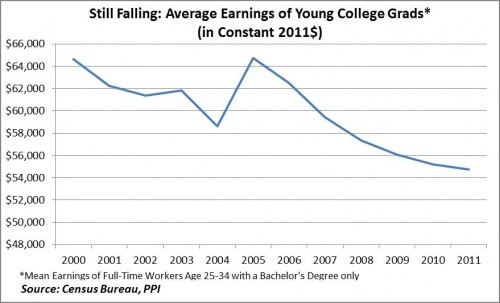

Average earnings of young college graduates are still falling

Alas, take a look:

Diana G. Carew, who works with Michael Mandel, reports:

The latest Census figures show real earnings for young college grads fell again in 2011. This makes the sixth straight year of declining real earnings for young college grads, defined as full-time workers aged 25-34 with a bachelor’s only. All told, real average earnings for young grads have fallen by over 15% since 2000, or by about $10,000 in constant 2011 dollars.

That picture is the single biggest reason why higher education in this country is in economic trouble as a sector. And yes, I do understand that the “education premium” is robust, but that means wages for non-college workers have been hurting as well. At some margin, when it comes to determining how much you will pay for college, the absolute return matters too. The full article is here.