Has the U.S. labor market adjusted?

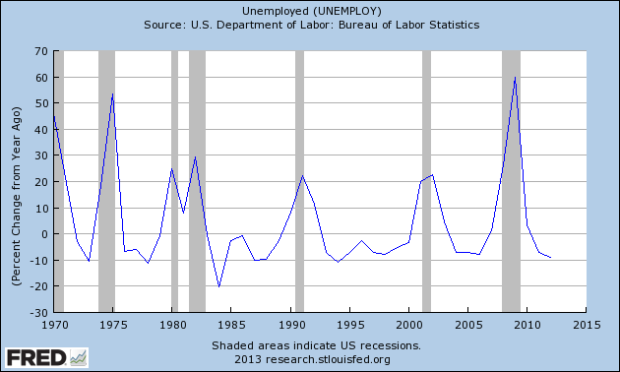

Via Ashok Rao, this is a scary chart:

If read “crudely,” the chart suggests that in terms of percentage changes, we already have seen a historically normal level of adjustment. There is an interesting discussion at the link.

By the way, if you’re not already, you all should be reading Ashok Rao.