Sentences to ponder

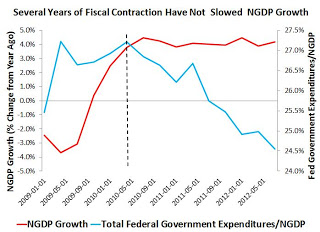

This first figure shows that aggregate demand growth has not been affected by a tightening of fiscal policy since 2010. Specifically, it shows that nominal GDP (NGDP) growth has been remarkably stable since about mid-2010 despite a contraction in federal government expenditures.

That is from Macro and Other Market Musings, and there is another good picture at the link. I understand full well that this is “unadjusted” and one may well argue “growth could have been stronger.” I’ll simply note that I’d like to see discussions of fiscal policy accompanied by this picture as a starting point for analysis.

I would not, by the way, endorse the author’s conclusion about crashing into the fiscal cliff;; for one thing uncertainty and sectoral effects would be significant and would interact negatively with AD effects, even under perfect Fed policy.

For the pointer I thank David Levey.