What Credit Crunch?

Paul Krugman points to the new Federal Reserve senior loan officer survey which reports that standards for commercial real estate loans are tightening creating in Krugman’s words "an incredible credit crunch in progress."

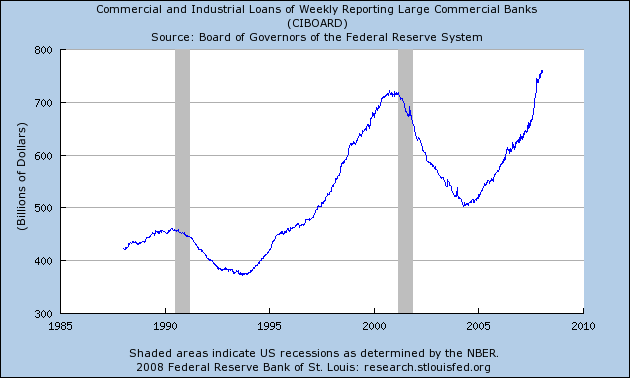

Over at Carpe Diem, however, Mark Perry looks to Federal Reserve data on actual loans and finds that commercial loans from large banks are at an all time high and increasing rapidly.

The credit crunch, if that is what one should call higher standards, appears to be contained to the real estate market.