How savage has European austerity (spending cuts) been?

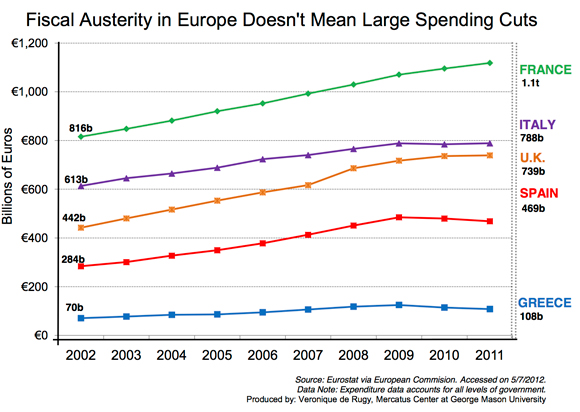

To be sure, there are particular small countries which have made serious spending cuts, in the Baltics most of all. But sometimes one hears it said that an anti-austerity strategy must be EU-wide as a whole, or that austerity is “a failed strategy for the eurozone,” or something similar. So perhaps it is worth looking at some numbers for the larger picture. Here is a graph which puts the matter in some perspective:

Veronique de Rugy, who compiled this data, writes:

First, I wish we would stop being surprised by what’s happening in Europe right now. Second, I wish anti-austerity critics would start acknowledging that taxes have gone up too–in most cases more than the spending has been cut. Third, I wish that we would stop assuming that gigantic “savage” cuts are the source of the EU’s problems. Some spending cuts have been implemented in a few countries. Also, if this data were adjusted for inflation (which I would prefer but the data isn’t available) it would possibly show a slight decrease and certainly a flatter line for all countries. However, the overwhelming take away from the European experience is that a majority of governments haven’t really implemented spending cuts, large or small, and some have even continued to grow.

There is further discussion at the link. Via Pat Lynch, here you will find OECD data, no country is spending below its 2004 level.

Addendum: My response from the comments section:

The real question addressed by this post is how bad spending cuts have been in nominal terms, keeping in mind in the short run it is supposedly nominal which matters (that said, gdp and population [and inflation] are not skyrocketing in these countries for the most part). It is fine to argue “due to automatic stabilizers, spending should have increased more than it did.” That is not how people phrase it, rather they are complaining rather vociferously about “spending cuts,” many of which are either imaginary or extremely small.

From the shrillness of responses, and by the frequency of frame switching, one can see how this post and this data have hit a raw nerve.