Results for “rognlie” 26 found

Sunday assorted links

1. The Quay twins are leading a marginal revolution. “In a sense we are obsessive, and anything that we do, read, or any music that we listen to, we always look to each other and say, can that be — we use the word cinematized — can it be “cinematized”? And there’s nothing more that we like than to coax new material out of something that almost doesn’t have a potential. We could never do adaptations of famous pieces. We need the marginal. Whenever we’re reading a book, if it’s a research book, we always find that it’s the footnotes that open up new chapters of imagination.”

2. Uber plus randomized Yelp, you could toss in randomized Tinder too. What else?

3. Scott Sumner makes the bull case for China.

4. William MacAskill’s doctoral dissertation (pdf), and MacAskill on “the infectiousness of nihilism.” In addition to his work on effective altruism, MacAskill is in the running to become one of the world’s most interesting moral philosophers.

5. The superb Matt Rognlie on the minimum wage and the likelihood of perfect offset, very good points.

Puzzles of capital and equity returns

And as Matt [Rognlie] also stressed, the secondary big news in his numbers is the pre-1990 fall in the net capital share, a fall driven by a very real rise in depreciation is real. Our capital stock has seen the replacement of long-lasting machines to perform Wellman-Lord desulfurization reactions with video editing machines rapidly obsoleted by Moore’s Law.

But it is puzzling that the pre-1990 fall in the net capital share not matched by a decline in the relative capitalization of the corporate sector. Matt points out a steady rise in capitalization up to the late 1960s, followed in the 1970s by a “negative bubble”–truly absurdly high earnings yields on equities–that lasts well into the 1980s. Then we see a bubbly rise in the relative capitalization of the corporate sector since the start of the 1990s–a rise that persists in spite of sub-par business-cycle performance. Very puzzling.

The post is of interest more generally,

Top Ten MR Posts of 2014

Here is my annual rundown of the top MR posts of 2014 as measured by page views, tweets and shares.

1. Ferguson and the Debtor’s Prison–I’d been tracking the issue of predatory fining since my post on debtor’s prisons in 2012 so when the larger background of Ferguson came to light I was able to provide a new take on a timely topic, the blogging sweet spot.

2. Tyler’s post on Tirole’s win of the Nobel prize offered an authoritative overview of Tirole’s work just when people wanted it. Tyler’s summary, “many of his papers show “it’s complicated,” became the consensus.

3. Why I am not Persuaded by Thomas Piketty’s Argument, Tyler’s post which links to his longer review of the most talked about economics book of the year. Other Piketty posts were also highly linked including Tyler’s discussion of Rognlie and Piketty and my two posts, Piketty v. Solow and The Piketty Bubble?. Less linked but one of my personal favorites was Two Surefire Solutions to Inequality.

4. Tesla versus the Rent Seekers–a review of franchise theory applied to the timely issue of regulatory restrictions on Tesla, plus good guys and bad guys!

5. How much have whites benefited from slavery and its legacy–an excellent post from Tyler full of meaty economics and its consequences. Much to think about in this post. Read it (again).

6. Tyler’s post Keynes is slowly losing (winning?) drew attention as did my post The Austerity Flip Flop, Krugman critiques often do.

7. The SAT, Test Prep, Income and Race–some facts about SAT Test Prep that run contrary to conventional wisdom.

8. Average Stock Returns Aren’t Average–“Lady luck is a bitch, she takes from the many and gives to the few. Here is the histogram of payoffs.”

9. Tyler’s picks for Best non fiction books of 2014.

10. A simple rule for making every restaurant meal better. Tyler’s post. Disputed but clearly correct.

Some other 2014 posts worth revisiting; Tyler on Modeling Vladimir Putin, What should a Bayesian infer from the Antikythera Mechanism?, and network neutrality and me on Inequality and Masters of Money.

Many posts from previous years continue to attract attention including my post from 2012, Firefighters don’t fight fires, which some newspapers covered again this year and Tyler’s 2013 post How and why Bitcoin will plummet in price which certainly hasn’t been falsified!

Alan Taylor on mortgage lending as predicting financial crises

He has a new paper (pdf) on this topic, with Jorda and Schularick, based on data from seventeen advanced economies since 1870. In an email he summarizes the main results as follows:

1. Mortgage lending was 1/3 of bank balance sheets about 100 years ago, but in the postwar era mortgage lending has now risen to 2/3, and rapidly so in recent decades.

2. Credit buildup is predictive of financial crisis events, but in the postwar era it is mortgage lending that is the strongest predictor of this outcome.

3. Credit buildup in expansions is predictive of deeper recessions, but in the postwar era it is mortgage lending that is the strongest predictor of this outcome as well.

Here is VoxEU coverage of the work. On a related topic, here is a new paper by Rognlie, Shleifer, and Simsek (pdf), on the hangover theory of investment, part of which is applied to real estate. It has some Austrian overtones but the main argument is combined with the zero lower bound idea as well.

Depreciating Capital

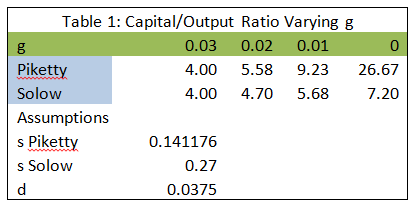

Brad DeLong attacks Krusell and Smith for using in some of their thought experiments a depreciation rate of 10%, which is probably too high. Fair point but in my post I assumed a depreciation of just 5% and showed that Solow and Piketty give very different predictions about how the K/Y ratio will change with a change in g.

Furthermore, having read DeLong’s comment, I went to the BEA and compared gross and net domestic product which gives capital depreciation as a fraction of GDP of around 15% in recent decades. At a K/Y ratio of 4 that’s a depreciation rate of 3.75%. Similarly, Inklaar and Timmer in constructing capital stocks for the Penn World Tables estimate a depreciation rate for the U.S. of 4.1%. I reran my simple Excel chart with the lower number, 3.75%.

As you can see, the numbers are very similar to earlier and the key point is still that a decrease in g increases K/Y much more in the Piketty model than in the Solow model.  Krusell responds to DeLong here making the additional point that their thought experiments show that Piketty’s assumption about savings is implausible at any depreciation rate (see also Hamilton on this point).

Krusell responds to DeLong here making the additional point that their thought experiments show that Piketty’s assumption about savings is implausible at any depreciation rate (see also Hamilton on this point).

First: if the net rate of saving remains positive as the economy’s growth rate falls toward zero, as Piketty assumes in his second fundamental law of capitalism, the gross saving rate in the economy must approach 100%. This observation is a way of illustrating how unreasonable the behavioral assumptions underlying his theory of saving really are.

Second: according to standard, and much more reasonable, saving theory (based either on the standard textbook Solow growth model or on the permanent-income model), the net saving rate must fall with the rate of growth, and become zero when growth is zero.

…These points are key because Piketty’s predictions are all about what happens as growth falls during the 21st century, as he argues it will.

…both of these results hold no matter what the depreciation rate is (so long as it is positive).

The heart of Piketty’s theory is his expression for the capital share of income in the long run, α = r × s/g with the prediction that if g falls the capital share will rise tremendously. This is a good opportunity to summarize some of the recent points about the theory.

There are no contradictions but many a slip ‘twixt the cup and the lip. Namely, will g fall? If g does fall, will K/Y increase? If K/Y increases will capital’s share of income increase? My answers:

Will g fall? Uncertain. Piketty’s forecast is as good as anyone’s. My own view is that at the global level g has been increasing for several centuries and that this will continue, especially because in this century we will see a massive increase in the number of scientists and engineers as China and then India devote increased human capital to the research frontier.

If g does fall, will K/Y increase? Yes, but probably less than Piketty estimates and more in line with Solow.

If K/Y increases will capital’s share of income increase? Uncertain but more likely no than yes. It depends on the elasticity of substitution between K and L and as Rognlie and Summers argue, the elasticity that Piketty needs is higher than current estimates suggest is the case.

Why I am not persuaded by Thomas Piketty’s argument

My Foreign Affairs review is here. (Open up “New private window” in Firefox, if need be.) I won’t attempt to cover all of the review, but rather will rephrase a few of my points for MR readers, in slightly different terminology:

1. If the rate of return remains higher than the growth rate of the economy, wages are likely to rise and quite a bit. You can find a wonky version of that idea here from Matt Rognlie. But it suffices to apply common sense, namely that capital accumulation bids up wages. Piketty suggests we are headed back to something resembling the 19th century. Well, that was a pretty good time for the average working person in Western Europe, especially once we get past the first part of that century, which had lots of war and a still-incomplete industrial revolution.

Since we today have had some wage stagnation, perhaps it does not feel that kind of favorable outcome is what we will get and many commentators are trading off this mood. But also realize the (risk-adjusted) return on capital hasn’t been that high lately and it has been falling for decades. This combination of variables — low returns and stagnant wages — does not refute Piketty but it doesn’t exactly fit into his mold either.

2. The crude seven-word version of Piketty’s argument is “rates of return on capital won’t diminish.” Is that really such a powerful forecast? I say over the next fifty or one hundred years we don’t have a very good sense of which factors will show diminishing returns and which will not. It is hard enough to make predictions of trend over a twenty-year time horizon. NB: At many points in the Piketty book he seeks to have it both ways: loads of caveats, but then he falls back into the basic model, and he and his defenders cite the caveats when it is convenient.

3. Piketty’s reasons why rates of return on capital won’t diminish are fairly specific and restricted to only a small share of capital. He cites advanced financial management techniques of the very wealthy and also investing abroad in emerging economies. Neither of these covers most capital, and thus capital returns as a whole may not be so robust. Nor is it obvious that either technique will prove especially successful over the next few decades or longer. Again, is there any particular reason to think either of these factors will outrace the basic logic of diminishing returns, or for that matter EMH, relative to other factor returns that is? They might, to be sure. They also might underperform. In any case this is pure speculation and Piketty’s entire argument depends upon it.

4. The actual increases in income inequality we observe are mostly about labor income, not capital income. They don’t fit easily into Piketty’s story and arguably they don’t fit into the story at all.

5. Piketty converts the entrepreneur into the rentier. To the extent capital reaps high returns, it is by assuming risk (over the broad sweep of history real rates on T-Bills are hardly impressive). Yet the concept of risk hardly plays a role in the major arguments of this book. Once you introduce risk, the long-run fate of capital returns again becomes far from certain. In fact the entire book ought to be about risk but instead we get the rentier.

Overall, the main argument is based on two (false) claims. First, that capital returns will be high and non-diminishing, relative to other factors, and sufficiently certain to support the r > g story as a dominant account of economic history looking forward. Second, that this can happen without significant increases in real wages.

Addendum: Still, it is a very important book and you should read and study it! But I’m not convinced by the main arguments, and the positive reviews I have read worsen rather than alleviate my anxieties. I’ll cover the policy and politics of this book in a separate post. Do read my review itself, which has much more than what is in this blog post.

Assorted links

2. Automated coach to practice conversations (pdf).

3. Will Wilkinson on fairness, norms, and inequality.

4. Food trucks for dogs (MIE), and use Kinect to control your cockroaches.

5. The shadow banking culture that is China.

6. Miles Kimball and Matt Rognlie on wage stickiness, price stickiness, and TFP. That is also a good post showing some differences between blogospheric economics and academic economics.

Matt Rognile does not like the LM curve (nor does David Romer)

Read the whole post, here is one excerpt:

…many countries now operate under an inflation targeting framework, in which responding to inflation is the key feature of the policy rule. In this environment, depicting policy as a relationship between “Y” and “i” misses what’s really going on—better to abandon the upward-sloping LM curve altogether and use a simple horizontal line to depict the current policy rate. I’m not alone in this sentiment.

David Romer wrote an entire piece for the JEP in 2000 called Keynesian Macroeconomics without the LM Curve. (As the title suggests, he shares my feelings on the matter.) Tyler Cowen puts this at #6 on his list of grievances. It’s a pretty obvious point—yet, for reasons I don’t entirely understand, we still print thousands of undergraduate textbooks a year with LM front and center.

Matt is an economics Ph.d student at MIT and an expert in macroeconomics.

Here is a good quotation from the above-cited David Romer piece (Romer, by the way, is not a member of my tribe, in fact he is a tenured professor at Berkeley):

In short, recent developments work to the disadvantage of IS-LM. This observation suggests that it is time to revisit the question of whether IS-LM is the best choice as the basic model of short-run fluctuations we teach our undergraduates and use as a starting point for policy analysis. The thesis of this paper is that it is not.

Assorted links

1. One paywall to rule them all?

2. The irrational voter with endogenous turnout (pdf, think of it as an attempt to refute Caplan. The result is hard to believe, and it is just published in gated form here).

Assorted links

1. When should we tax goods with inelastic demand?

3. Will on the new Jerry Gaus book; Kevin Vallier’s summary is intended as positive, but it reflects my reservations about the book: “In sum, OPR defends public reason liberalism without contractarian foundations. It is Kantian without being rationalistic. It is Humean without giving up the project of rationally reforming the moral order. It is evolutionary but not social Darwinist. It is classical liberal without being libertarian. It is Hegelian and organicist without being collectivist or statist.” Too much engagement with macro-positions of philosophic others, too many strung together, semi-empirical casual observations, not enough focused, narrowed down progress on the knotty particular problems of social choice and aggregation and whether rules are simply an arbitrary category. The argument takes on too many moving pieces — not quite empirical, not quite theoretical — in a way which is to this reader was not persuasive.

Assorted links

1. Michael Pollan or Michel Foucault? — a new blog.

2. The swine flu rate of hospitalization: about 2 percent. The crisis isn't over.

3. Via Arnold Kling, an excellent economics blog by Matthew Rognlie, a twenty-year-old. Here is Matt's vita, hire him. His blog is much better than what most professors could do plus he has an 800 trifecta on his SATs.

4. Videos of the world's top scholars.

5. Peak car?

6. From Julian Sanchez, a proposal for Hansonian journalism.