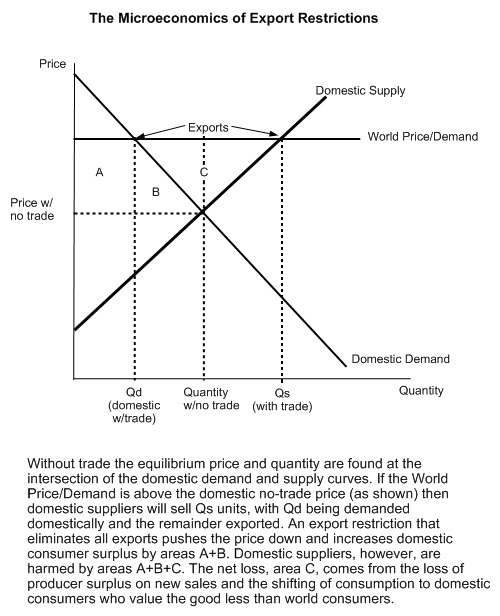

The Microeconomics of Export Restrictions

The typical protectionist measure is a limit on imports such as a tariff or a quota. Restrictions on exports are less common and less discussed but proposals to restrict the exports of natural gas have been in the news recently so perhaps a quick refresher on the protectionism of export restriction is in order. Restrictions on imports harm domestic demanders and benefit domestic suppliers but the harm is greater than the benefit so restrictions on imports create a net social loss. The basic result on export restrictions is similar, export restrictions benefit domestic demanders and harm domestic suppliers but the harm is greater than the benefit so restrictions on exports create a net social loss. The figure gives the analysis. As with import restrictions, the arguments for export restrictions soon turn to spillovers, networks effects, and other second round arguments. Without dismissing these in any particular case, the basic analysis suggest we should be wary of such arguments–the transfer always creates political opposition and any second round gains would have to be larger than the first round net benefits.

Addendum: Matt Yglesias comments. In brief he argues for the tax on Georgist grounds. Just because natural gas comes from land, however, doesn’t make a tax on natural gas equivalent to a tax on land. It’s the value of unimproved land that should be taxed not the value of the improvements, namely the extraction of the gas.