China fact of the day

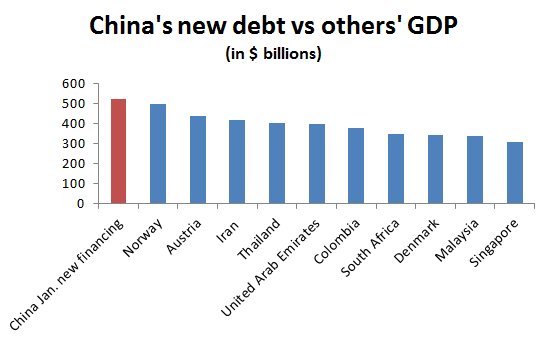

If China’s new debt in January were a country, it would be the world’s 27th-biggest economy.

That is from Simon Rabinovitch.

p.s. they are not deleveraging.

p.p.s. my old method of clicking on the time stamp no longer creates a separate link for a tweet, how do I link to individual tweets now? Or does the algorithm no longer permit this?