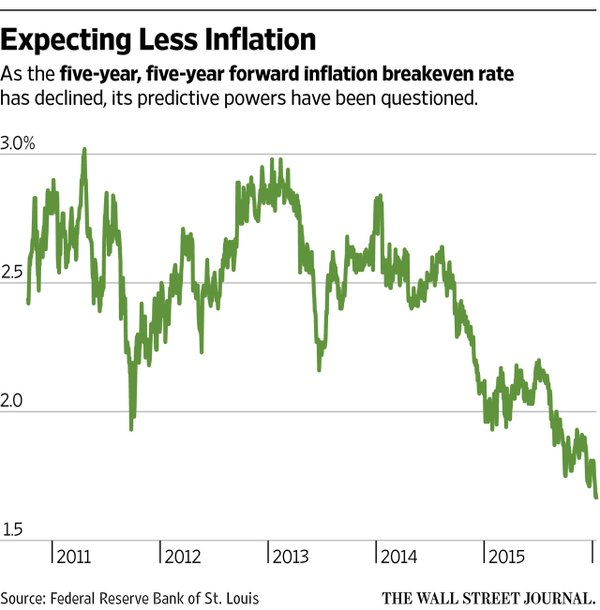

Expecting less inflation

Here is the associated WSJ article. Yes oil is down and the Fed did a slight rate hike, but still the broader lesson is that we are moving into economic corridors we do not understand. I don’t know that any theory has done a good job predicting inflation dynamics. Wages are showing (finally) some very modest growth, so the “we were in a liquidity trap, deflation was delayed because wages are sticky, finally wage are falling” explanation also seems wrong. I also don’t think we will be seeing another Fed rate hike anytime soon.