What kind of austerity did Great Britain implement in the 1920s?

When it comes to the post-WWI period, Paul Krugman recently argued: “…Britain demonstrated a fairly awesome commitment to austerity…” (and see here today’s post).

The cited IMF report notes with disapproval:

…the U.K. government implemented a policy mix of severe fiscal austerity and tight monetary policy. The primary surplus was kept near 7 percent of GDP throughout the 1920s. This was accomplished through large expenditure decreases, courtesy of the “Geddes axe,” and a continuation of the higher tax levels introduced during the war.

Is this portrait true? I say yes and no. For 1918-1920, government spending plummets, mostly because of demobilization and the end of the war, source here.

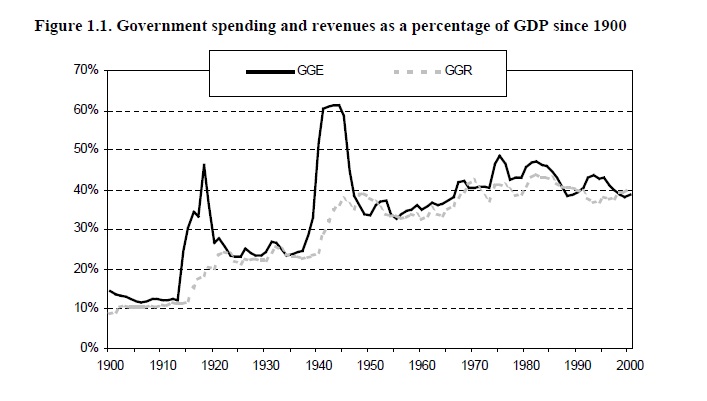

Yet there is an alternative perspective. Even after the demobilization is over, consider that in 1910 British government spending was about 10% of gdp and in the 1920s it runs near 25% of gdp. Is that such an awesome commitment to austerity?

If we consider a more finely grained approach, and focus on shorter-term rates of change, we do see real restraint on the spending side:

…spending was cut by 10% in real terms in two years, while tax as a share of GDP remained constant. The budget deficit was reduced from 7% GDP in 1920 to near balance in 1923, followed by a swift recovery. Defence bore the brunt of the cuts.

As mentioned in the quotation (“followed by a swift recovery”), this transition went reasonably well. If you read this very up to date, very careful with the data paper (try p.10), you see a notable gdp plunge from 1920-1921, mostly from a coal strike and a series of postwar shocks, and then solid growth from 1921 to 1926, running over and after the period when Britain was cutting government spending. It seems that policy was hardly a macroeconomic catastrophe. Things do go south in 1926, but it is well known that is from bad monetary and exchange rate policy, plus a major coal strike.

Or read Barry Eichengreen (pdf). He notes that Britain under-performs relative to other European nations in the first half of the 1920s, although he focuses much more on monetary policy and real factors, rather than fiscal policy. Furthermore, that’s hardly the only period when Britain was under-performing its rivals on the continent.

In other words, I don’t see how the episode as a whole supports the interpretative weight being placed upon it as an anti-austerity parable. Note that when it comes to the U.S. (switching from the UK for a moment), Krugman wrote the entirely defensible sentence: “…even a cursory examination of the available data suggests that 1921 has few useful lessons for the kind of slump we’re facing now.” If the UK in 1921 shows more relevance, that has yet to be shown.