Some Economics of Pay What You Want Pricing

A number of musicians and game developers have experimented with pay-what-you-want pricing (e.g. see the important field experiment by Gneezy et al. and less formal reports from Radiohead, Norwegian composer Gisle Martens Meyer and the video-game makers 2D Boy and Joost van Dongen.)

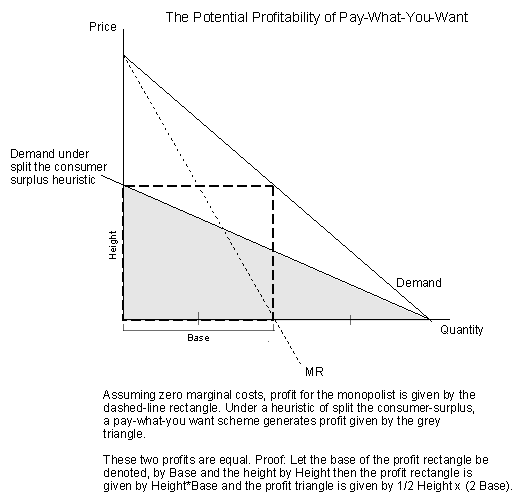

Imagine that under the pay-what-you-want model consumers choose to split their consumer-surplus with the seller. Here is a neat little proof for the linear demand case that under this heuristic profits are as large as under monopoly pricing! I have also assumed MC of zero which makes sense for digital goods and is also quite important to the result as pay-what-you-want can result in negative profits should consumers choose to pay less than marginal cost.

Split the consumer surplus is optimistic for the seller although splitting the gains does happen quite often in the dictator game so it is not without interest. Probably more importantly, pay-what-you-want pricing is going to be advantageous when the seller also sells a complementary good, such as concerts, which benefit from consumption spillovers from the pay-what-you-want good.