A Calculation of the Social Returns to Innovation

Benjamin Jones and Larry Summers have an excellent new paper calculating the returns to social innovation.

This paper estimates the social returns to investments in innovation. The disparate spillovers associated with innovation, including imitation, business stealing, and intertemporal spillovers, have made calculations of the social returns difficult. Here we provide an economy-wide calculation that nets out the many spillover margins. We further assess the role of capital investment, diffusion delays, learning-by-doing, productivity mismeasurement, health outcomes, and international spillovers in assessing the average social returns. Overall, our estimates suggest that the social returns are very large. Even under conservative assumptions, innovation efforts produce social benefits that are many multiples of the investment costs.

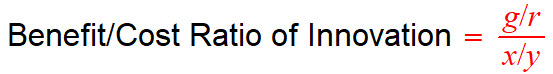

What was interesting to me is that their methods of calculation are obvious, almost trivial. It can take very clever people to see the obvious. Essentially what they do is take the Solow model seriously. The Solow model says that in equilibrium growth in output per worker comes from productivity growth. Suppose then that productivity growth comes entirely from innovation investment then this leads to a simple expression:

Where g is the growth rate of output per worker (say 1.8% per year), r is the discount rate (say 5%), and x/y is the ratio of innovation investment, x, to GDP, y, (say 2.7%). Plugging the associated numbers in we get a benefit to cost ratio of (.018/.05)/.027=13.3.

Where g is the growth rate of output per worker (say 1.8% per year), r is the discount rate (say 5%), and x/y is the ratio of innovation investment, x, to GDP, y, (say 2.7%). Plugging the associated numbers in we get a benefit to cost ratio of (.018/.05)/.027=13.3.

To see where the expression comes from suppose we are investing zero in innovation and thus not growing at all. Now imagine we invest in innovation for one year. That one year investment improves economy wide productivity by g% forever (e.g. we learn to rotate our crops). The value of that increase, in proportion to the economy, is thus g/r and the cost is x/y.

Jones and Summers then modify this simply relation to take into account other factors, some of which you have undoubtedly already thought of. Suppose, for example, that innovation must be embodied in capital, a new design for a nuclear power plant, for example, can’t be applied to old nuclear power plants but most be embodied in a new plant which also requires a lot of investment in cement and electronics. Net domestic investment is about 4% of GDP so if all of this is necessary to take advantage of innovation investment (2.7% of gdp), we should increase “required” to 6.7% of GDP which is equivalent to multiplying the above calculation by 0.4 (2/7/6.7). Doing so reduces the benefit to cost ratio to 5.3 which means we still get a very large internal rate of return of 27% per year.

Other factors raise the benefit to cost ratio. Health innovations, for example, don’t necessarily show up in GDP but are extremely valuable. Taking health innovation cost out of x means every other R&D investment must be having a bigger effect on GDP and so raises the ratio. Alternatively, including health innovations in benefits, a tricky calculation since longer life expectancy is valuable in itself and raises the value of GDP, increases the ratio even more. (See also Why are the Prices So Damn High? on this point). International spillovers also increase the value of US innovation spending.

Bottom line is, as Jones and Summers argue, “analyzing the average returns from a wide variety of perspectives suggests that the social returns [to innovation spending] are remarkably high.”