Are corporate profits a sinkhole for purchasing power?

That seems to be Krugman’s argument here, and here, excerpt:

So corporations are taking a much bigger slice of total income — and are showing little inclination either to redistribute that slice back to investors or to invest it in new equipment, software, etc.. Instead, they’re accumulating piles of cash.

I am confused by this argument. I would understand it (though not quite accept it) if corporations were stashing currency in the cupboard. Instead, it seems that large corporations invest the money as quickly as possible. It can be put in the bank and then lent out. It can purchase commercial paper, which boosts investment.

Maybe you are less impressed if say Apple buys T-Bills, but still the funds are recirculated quickly to other investors. This may not end in a dazzling burst of growth, but there is no unique problem associated with the first round of where the funds come from. If there is a problem, it is because no one sees especially attractive investment opportunities in great quantity. (To the extent there is a real desire to invest, the Coase theorem will get the money there.) That’s a problem at varying levels of corporate profits and some call it The Great Stagnation.

The same response holds if Apple puts the money into banks which earn IOR at the Fed and the money “simply sits there.” The corporations are not withholding this money from the loanable funds market but rather, to the extent there is a problem, the loanable funds market does not know how to invest it at a sufficiently high ROR.

If anything, large corporations are more likely to diversify out of the U.S. dollar, which could boost our exports a bit, a plus for a Keynesian or liquidity trap story.

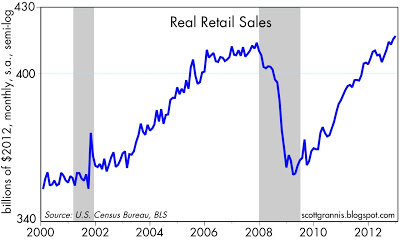

When one looks at the components of aggregate demand, retail sales, after a large and obvious hit, seem to be recovering. They are up 4.7% from Dec. 2011 to Dec. 2012 (pdf). If that is what a sinkhole looks like, as I said I am puzzled:

Here is the story of business investment minus corporate profits and that series doesn’t impress me (Krugman seems to think it is doing OK). The trickier variable of net investment you will find here and that looks worse.

By the way, Fritz Machlup considered related arguments in his 1940 book.