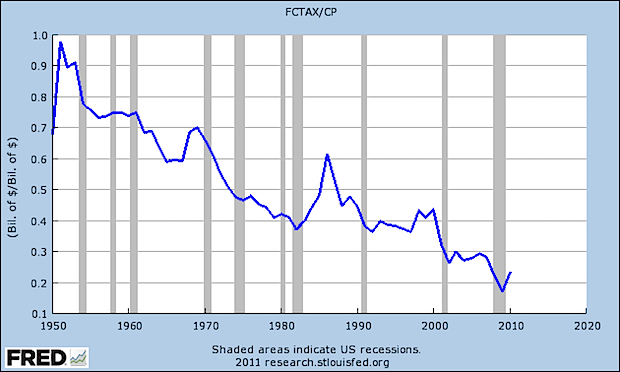

Corporate income tax as a share of corporate profits

That is from Felix Salmon, or try this one, namely corporate income tax as a percentage of gdp:

I still think the corporate rate should be zero, but the corporate income tax is one of the most commonly over-villainized institutions by the intelligent Right.

Addendum: Kevin Drum offers up a related chart.