The Piketty Bubble?

Piketty’s Capital is not very clear on how to distinguish greater physical capital from higher asset prices. For the most part, Piketty discusses capital as something that builds up over time through savings. The increase in physical capital then generates large returns to rentiers and those returns increases the capital share of income. When it comes to measuring capital, however, this has to be done in money terms which means that we need the price of capital. But the price of capital can vary significantly; as a result, Piketty’s capital stock can vary significantly even without changes in physical capital or savings. When capital increases because of changes in its price, however, the implications are quite different from a physical increase in capital.

Consider an asset that pays a dividend D forever; at interest rate r the asset is worth P=D/r. As r falls, the price of the asset rises. An asset that pays $100 forever is worth $1000 at an interest rate of 10% (.1) but $2000 at an interest rate of 5%. Piketty measures a higher P as more capital but notice that P is high only because r is low. You can’t, therefore, multiply P by some fixed r and conclude that rents have increased. Indeed, in this case rents, the dividend, haven’t increased at all. For the most part, Piketty simply ignores this issue (at least in the book) by arguing that changes in the price of capital wash out over long time periods but that does not appear to be the case in his data.

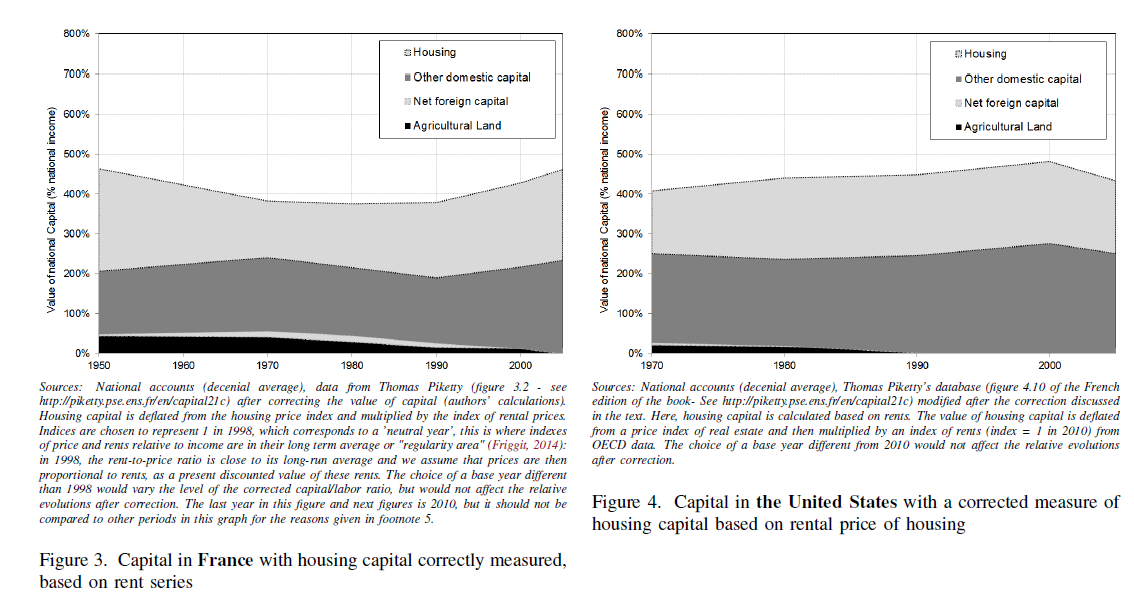

According to four French economists, Piketty’s measure of the capital stock is greatly influenced by the Europe-US housing bubble that preceded the financial crisis (Tyler earlier pointed to the French version of this paper, this is the English version). Since Piketty’s theory is based on rents from physical capital, the authors suggest that measures of housing capital based on prices should be corrected using the rent to price ratio. In other words, if the rentiers aren’t getting more rents then their capital hasn’t really increased. When measured in this way, the authors find little to no increase in the capital stock in either France or the United States.

Addendum: Do note that the debate here is not about income inequality but rather the source of income inequality and the implications for the future that Piketty draws from a (possibly not) rising capital stock.