The falling returns to venture capital

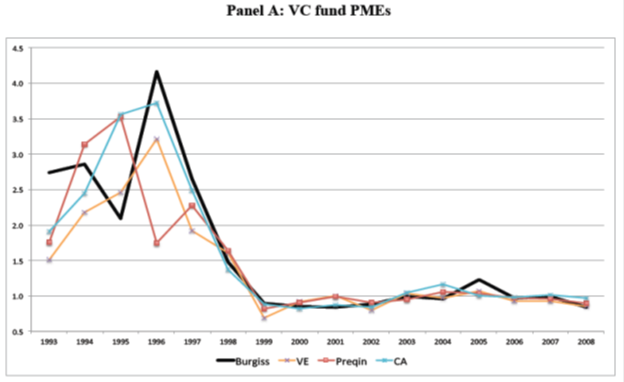

Noah Smith has a very interesting post on this topic, here is one picture, explained more at his link:

Noah wrote:

…that graph sure looks like a structural break to me. Something looks like it broke the VC business model after the dot-com crash. Maybe the new tech bubble (Facebook, etc.) will pump those returns back up, but there have been some big IPOs and some big acquisitions in Tech Bubble 2.0, and VC returns haven’t really bounced back yet, so I’d be cautious. What’s more, I’m starting to read about a slump in venture funding…Could this be the (temporary) end of the VC industry? If so, is it a harbinger of technological stagnation, or simply the passing of a financial fad?

He is drawing upon this recent paper by Harris, Kaplan, and Jenkinson (pdf). As I remarked at a party recently: “We are all stagnationists now.”

Addendum: Tim Worstall adds comment.