Risk Free No Longer

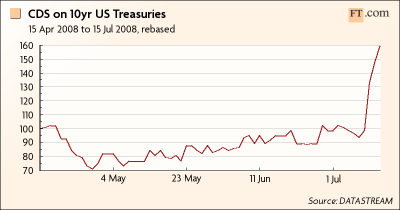

Wow, we usually think about U.S. bonds as being the "risk-free" asset but with a credit default swap you can buy insurance on a US default and the price of such insurance is way up.

The change in price is a shock but to put things in perspective do note that the price for insuring US debt is now higher than for German debt but similar to that for Japanese and British debt. We are still far from Argentinian levels.

Hat tip to at, in the comments to my post on the peso problem.