Regulation and Rents

Here’s James Bessen writing in the Harvard Business Review:

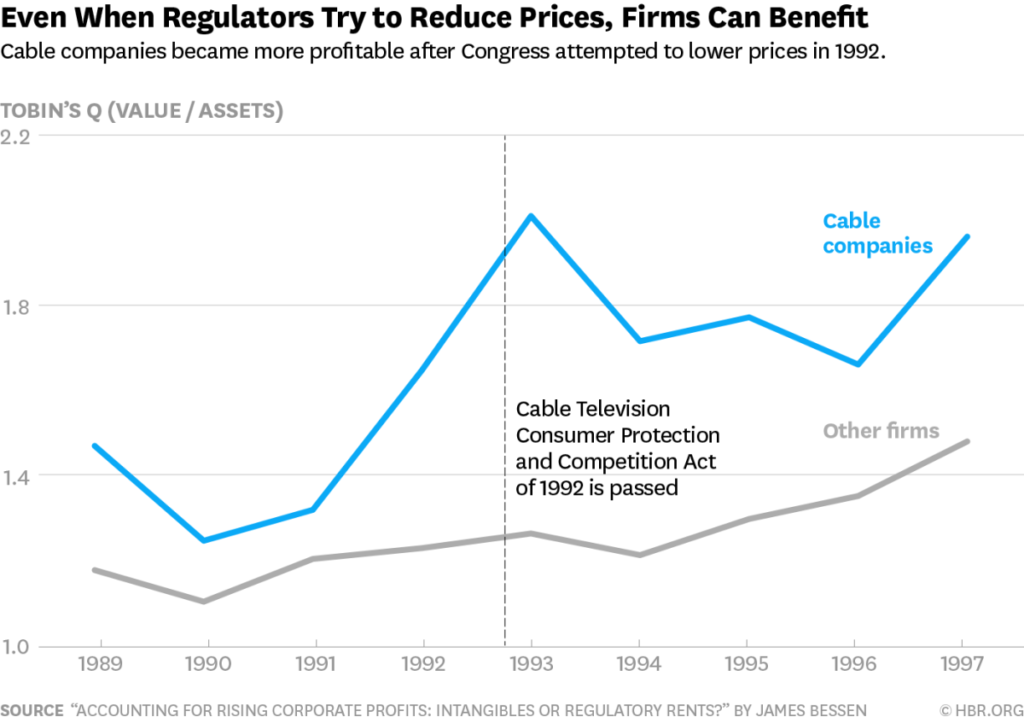

…in 1992 Congress passed the Cable Television Consumer Protection and Competition Act in response to high cable TV rates. Regulators expected cable prices to fall by 10%. Instead, however, cable companies changed their programming bundles, prices did not fall, and corporate valuations increased. The chart below shows that the aggregate market value of cable companies relative to assets (Tobin’s Q) rose following the Act, compared to valuations of other firms.

Regulation doesn’t seem to have reduced profits in the cable industry and may have increased profits. Is there a general lesson here? In a new paper, Bessen finds that the answer is yes:

The pattern around the 1992 Cable Act is representative: I find that firms experiencing major regulatory change see their valuations rise 12% compared to closely matched control groups. Smaller regulatory changes are also associated with a subsequent rise in firm market values and profits.

This research supports the view that political rent seeking is responsible for a significant portion of the rise in profits. Firms influence the legislative and regulatory process and they engage in a wide range of activity to profit from regulatory changes, with significant success. Without further research, we cannot say for sure whether this activity is making the economy less dynamic and more unequal, but the magnitude of this effect certainly heightens those concerns.

Addendum: Reed Hundt, chairman of the FCC from 1993 to 1997, discusses cable TV regulation during this period in the comments.