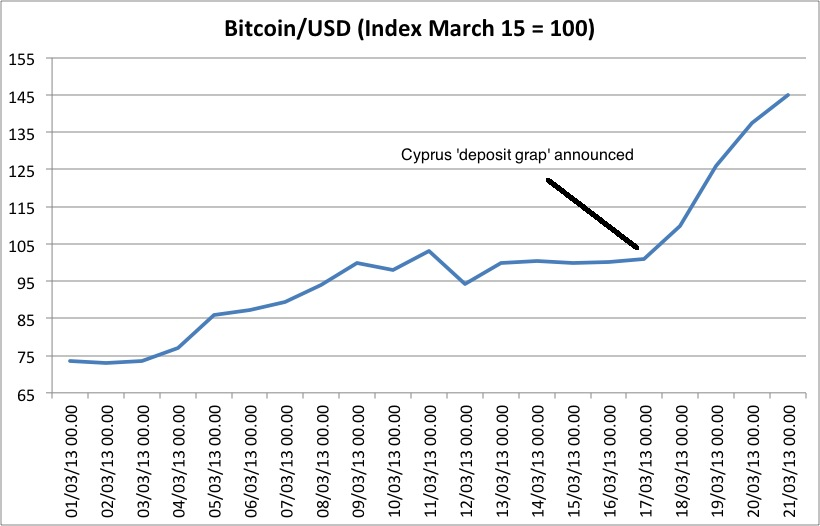

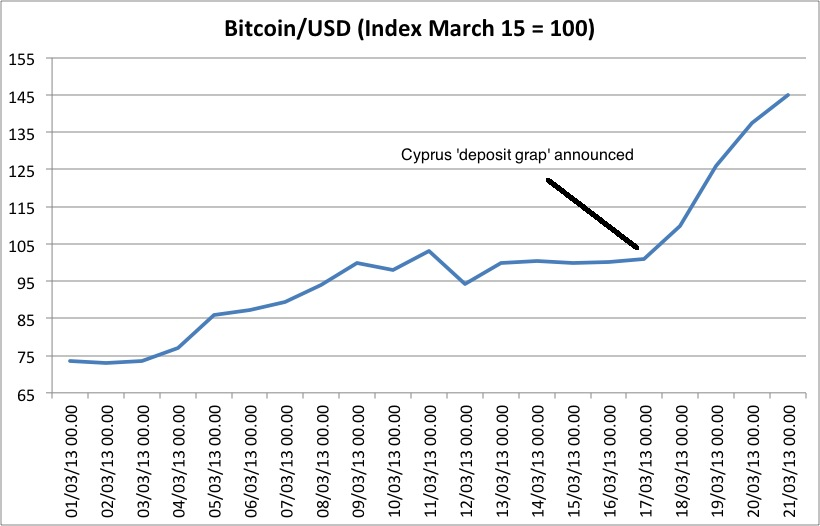

Bitcoin Demand

The Market Monetarist points us to this graph. I wonder whether this is generalized demand or demand from Cypriots/Russians specifically.

The Market Monetarist points us to this graph. I wonder whether this is generalized demand or demand from Cypriots/Russians specifically.