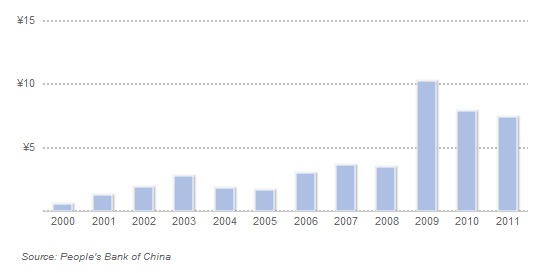

Bank lending in China

With caveats about the data, yes, but still this is striking:

That is from Christopher Balding’s Asia/China blog, the post is here. It is entitled “Why I am Concerned About the Chinese Economy in One Picture.” If you would prefer the words:

From 2008 to 2009 new local currency loans rose from 3.48 trillion rmb to 10.32 trillion according to the PBOC for an annualized increase of nearly 300%.

I do not know if those who praised the Chinese in 2009 for their aggressive stimulus program are having second thoughts, or fearing that the stimulus simply postponed — and intensified — a much-needed adjustment.