The Iceland dust-up

There has been enough coverage that I won’t summarize the entire debate, suffice to say that Krugman offered a picture like this:

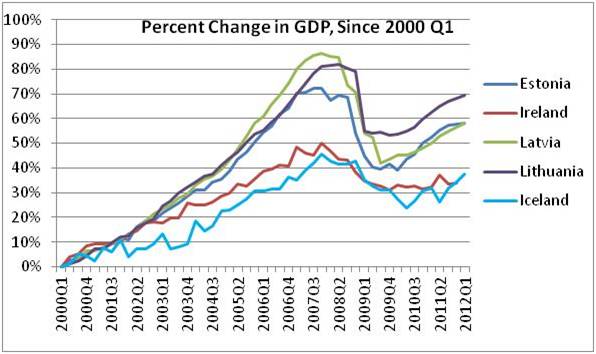

Some writers from the CFR (I am not completely sure how to attribute authorship), offered this picture, along with some analysis and links (and further pictures). The key point is that the second picture considers a longer time horizon, and all of a sudden the relative performance of the different countries has changed:

They argue that in this light, looking over the longer time horizon, the Icelandic story appears mediocre rather than impressive relative to some of the other small countries. A few points:

1. Arvind Subramanian argues we should look at per capita growth and also PPP vs. market exchange rates, read here.

2. Arvind’s point aside, that the pictures give different impressions is more important than either picture taken alone.

3. The second picture brings value-added to the debate, and it suggests stories which the first picture taken alone does not. I’ll come back to that.

4. The debates have mixed together a few different questions, such as “how well have the countries done?,” “how well have the countries’ policies done?,” and “should we be looking at both pictures?” Since the answer to the first two is obviously agnostic — too soon to tell — I will focus on the last of these questions and the answer is yes, we definitely should be looking at both pictures.

Krugman’s response, once you get past the inappropriate insults, doesn’t serve up much. He has arguments against the view “Don’t look at the first picture” but no good arguments against “Look at both pictures very carefully and integrate.”

Ryan Avent offers a more polite response here. He focuses on convergence (maybe we should have expected the Baltics to have outperformed Iceland, so a tie means Krugman wins), but this estimate suggests the fixed exchange rate did not really cost the Baltics much in the way of convergence points. In any case I fear the goalposts are being shifted and what we know about convergence and its speed is iffy anyway; for instance anyone worried about bad monetary policy, and opposing 1980s style RBC theories, should be a convergence pessimist for the short run.

Most importantly, there is still no argument against looking at both pictures in a serious way.

So what additional thoughts come to mind looking at the second picture, which you might not get so much from the first picture alone? Here are two:

a. Some countries simply may be more volatile than others, and this may or may not have to do with their policy responses. I’ll note Cowen’s Second Law, namely that there is a literature on this and the people who work in that literature consider this to be a plausible proposition (which does not mean it is here the operative explanation, however).

b. The size of an initial run-up, possibly bubbly at that, is correlated with the size of the later collapse and also the difficulty of recovering from that later large collapse.

There is a literature on that too, start here, it is not an absurd proposition by any means.

By the way, did I mention a 2009 IMF Staff Report which concluded that Latvian “output exceeded potential by 9 percent in 2007.”? That supports the relevance of b) and possibly a) as well, and it discriminates against Krugman’s story of the peak being a point reattainable through policy management.

I take Krugman to be suggesting something like c): all the relevant information for understanding performance is contained in post-bust policy, so we needn’t look at earlier years and in fact doing so may mislead us.

Yet this attempts to pre-settle the dispute by putting all of the explanatory burden on post-crash policy. In general commentators often overattribute results to policies and in any case we should not build in this bias a priori.

Are you a fan of Dani Rodrik’s “every country is different” hypothesis? If so, you probably should think that both graphs are important. Country characteristics don’t morph away overnight, so earlier data points should matter for understanding current policy results.

If we look carefully at both pictures, I say we still don’t know what is going on, but we do have a richer sense of the possibilities.

From now on these two pictures should be shown and considered together.