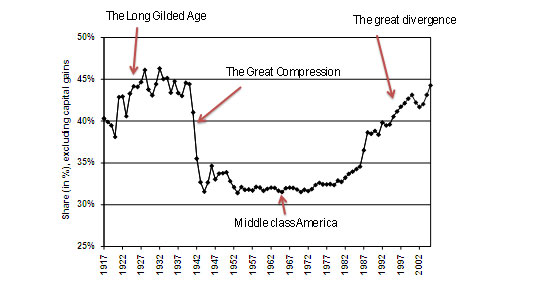

The Great Compression

Paul Krugman recently blogged:

The middle-class society I grew up in didn’t evolve gradually or automatically. It was created,

in a remarkably short period of time, by FDR and the New Deal. As the

chart shows, income inequality declined drastically from the late 1930s

to the mid 1940s, with the rich losing ground while working Americans

saw unprecedented gains.

As you can see, the share of the top ten percent (not counting capital gains) falls steeply at about 1937 and flattens out by about 1942-43, with a slight uptick just afterwards. But I am puzzled by Krugman’s description of the process. A few points:

1. 1937-38 were disastrous years for the American economy and also for the middle class, mostly because of bad contractionary monetary policy. This can be considered a second Great Depression and it aborted a recovery in process. Robert Higgs has shown convincingly that World War II was an economic disaster, look at the figures at consumption don’t be fooled by aggregate gdp which is inflated by production for the war.

2. Therefore I am not sure when the "unprecedented gains" came during this period. Yes 1940 was a year of recovery (and part of 1939) but is the claim that the middle class was created in that year? Surely not but then I am confused.

3. Krugman cites "strong unions, a high minimum wage, and a progressive tax system" as driving the Great Compression — did these factors change so notably in 1937-44?

4. In real terms, relative to the time, the new federal minimum wage of 1938 was not especially high, even compared to the minimum wage today. And the data are for pre-tax incomes, which means that progressive taxation is unlikely the major part of the story about the distribution of pre-tax income (noting the Yglesias caveat that the rate of tax will influence pre-tax incomes through labor supply).

5. Here are some data on U.S. unionization. The history does broadly track Krugman’s time frame, as long as one does not obsess over 1937-43 as being special. Note that optimistic estimates of the union wage premium today run about 15 percent, so it is hard to see unionization as the dominant factor in the change in the distribution of income.

6. The wartime economy, and the scarcity of labor, bid up wages for black workers, women, and many remaining non-drafted male laborers (due to forced saving, however, consumption was low).

7. My explanation of the break in the chart emphasizes a combination of events: top incomes were crushed by the depression of 1937-8, the war economy put a further lid on top of high incomes (for reasons of law and norms; surely the phrase "wartime wage and price controls" deserves to be uttered at least once), and the war economy bid up wages for many people near the bottom and middle of the distribution. The wealthy classes financed a disproportionate chunk of World War II, it seems.

8. Krugman mentions none of the factors listed in #7. Admittedly I may be wrong, but are not those factors obvious candidates for an explanation?

9. It is a vitally interesting question why postwar America stayed at this new percentile distribution of income (more or less), even after recovery from the war. It may be possible to defend a version of Krugman’s broader hypothesis — policy matters for income distribution — in this setting, but the story then puts greater stress on both the equalizing effects of catastrophes and also on path-dependence. That story might also suggest that strongly negative real shocks would be needed once again to make income distribution much more egalitarian.

10. How about this for an alternative story: "Crush the incomes at the top and then make the fat cats pay much higher wages to protect the world and become a superpower. Impose wage and price controls as well. See how long it takes before these distributional effects — which don’t exactly match the distribution of economic talent– reverse themselves in the aggregate." I’m not sure that’s right but at least it seems to match more of the history.

I am sensitive to the claim that many people misinterpret the words of Paul Krugman, so please do read his whole post. If he addresses these matters in more detail in his forthcoming book, I will let you know.