Who Benefits from the Federal Government?

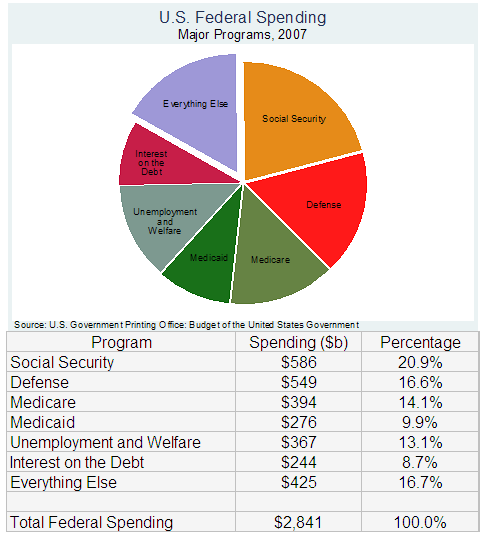

A common response to my post showing that The Rich Pay for the Federal Government was that the rich also get more benefits from the federal government. Let’s go to the numbers. Here’s a chart showing federal spending categories for 2007. (Click to expand.)

Social Security, the biggest category, doesn’t benefit the rich at all because net Social Security payments are heavily biased against the rich. According to Eugene Steuerle and Adam Carasso of the liberal Urban Institute a two earner couple earning $230,000 a year (thus putting them at the mean household income for the top 20%) and scheduled to retire in 2030 will pay $227,886 more in social security taxes than they receive in benefits (in present value).

Defense is the next biggest category. To me a lot of "defense" spending doesn’t benefit anyone but let’s be generous and say that the rich benefit from military spending in proportion to their income share which for the top 20% means 55%. Thus $301b.

Medicare benefits the rich less than the poor since they are healthier (plus they must pay higher premiums) but let’s say that Medicare benefits the rich in proportion to their population. If we say the top 20% are rich and assume that this is the same in the 65 and older category then 20% of Medicare goes to the rich. $78.8b.

Medicaid doesn’t benefit the rich. The rich do use unemployment insurance but at far lower rates than the poor. Does welfare benefit the rich? Not directly but maybe from the warm glow. I don’t think the benefits of charity are what most people mean when they say that the rich benefit from the federal government but who knows. Let’s again be generous and say that the warm glow goes just to the rich and that it is worth 20% of the benefit to the poor. $73.4b

Everything else includes the example that people always seem to mention first, roads! Alas, the entire transportation budget is just $77 billion, not much there even if a lot of it goes to the rich. By my judgment a lot of "everything else" has low value but again let’s be generous and say that the rich benefit from everything else in proportion to their income share (.55). $233b.

Excluding the national debt gives us a total of $687 billion out of $2597 billion going to the rich or 26%. If we assume that the division of the national debt is the same as for the government as a whole (since this is just past expenditures) the percentage is still 26%.

Thus in a generous accounting the rich get 26% of the benefits of federal spending and pay 68.7% of the costs. In percentage terms the rich get about 37 cents on the dollar.

Alternatively stated about 63 cents of every dollar in taxes paid by the rich is transferred down. Given that the median voter is a taxeater not a taxpayer we should not be too surprised, although this is a smaller number than I would have guessed before I did the calculation. From an efficiency point of view we should be happy that the rich don’t get too much – transferring resources creates a lot of waste but transferring resources from the rich to the rich is especially wasteful.

The basic point is clear; In the United States, one can argue for taxing the rich on the ability to pay principle but not on the benefit principle.

Addendum: Thanks to Ted Frank for catching a math slip-up on my part which I fixed raising the total to 26%.