American Austerity (and Growth)

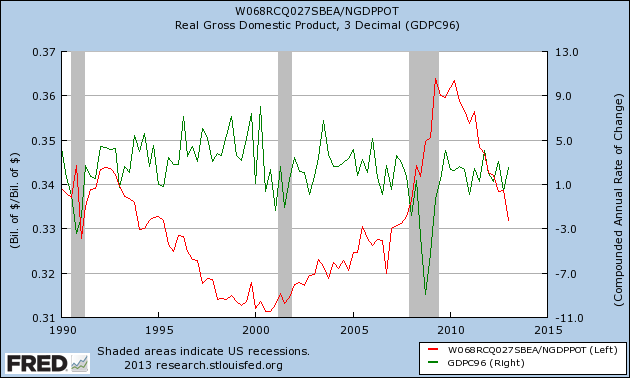

The red line in the chart above is Paul Krugman’s preferred measure of austerity, the ratio of overall government expenditure to potential GDP. The idea of potential GDP has plenty of problems and biases but I want to be more than fair. In his post on American Austerity Krugman warns:

the truth is that federal stimulus is years behind us, while state and local governments have cut back, so the overall story is one of fiscal contraction that’s smaller than in Europe, but not by that much.

…Spending is down to what it was before the recession, and also significantly lower than it was under Reagan. Bear in mind that in the years since the recession began we’ve seen a significant number of boomers reach retirement age, which would ordinarily have led to rising spending, not to mention the effects of rising health care costs. Bear in mind also that the private sector is still deleveraging, which means that government should be spending more to help sustain the economy. So this is actually a picture of very bad policy. (emphasis added)

I assume that by very bad policy what Krugman means is a policy that is likely to have very bad effects. Hence, I have added to Krugman’s graph the growth rate of real gdp (annual rate). I don’t see the very bad effects. In the 1990s growth was strong even while “austerity” was increasing (falling red line) [as this sentence appears to be driving people mad do note that it is a factual description of the data from which I do not draw a conclusion]. More recently, we have seen a big increase in austerity according to Krugman and his measure but although there has been no boom, growth has remained modest. As Justin Wolfers tweeted this morning with the strong jobs report, “the recovery has been remarkably persistent, and resilient,” albeit not rapid. Scott Sumner argues that this is bye, bye Keynesian multiplier as monetary policy stands triumphant (also here) which is one possible interpretation.