Innovation Nation v. Warfare-Welfare State (more)

The New York Times has a lengthy piece on the expansion of the welfare state:

The government safety net was created to keep Americans from abject poverty, but the poorest households no longer receive a majority of government benefits.

…Dozens of benefits programs provided an average of $6,583 for each man, woman and child in the county in 2009, a 69 percent increase from 2000 after adjusting for inflation.

…The recent recession increased dependence on government, and stronger economic growth would reduce demand for programs like unemployment benefits. But the long-term trend is clear. Over the next 25 years, as the population ages and medical costs climb, the budget office projects that benefits programs will grow faster than any other part of government, driving the federal debt to dangerous heights.

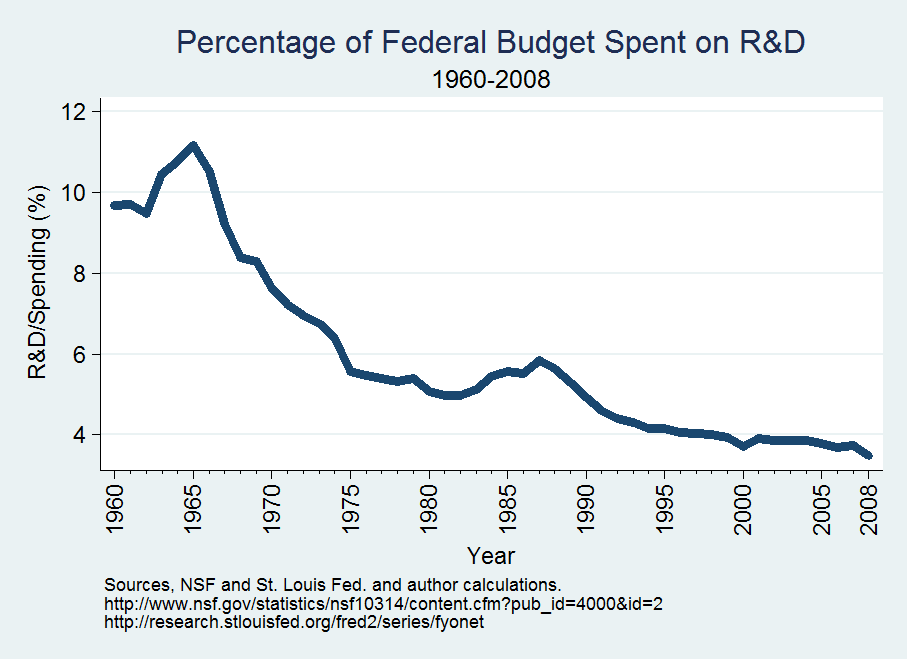

In Launching the Innovation Renaissance (and here) I argue that the warfare-welfare state is crowding out other areas of spending, even when such spending could be highly valuable.