The Pandemic JOLTS

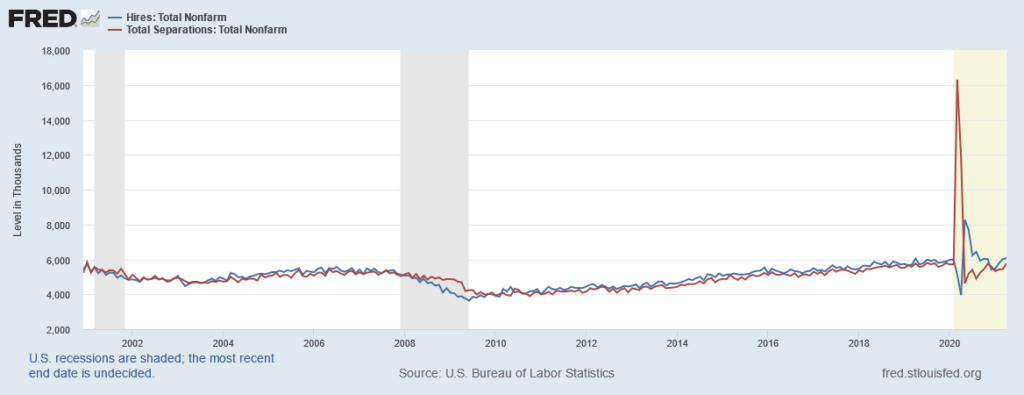

The 2009 recession was big but it followed a very familiar pattern–job separations were a little bit larger than job hires and this lasted for a little less than year which drove up unemployment rates. Unemployment rates then declined slowly as hires became a little bit larger than separations. Now look at the pandemic recession! Separations triple from normal–absolutely unprecedented. Hires then rebound at a slower rate than separations but at a much faster rate than in any previous recession (I haven’t bothered correcting for population since the differences are so large.)

I don’t know entirely what to make of this but we are still debating the Great Depression and the Great Recession so the Pandemic Recession will provide data and questions for a generation of economists. Why, for example, are supply shocks seemingly so much easier for an economy to handle than demand shocks? And why are some demand shocks worse than others? The dot com bust was at least as big a decline in wealth than the housing bust in 2009 but the latter resulted in a much bigger recession. How much was due to policy? How much was due to the fact that the financial system wasn’t so involved in the dot com bust or the pandemic recession? Finance often seems like it doesn’t do so much but why then do things go so badly when the financial system is impeded?