The future is here, just not evenly distributed

Chiara Criscuolo at HBR discusses a new research report from the productivity group at the OECD.

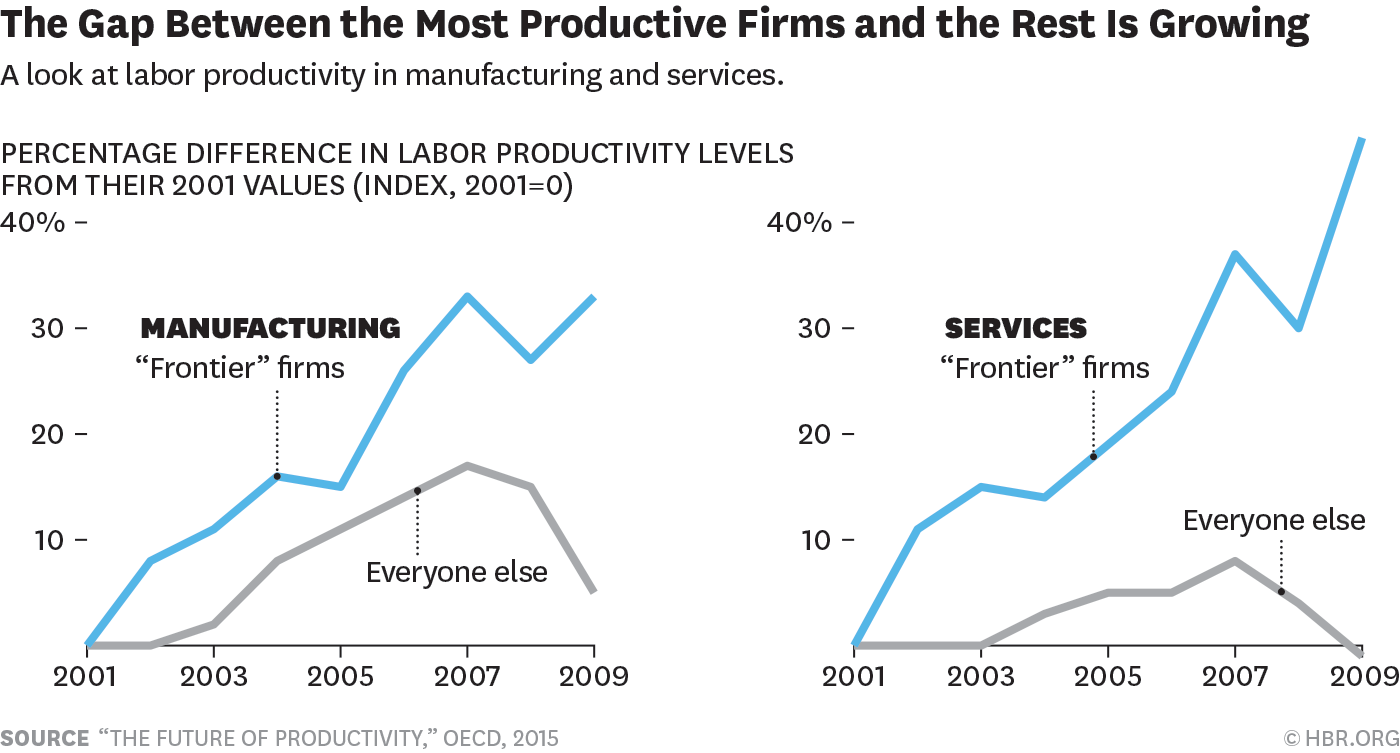

Our research shows that the slow productivity growth of the “average” firm masks the fact that a small cadre of firms are experiencing robust gains. OECD analysis shows that the productivity of the most productive firms – those on the “global productivity frontier” in economic terms—grew steadily at an average 3.5% per year in the manufacturing sector, or double the speed of the average manufacturing firm over the same period. This gap was even more extreme in services. Private, non-financial service sector firms on the productivity frontier saw productivity growth of 5%, eclipsing the 0.3% average growth rate. Perhaps more importantly, the gap between the globally most productive firms and the rest has been increasing over time, especially in the services sector. Some firms clearly “get it” and others don’t, and the divide between the two groups is growing over time.

What this means is that the problem is not a lack of innovation it’s a lack of innovation diffusion. Note that a failure of innovation diffusion is also consistent with the argument that much of the rise in income inequality can be attributed to greater inequality among firms.

Why this is happening is unclear. Patents and other intellectual property being locked up in the frontier firms is one possible answer. Greater diffusion of ideas and people could thus increase innovation.Another possibility is that innovations are embedded in capital so you need new investment to diffuse innovation and business investment has been low for some time perhaps for “cyclical” reasons.

In one sense, these views provide some grounds for optimism. It’s easier to spread good ideas than to create good ideas. My Australia report discusses many levers we can pull to increase innovation diffusion.

If the future is here just not evenly distributed then increasing the speed of diffusion holds the promise of a highly productive catch-up period in which the average advances to the frontier.