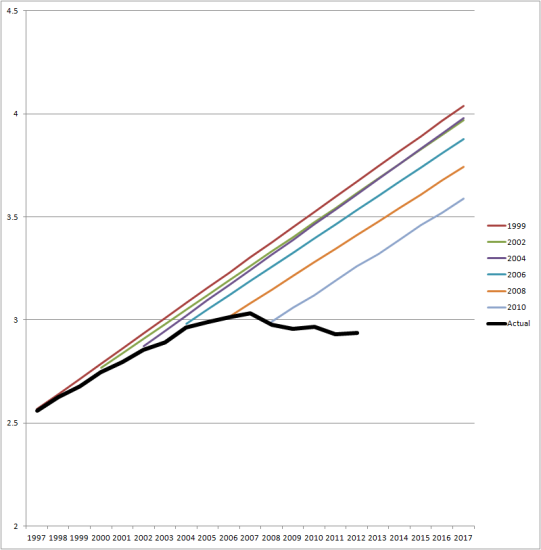

Traffic Forecasts

Official DOT forecasts of road traffic with actual road traffic.

Hat tip to Andrew Gelman, who compares it with some other famous forecasts.

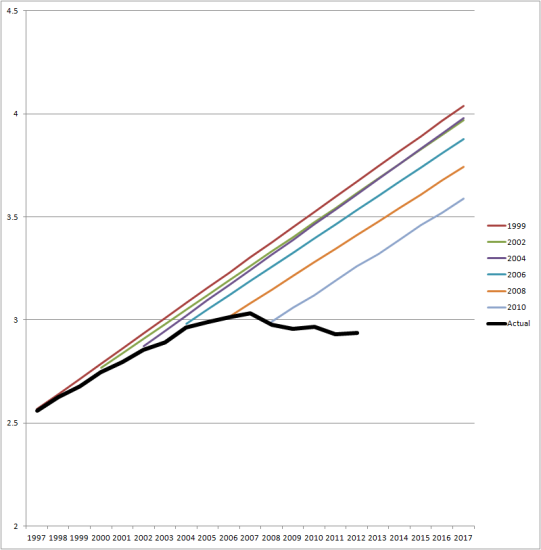

Official DOT forecasts of road traffic with actual road traffic.

Hat tip to Andrew Gelman, who compares it with some other famous forecasts.