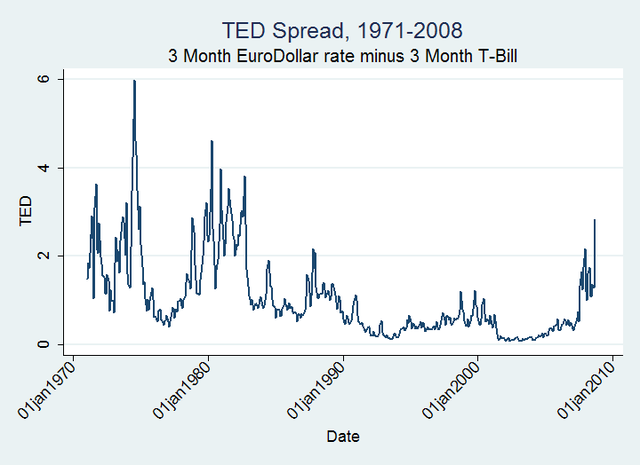

The Long Term Perspective on the TED Spread

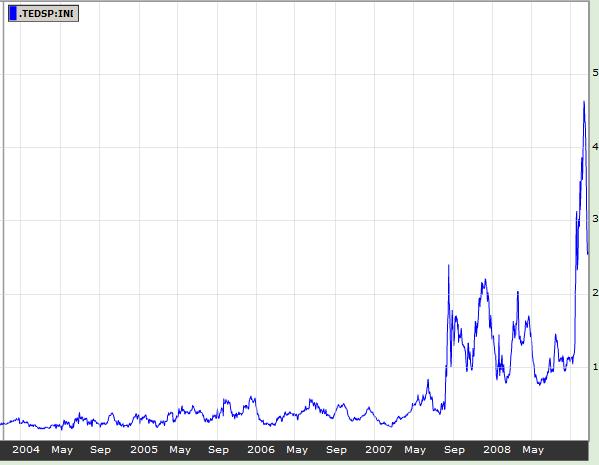

Here is the usual picture of the TED spread from Bloomberg.

I was curious to see a longer-term picture so I collected data on the 3 month Treasury bill rate (TB3MS from the St. Louis Fed.) and the 3-month Eurodollar rate (EDM3 from the Fed.) Note that this is current up to September. Also this is slightly different from calculations elsewhere because it’s on a monthly basis, so some daily jumps are smoothed out, and sometimes a different LIBOR rate seems to be used for the ED rate but the different versions appear to correlate well. The advantage of using these measures is that you can get a much longer time series. Here it is (click to expand if unclear).