Each citizen was given a knife, and told they could crawl on their hands and knees down the road, and then use the knife to cut a hole in the box, and retrieve their money.

Scott’s point is twofold. First, there is a lot of waste in crawling down the road. Second, taken in isolation, it looks like the plan at least offers people an option and so, in isolation, flex accounts and their ilk appear to benefit taxpayers. In the big picture, however, the total amount taken in taxes is somewhat fixed by politics and economics so if we got rid of the spending accounts, taxes would probably fall in other ways that are difficult to predict but nonetheless real.

Some want to crawl down the gravel road, fearing that if they abolish the program the government will not reduce their tax rates, instead the money in the box will be diverted to welfare for the poor, or higher salaries for teachers. I can’t deny that this might occur, but if we don’t even TRY to build a good country, how can we possibly succeed? Isn’t it better to try and fail, rather than not even try?

I agree with Scott. If I am going to be forced to pay taxes I’d like to hand over my cash standing like a man and not be given the option of crawling to recoup some bills the tax collector magnanimously throws on the floor.

Game of Theories: Putting it All Together

In the final video in our Game of Theories mini-class, Tyler puts all the theories together to examine the great recession.

GDP, GNP, and foreign investment

A few of you have written me to ask what I think of Paul Krugman’s recent posts on tax reform and evaluating it by gnp rather than gdp, the latter being an emphasis in the GOP literature. Paul notes correct that a lower corporate rate will attract foreign investment, and the returns to that investment, by definition, will not accrue to American citizens. So far, so good.

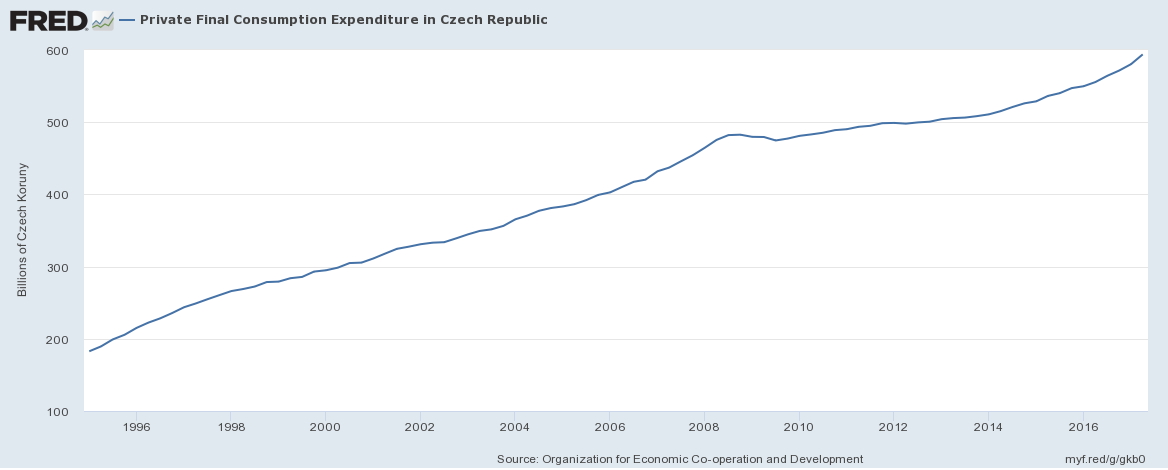

Paul reproduces the following graph for the Czech Republic, ratio of gnp to gdp:

If the GOP literature focuses on gdp, it is fine enough to criticize it on that basis. What worries me, however, is that the corrective doesn’t go nearly far enough. Gnp isn’t the right standard either, nor is gnp/gdp, rather it is welfare, either nationally or globally.

From that gdp/gdp ratio graph, you might come away with a grim view of life in the Czech Republic, but consider this cheerier picture of consumption, which nearly triples over a twenty year period:

Pretty awesome. And under the standard story of the Czech economy, investment from abroad, most of all from Germany, has helped drive those gains. Germany invested more, that boosted wages, improved the local political economy, and transferred some technology and entrepreneurial skills. It is standard international economics, or for that matter Solow model, that capital-rich, lower-return economies should invest in their poorer peripheries (which is not to say it always works out that way).

It’s entirely fair to note that Czech household debt to gdp has risen to about thirty percent. Still, in the U.S. it is about eighty percent, so the Czechs are not in dire straits just yet. Private debt to gdp seems to run about 136 percent, compared to about 200 percent in the U.S.

Of course, this still could end up as a bad deal for the Czechs. They might waste their foreign investment, the accompanying wage gains, the associated external benefits, and end up having to snap back their consumption and see their whole country owned by Germany, China, and others. But that’s not the baseline case. The default assumption is that these are gains from trade like other such gains, in this case gains from trading with foreigners who wish to invest. They are not lesser gains or gains to somehow be subtracted from the overall calculus.

Here is a useful point of contrast. Let’s say I advocated high taxes on foreign trade, on the grounds that “half of the gains from those trades are shared with foreigners,” and therefore we ought to, post-tariff, trade more with fellow citizens, so that only Americans get those gains. We all know why that argument generally is wrong, noting there are some second best cases where tariffs can improve welfare. It’s still wrong when the trades involve foreign investments.

So it is misleading to induce people to mentally downgrade foreign investment as a source of welfare gains. I get that Krugman doesn’t quite say that, but that is the impression his discussion and diagram produces on the unwary. Technically, he might only be criticizing the Republicans internally, using their own gdp standard. The actual produced impression is to cause people to doubt that a lot of foreign capital inflow fully counts as a gain from trade.

America of course is in a quite different position than is the Czech Republic. But the gains from foreign investment into the United States also ought not to be downgraded, either explicitly or by implied presumption.

Tuesday assorted links

1. Do economic freedom indices measure regulation properly?

2. An economics class, as taught through the contributions of Nobel Laureates.

3. Noah Smith picks best economics reading of the year.

4. The secret codes of Edward Elgar?

5. John Lukacs, “from the age of books,” at age 94.

6. Ray Dalio on SALT and out-migration from high-tax states.

The (pricing) culture that Washington is not

The Interstate 66 toll lanes opened Monday in Washington’s Northern Virginia suburbs with prices so steep they could be among the highest drivers have paid for the privilege of traveling on a state-owned highway in the United States.

Tolls in the high-occupancy toll lanes hit $34.50 — or close to $3.50 a mile — to drive the 10-mile stretch from the Beltway to Washington during the height of the morning commute.

Bravo, but we’ll see how this develops.

Trumponomics is in fact novel, we neglect it at our peril

That is the topic of my latest Bloomberg column, here is the opening bit:

I’ve seen hundreds of articles on President Donald Trump and trade, but the real significance of the Trump economic revolution — for better or worse — is a focus on investment. There is no coordinating mastermind, but if you consider the intersection between what the Trumpian nationalists want and what a Republican Congress will deliver, it’s this: wanting to make the U.S. a new and dominant center for investment, including at the expense of other nations.

And:

In essence, a new kind of supply-side economics has been invented. The theory of the 1980s focused mainly on individuals, and lowering the tax rates they faced on labor income and capital gains. Cutting these rates was supposed to mobilize the power of those individuals, through more work or more investment. The idea today is that the real power of mobilization comes through corporate associations. Assuming the tax bill passes, that theory is about to get a major test.

Strikingly, the tax bill and the trade policies of the Trump administration can be viewed as having a similar underlying philosophy, whether entirely intended or not. One of the president’s first official acts was to withdrawal from the Trans-Pacific Partnership. Although I favored that agreement, as did most other economists, it’s worth considering what the most intelligent nationalist case against the TPP looks like. It’s not about trade, because the deal wouldn’t have affected tariff rates faced by Americans very much (exports of beef to Japan aside). Rather, the TPP would have given American certification to Vietnam, Malaysia and eventually other emerging economies as stable repositories of foreign investment from multinationals. That could in turn draw investment away from the U.S.

Do read the whole thing, it is my favorite recent piece by me.