Is the Fed able to offset “austerity”?

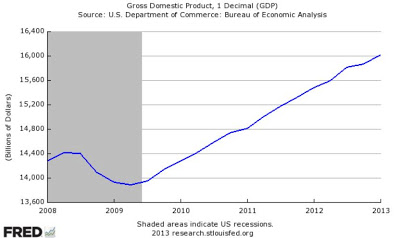

David Beckworth serves up another very good blog post and directs us to this graph of nominal gdp; it seems aggregate demand has been recovering steadily:

Scott Sumner directs us to Marcus Nunes, but here is a quotation from Scott:

In 1937 real government purchases recoiled 4.2% and the economy tanked. In 2012 real government purchases were 4.8% below the 2010 level and the recovery is slow!

Surely something is going on that´s making comparable ‘fiscal austerity’ so much less damning in 2012 than in 1937.

And that ‘something’ is monetary policy.

Here are further remarks from Scott.