The Education Tax Reduces Inequality and the Incentive to Work

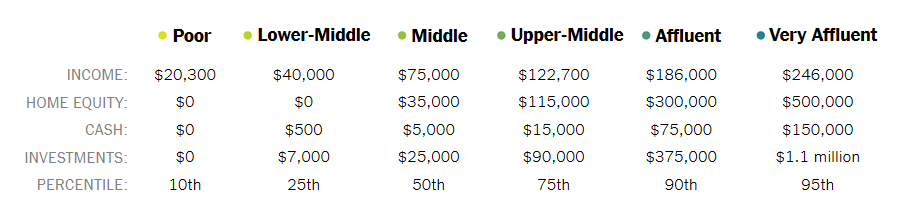

At the NYTimes David Leonhardt breaks families down into six income classes from the poor to the very affluent, defined as follows:

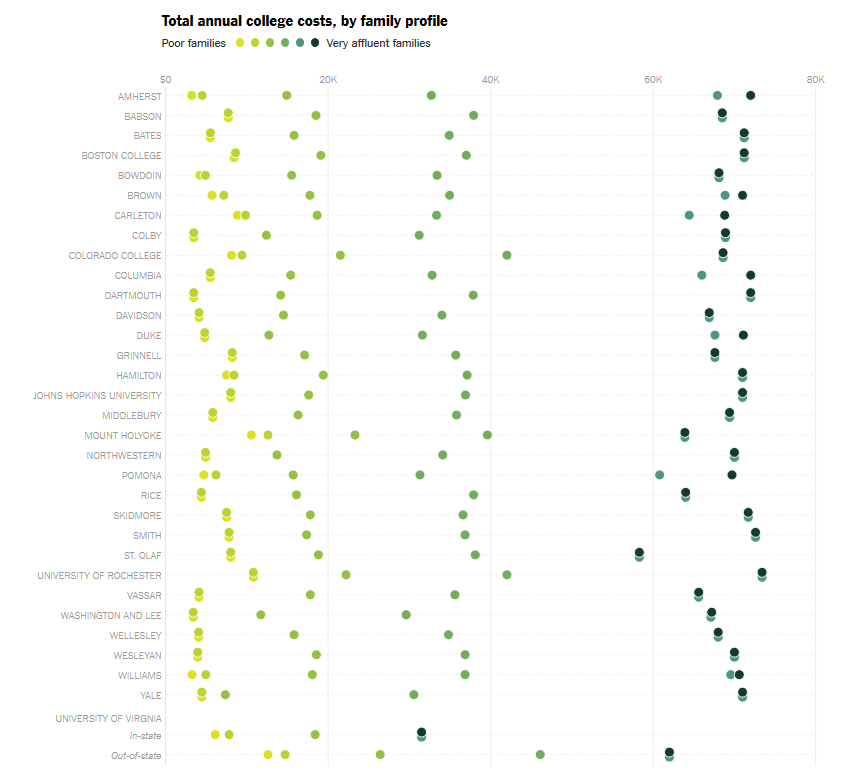

Using a tuition calculator he then estimates tuition (including room and board) by income class at 32 colleges and universities (see below–the darker dots indicate the richer income classes). At many private colleges and universities it is not unusual for some students to be paying $70,000 per year while others pay less than $5,000, for exactly the same education. (Tyler and I provide some similar data on college price discrimination in Modern Principles.) Leonhardt’s point is that a poor student can afford an expensive education and might actually save money by going to an elite private university rather than to a state college.

Price discrimination in education has two other, less recognized, consequences. It reduces income inequality and it reduces the incentive to work. If every firm charged twice as much to someone who earned twice as much, there would no consumption inequality despite high measured income inequality. The rich don’t pay more than the poor when they buy the same basket of goods at the grocery store but they do pay much more for the same education.The Affluent pay approximately $70 thousand for education at the colleges Leonhardt examines while the Upper-Middle pay about half that. The effect on inequality is significant for families with kids in college. An Affluent person is 52% richer than an Upper-Middle income person (186/122=1.52) but an Affluent person with a kid in college is only 33% richer than an Upper-Middle income person with a kid in college (((186-70)/(122-35)=1.33). Shockingly, an Affluent person with two kids in college is actually poorer than an Upper-Middle income person with two kids in college! ((186-140)/(122-70)=0.88.

Under income-based pricing the education tax becomes an income tax with all the negative aspects of income taxes on behavior such as diminished work incentives. Let’s take a closer look at an Upper-Middle income parent earning $122 thousand per year. If this parent gets a promotion or takes on extra work that bumps their salary by $64 thousand, they move from being Upper-Middle income to Affluent. At least on paper. At an income of $122 thousand the parent will be paying approximately $35 thousand to send their child to college but at $186 thousand they will have to pay $70 thousand for the same college so the increase in salary of $64 thousand is an effective increase of only $29 thousand. If the Upper-Middle income parent has two children in college, earning more money actually results in a net loss. For an Upper-Middle income family with two kids spaced in age a few years apart the education tax could be a very severe work disincentive for up to a decade.

The education tax is a peculiar tax as it is often paid to private organizations rather than to the government but it is still a tax and for those of Upper-Middle income the education tax is a very significant tax.

The consequences of the education tax on inequality and work incentives are neither well studied nor well understood.