Who gained the most from the euro?

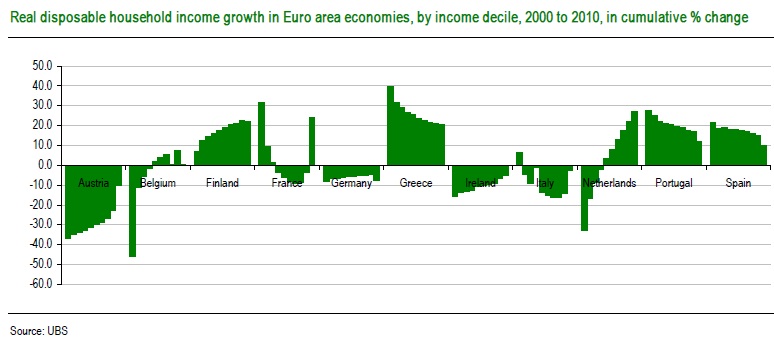

Looking at the growth of real incomes over the first few years of the Euro’s existence, it is hard to argue against the idea that the peripheral countries should be taking more pain now. Core countries have had to accept a decline in real living standards, and it seems unrealistic to expect them to finance an increase in living standards for others.

Here is much more. I don’t agree with all of their methods of assessment, but the piece makes some important (and valid) points.

For all the talk about how much German has benefited from the euro, we learn:

What Donovan and co found is that the lowest-income sections of the more “core” countries saw negative real disposable income growth, while those at the other end of the income scale saw incomes rise still further. In other words, in the core countries, the rich got richer, the poor got poorer.

In other contexts, this pattern is not usually considered a benefit at all. Brad Plumer adds comment, as does Angus.