Integrate Crypto with the India Stack

In India Should Embrace Not Ban Cryptoc I said “the irony is that India has one of the world’s most advanced identity and payments systems, the India stack” and by integrating the India stack with crypto India could take in important step and leapfrog slower to adapt countries. Now iSpirit, the team behind the India Stack, are pushing the idea. They note that the technology developed for India’s Goods and Service Tax can help by providing verified invoice data that can be used for lending.

India’s Goods and Services Tax (GST) helps to address this by generating invoice and payment data in a format suitable for credit underwriting and risk analysis. The GST data also enables a small enterprise in a large value system to provide data and visibility across the supply chain; for example, one can track the progress of parts from a small parts supplier to an auto component manufacturer to a large passenger car maker all the way through to distributors, sub-dealers, and retail sales.

The digital version of an SME’s sales and purchase invoices ledger thus amounts to informational collateral on both the company and the larger ecosystem within which it sits, that could become the basis for extending credit, as an alternative to the hard asset or collateral-based financial system. This is similar to how Square Capital and Stripe Capital already function in the West.

In addition to credit-based financing, the trustworthy records furnished by GST’s informational collateral can also support equity or quasi-equity financing, to support growth without increasing debt. These might take the form of direct equity investments in small businesses, or even personal micro-equity investments in individual consultants or students.

India’s innovation: use new pools of crypto capital to address long-standing financing needs

Accompanying the iSpirit post is a great manifesto by Balaji Srinivasan that explains the India Stack, crypto, and how they fit together.

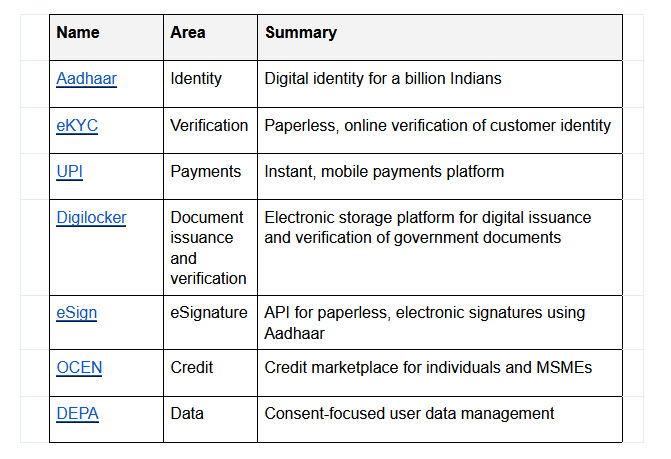

The first step in understanding Crypto IndiaStack is to understand IndiaStack itself. It is a set of national APIs for payments, identity, KYC, e-signature, and document verification that scales to a billion people. Here’s a quick overview of the IndiaStack APIs:

… crypto is now bigger than Bitcoin. It also includes newer blockchains like Ethereum, which have enabled the new world of decentralized finance or “defi” for short. This new space is growing at an astonishing pace, with >25X year-over-over growth. It’s putting Wall Street on the internet and changing the very foundations of how money is represented and invested around the world. And most importantly for our purposes, defi is making huge pools of capital newly available to any Indian with a digital wallet, in the same way the internet made huge swaths of information available to any Indian with a cellular phone.

…defi is to finance what the internet was to information.

By adding both a digital rupee and crypto support to IndiaStack, we could turn every phone into not just a bank account but a bonafide Bloomberg Terminal, giving every Indian the ability to make both domestic and international transactions of arbitrary complexity, attracting crypto capital from around the world, and leapfrogging the 20th century financial system entirely.

How do we get there? In four easy steps:

- Understand what a digital rupee is.

- Add digital wallet support to IndiaStack.

- Add crypto assets to the IndiaStack digital wallet.

- Extend IndiaStack APIs with crypto concepts.

Read the whole thing.

Addendum: On defi see also my earlier piece on Elrond.