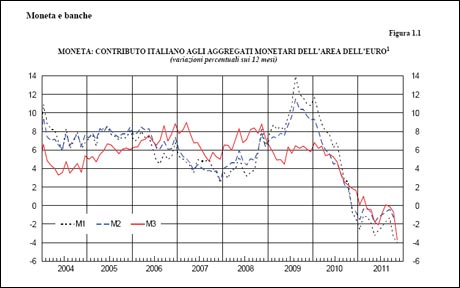

M3 in Italy

The link is here. There is a lot of talk of self-defeating austerity, and I agree that spending cuts often lead to real and nominal gdp declines in the short run, but most likely this is the critical problem, including in Greece.

For the pointer I thank Antony Slumbers.