More than Half of Workers Have New Jobs Since the End of the Recession

Many people continue to call for greater inflation to solve our current economic problems. A classic argument for why inflation can help is downward nominal wage rigidity. It is difficult to believe that nominal wage rigidity is important now, years after the end of the recession. The main reason nominal wages don’t fall is that wages are an anchor around which expectations and understandings are built and when wages are cut workers get angry and upset. But when a worker begins a new job with a new employer it’s anchors away! New job, new wage and no feelings of loss even if the wage is less than what some other person earned sometime in the past for doing something sort of similar.

Now here is an important fact: the median number of years that current wage and salary workers have been with their current employer is about four and a half. In other words, more than half of current workers have jobs that are new since the end of the recession. A majority of workers have new jobs, some workers have wages that are increasing (and thus a fortiori not downwardly rigid) and quite a few workers have flexible wages due to piece rates, commissions, bonuses and so forth. Not all of these categories perfectly overlap. Thus, the scope for nominal wage rigidity as an explanation for current problems appears to be small.

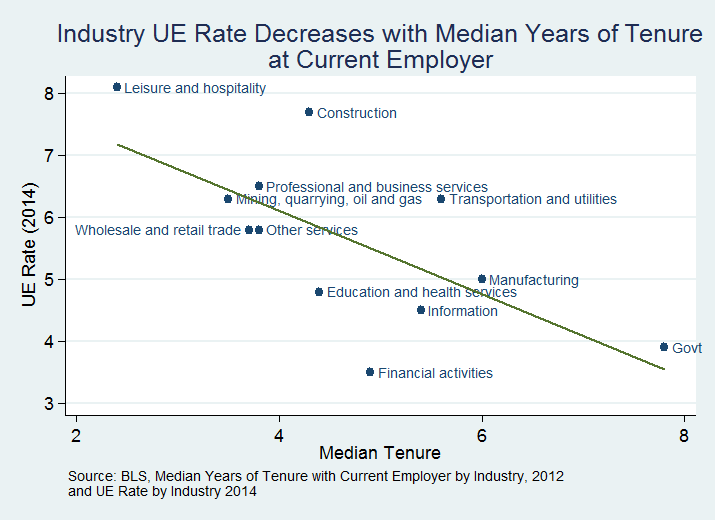

Moreover, here’s an interesting test. If nominal wage rigidity explains unemployment and if wages are more rigid at old jobs than at new jobs then we ought to see a positive correlation between unemployment rates and job tenure. Instead, we see the exact opposite, unemployment rates are lowest in the industries with the higher tenure. Of course, this is a raw correlation not a causal estimate. Nevertheless, some of the points are striking.

In the leisure and hospitality industry, for example, the median worker has been in their job only about 2.4 years–that means that well over the half of the jobs in this industry are new since the end of the recession–yet the unemployment rate in that industry is over 8%. With that kind of turnover in jobs its difficult to believe that wages have not adjusted. Or to put it differently, if one were to ask apriori which will have a greater influence on reducing nominal wage rigidity either a) turning over more than half the jobs in the industry or b) a few extra points in the inflation rate then I think most economists would, without hesitation, answer the former. Inflation is not magic.