Does Cable TV Ripoff People Who Don’t Like Sports?

Recently the LATimes ignited a firestorm of anti-sports commentary by arguing that people who don’t watch sports are being ripped off by Cable TV.

A key concern is that the higher bills driven by sports are being shouldered by subscribers whether they watch sports or not.

…”I pay $98 a month for cable and half of that is for sports?” said Vincent Castellanos, 51, a fashion stylist who lives inLos Feliz. “I’ve never once gone to a single sports channel. I wasn’t even aware I was paying for it. I want my money back. Who do I call?”

Derek Thompson at The Atlantic corrected some of the numbers but agreed with the analysis:

If you watch sports, millions of pay-TV households who never click on their ESPN channels are subsidizing your habit. If you don’t watch sports, you’re one of the suckers paying an extra $100 a year for a product you don’t consume.

Kevin Drum demanded a la carte pricing so that:

“sports fans would be forced to pay the actual cost of their sports programming without being subsidized by the rest of us.”

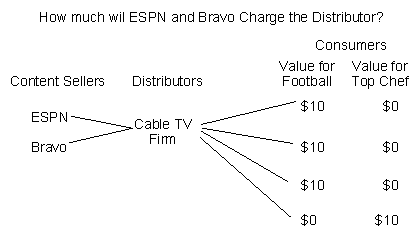

I don’t watch sports very often but I think the commentators have misunderstood the economics of Cable TV and the math of content provision. Let’s consider a simple model, there are content providers such as ESPN and Bravo, distributors such as the cable company and consumers. Let’s assume that there are 4 consumers, 3 of them value football at $10 and Top Chef at $0 and one vice-versa so the model looks like this:

How much will ESPN and Bravo charge the distributors? Bilateral bargaining between content sellers and distributors can be complex but for the point I want to make we can assume that the distributors simple pass on their input costs to consumers. In this case, ESPN will charge the distributor $30 and Bravo will charge $10, the maximum that they can get.

Here is where the LA Times and the others go very wrong – they reason that $30 of the $40 charged is due to sports so each person is paying $7.50 for football ($7.50*4=$30) and $2.50 for Top Chef ($2.50*4=$10) and, therefore, the Top Chef viewer is being ripped off because 3/4 of their bill is going to support programming they never watch! Mathematically this is as true as any other division of total cost but conceptually it makes little sense. Consider, for example, what happens if we add football viewers. With 9 football viewers, ESPN will charge $90 and Bravo $10 and thus the LA Times would conclude that the Top Chef viewer is even more ripped off than before–90% of their bill is going to football! It’s very odd, however, that the ripoff of the Top Chef viewer gets bigger even as the price that they are charged and their viewing habits aren’t changing! Also as we add more football viewers the per-subscriber charge for Bravo gets smaller and smaller, with 10 viewers it’s only $1. Implicitly the LA Times is suggesting that this number represents what a la carte price would be or could be but that’s nonsense–whatever Bravo’s a la carte price would be it doesn’t get lower as we add more football viewers.

Conceptually it’s much clearer to say that each person is being charged $10 for the programming that they most want to watch. Moreover, the reason that Cable TV firms bundle is precisely because by making the demand for their product more homogeneous they can increase profits. In other words, the best bundle for the Cable TV firm is one in which everyone does in fact value the bundle equally.

The bottom line is that there is no reason to think that Top Chef viewers are subsidizing football.