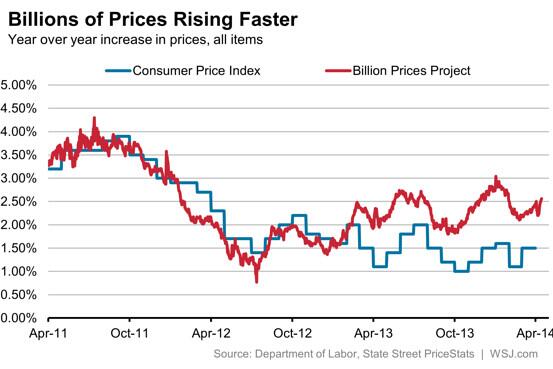

What is the Billion Prices Project showing us about inflation?

The Twitter source is here. I would stress this is speculative, and I am not trying to argue we should panic about higher inflation. I do, however, take this as additional evidence against the view that these days lack of nominal aggregate demand is a major problem.