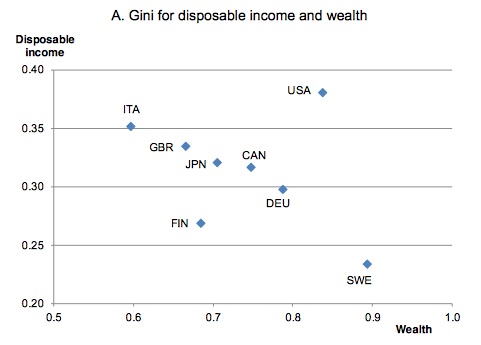

How is income inequality correlated with wealth inequality?

From the OECD, Kaja Bonesmo Frederiksen writes on “More income inequality and less growth” and presents this table:

If you were to fit that with a curve, the overall slope would be negative, suggesting a negative empirical correlation between income inequality and wealth inequality. Now do not leap to a conclusion here, as there are points to be made:

1. This scatter plot is not based on a model with adjustments for confounding factors.

2. These may not be the right or best data on wealth inequality.

3. There are not many data points on this graph in the first place.

4. Lots of other stuff.

The point is that everyone is talking about wealth inequality lately, yet it is not always recognized that the relationship between wealth and income inequality is complex, as illustrated for instance by the case of Sweden. (There is nothing in this post by the way which should be construed as criticism of Piketty, I’m just trying to lay out some basic expository principles.)

Wealth inequality and income inequality may diverge for at least three reasons. First, savings rates may differ across societies. Second, locally available rates of return may differ. Third, the ups and downs of mobility may mean high income inequality in a given year but overall lower levels of wealth inequality.

By the way, here is a good sentence from the abstract:

Wealth dispersion [inequality] is especially high in the United States and Sweden

The support document is here, I have reproduced Figure 3a. Hat tip goes to Luis Pedro Coelho.