Declining Labor Force Growth Explains Declining Dynamism

The best paper I have read in a long time is Hopenhayn, Neira and Singhania’s From Population Growth to Firm Demographics: Implications for Concentration, Entrepreneurship and the Labor Share. HNS do a great job at combining empirics and theory to explain an important fact about the world in an innovative and surprising way. The question the paper addresses is, Why is dynamism declining? As you may recall, my paper with Nathan Goldschlag, Is regulation to blame for the decline in American entrepreneurship?, somewhat surprisingly answered that the decline in dynamism was too widespread across too many industries to be explained by regulation. HNS point to a factor which is widespread across the entire economy, declining labor force growth.

The best paper I have read in a long time is Hopenhayn, Neira and Singhania’s From Population Growth to Firm Demographics: Implications for Concentration, Entrepreneurship and the Labor Share. HNS do a great job at combining empirics and theory to explain an important fact about the world in an innovative and surprising way. The question the paper addresses is, Why is dynamism declining? As you may recall, my paper with Nathan Goldschlag, Is regulation to blame for the decline in American entrepreneurship?, somewhat surprisingly answered that the decline in dynamism was too widespread across too many industries to be explained by regulation. HNS point to a factor which is widespread across the entire economy, declining labor force growth.

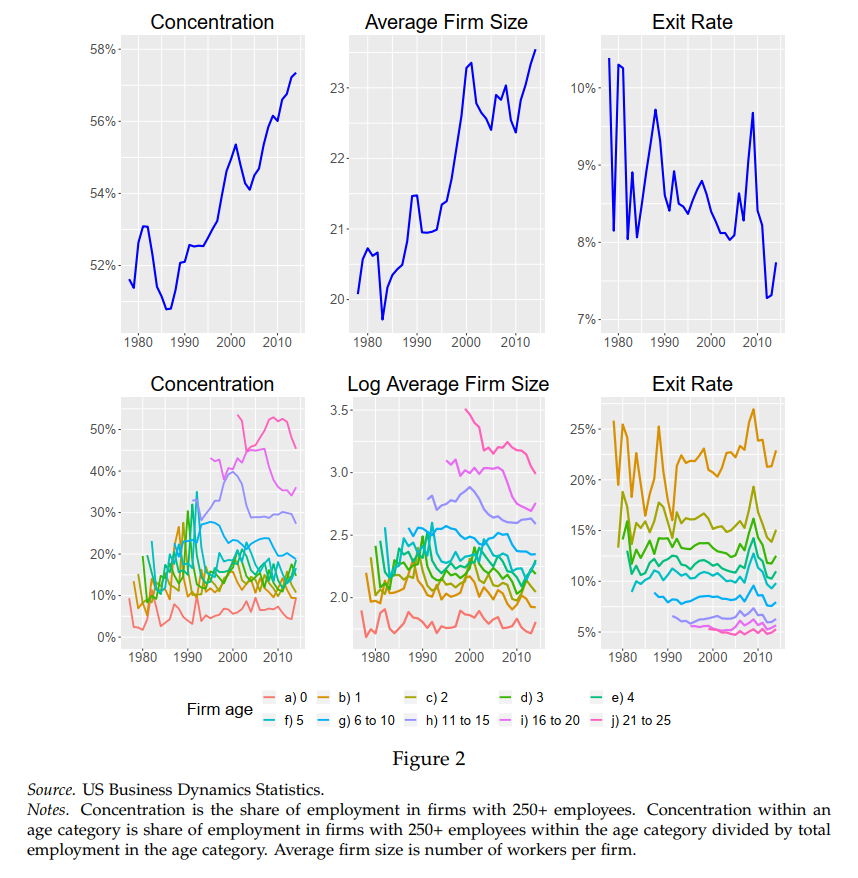

Figure Two of the paper (at right) looks complicated but it tells a consistent and significant story. The top row of the figure shows three measures of declining dynamism: the rise in concentration which is measured as the share of employment accounted for by large (250+) firms, the increase in average firm size, and the declining exit rate. The bottom row of the figure shows the same measures but this time conditional on firm age. What we see in the bottom figure is two things. First, most of the lines jump around a bit but are generally flat or not increasing. In other words, once we control for firm age we do not see, for example, increasing concentration. Peering closer at the bottom row the second thing it shows is that older firms account for a larger share of employment, are bigger and have lower exit rates. Putting these two facts together suggests that we might be able to explain all the trends in the top row by one fact, aging firms.

So what explains aging firms? Changes in labor force growth have a big influence on the age distribution of firms. Assume, for example, that labor force growth increases. An increase in labor force growth means we need more firms. Current firms cannot absorb all new workers because of diminishing returns to scale. Thus, new workers lead to new firms. New firms are small and young. In contrast, declining labor force growth means fewer new firms. Thus, the average firm is bigger and older.

HNS then embed this insight into a dynamic model in which firms enter and exit and grow and shrink over time according to random productivity shocks (a modified version of Hopenhayn (1992)). We need a dynamic model because suppose the labor force grows today, this causes more young and small firms to enter the market today. Young and small firms, however, have high exit rates so today’s high entry rate will generate a high exit rate tomorrow and also a high entry rate tomorrow as replacements arrive. Thus, a shock to labor force growth today will influence the dynamics of the system many periods into the future.

HNS then embed this insight into a dynamic model in which firms enter and exit and grow and shrink over time according to random productivity shocks (a modified version of Hopenhayn (1992)). We need a dynamic model because suppose the labor force grows today, this causes more young and small firms to enter the market today. Young and small firms, however, have high exit rates so today’s high entry rate will generate a high exit rate tomorrow and also a high entry rate tomorrow as replacements arrive. Thus, a shock to labor force growth today will influence the dynamics of the system many periods into the future.

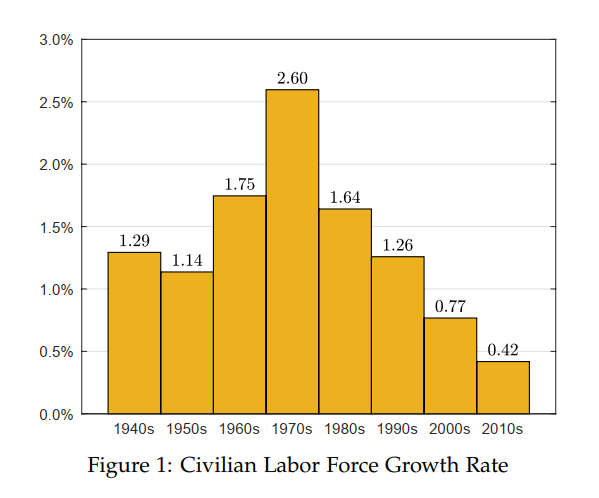

So what happens when we feed the actual decline in labor force growth into the HNS dynamic model (calibrated to 1978.) Surprisingly, we can explain a lot about declining dynamism. At right, for example, is the startup rate. Note that it jumps up with rising labor force growth in the 1950s and 1960s and declines after the 1970s.

So what happens when we feed the actual decline in labor force growth into the HNS dynamic model (calibrated to 1978.) Surprisingly, we can explain a lot about declining dynamism. At right, for example, is the startup rate. Note that it jumps up with rising labor force growth in the 1950s and 1960s and declines after the 1970s.

The paper also shows that the model predictions for firm age and concentration also fit the data reasonably well.

Most surprisingly, HNS argue that essentially all of the decline in the labor share of national income can be explained by the simple fact that larger firms use fewer non-production workers per unit of output. That is very surprising. I’m not sure I believe it.

If HNS are correct it implies a very different perspective on the decline in labor share. In the HNS model for example non-competitive factors do not play a role so there’s no monopoly or markups . Moreover, if the decline in labor share is caused by larger firms using fewer non-production workers then this is surely a good thing. In their model, however, there is only one factor of production so declining labor share means increasing profit share which I find dubious. If production and non-production labor are distinguished it may also be that declining non-production share will redound to production labor so the labor share won’t fall as much. Nevertheless, the ideas here are intriguing and the results on dynamism, which are the heart of the paper, do not rely on the arguments about the labor share.