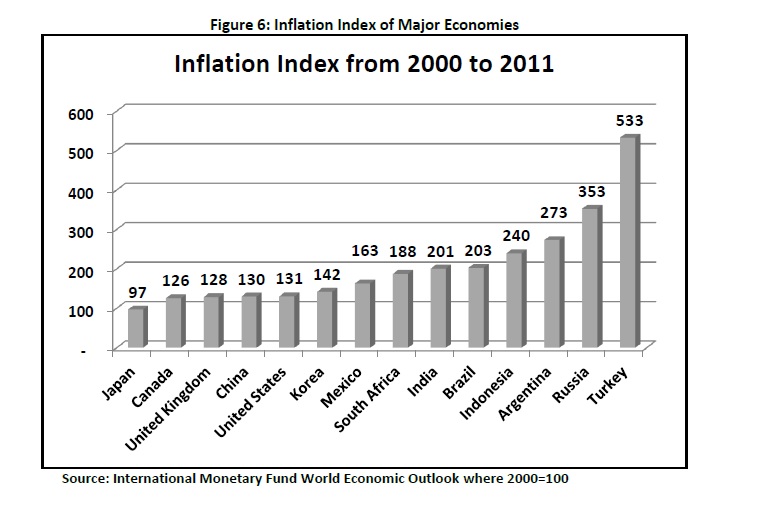

Why are the high growth countries so often the high inflation countries?

That is from this paper by Christopher Balding. South Korea, by the way, during its years of most rapid growth, sometimes had inflation rates of over fifteen percent. I might add that the slow growth countries often see deflation, or deflationary pressures, contrary to what a “naive” supply side model would suggest.

I can think of at least two mechanisms here. First, when economic growth is high and wages are rising rapidly, there may be less public opposition to inflation.

Second, whenever there is lots of growth, markets are forward-looking and the supply of credit outraces the growth of the moment, a’la Long and Plosser (1983). This leads to immediate inflationary pressures.

Of course these two options are not mutually exclusive. In any case, low observed rates of price inflation do not militate against the relevance of supply-side “stagnation-like” shocks, in fact they may point to them.

Addendum: Interfluidity has some interesting speculations on demography and rates of price inflation. Karl Smith offers related comment.