The problem with ECB corporate bond buying

Yes, it is on the agenda, and those bond prices are up sharply, but there are more eligible bonds in some places than others:

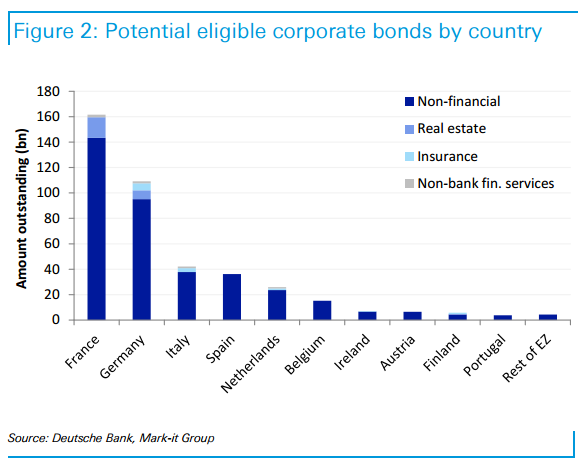

Still BofAML sees €554 billion of debt ultimately eligible for ECB buying out of a European investment-grade universe that they put at €1.6 trillion. Of that €554 billion the vast majority has been issued by French and German credits, a fact which may disappoint some who were hoping for targeted stimulus of the eurozone’s weaker nations.

Deutsche Bank AG Credit Analysts led by Nick Burns see similar figures, estimating around €418 billion of eurozone corporate debt could be eligible for ECB purchases, with the bulk of that coming from German and French issuers.

The more economically integrated United States would not have this problem to the same degree.