GDP, GNP, and foreign investment

A few of you have written me to ask what I think of Paul Krugman’s recent posts on tax reform and evaluating it by gnp rather than gdp, the latter being an emphasis in the GOP literature. Paul notes correct that a lower corporate rate will attract foreign investment, and the returns to that investment, by definition, will not accrue to American citizens. So far, so good.

Paul reproduces the following graph for the Czech Republic, ratio of gnp to gdp:

If the GOP literature focuses on gdp, it is fine enough to criticize it on that basis. What worries me, however, is that the corrective doesn’t go nearly far enough. Gnp isn’t the right standard either, nor is gnp/gdp, rather it is welfare, either nationally or globally.

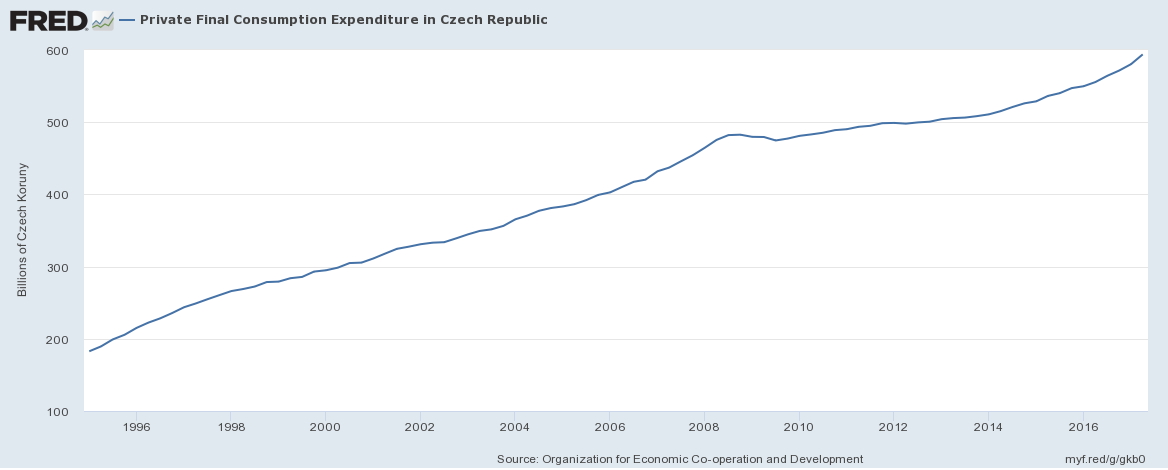

From that gdp/gdp ratio graph, you might come away with a grim view of life in the Czech Republic, but consider this cheerier picture of consumption, which nearly triples over a twenty year period:

Pretty awesome. And under the standard story of the Czech economy, investment from abroad, most of all from Germany, has helped drive those gains. Germany invested more, that boosted wages, improved the local political economy, and transferred some technology and entrepreneurial skills. It is standard international economics, or for that matter Solow model, that capital-rich, lower-return economies should invest in their poorer peripheries (which is not to say it always works out that way).

It’s entirely fair to note that Czech household debt to gdp has risen to about thirty percent. Still, in the U.S. it is about eighty percent, so the Czechs are not in dire straits just yet. Private debt to gdp seems to run about 136 percent, compared to about 200 percent in the U.S.

Of course, this still could end up as a bad deal for the Czechs. They might waste their foreign investment, the accompanying wage gains, the associated external benefits, and end up having to snap back their consumption and see their whole country owned by Germany, China, and others. But that’s not the baseline case. The default assumption is that these are gains from trade like other such gains, in this case gains from trading with foreigners who wish to invest. They are not lesser gains or gains to somehow be subtracted from the overall calculus.

Here is a useful point of contrast. Let’s say I advocated high taxes on foreign trade, on the grounds that “half of the gains from those trades are shared with foreigners,” and therefore we ought to, post-tariff, trade more with fellow citizens, so that only Americans get those gains. We all know why that argument generally is wrong, noting there are some second best cases where tariffs can improve welfare. It’s still wrong when the trades involve foreign investments.

So it is misleading to induce people to mentally downgrade foreign investment as a source of welfare gains. I get that Krugman doesn’t quite say that, but that is the impression his discussion and diagram produces on the unwary. Technically, he might only be criticizing the Republicans internally, using their own gdp standard. The actual produced impression is to cause people to doubt that a lot of foreign capital inflow fully counts as a gain from trade.

America of course is in a quite different position than is the Czech Republic. But the gains from foreign investment into the United States also ought not to be downgraded, either explicitly or by implied presumption.