SlateStarCodex and Caplan on ‘Why Are the Prices So D*mn High?’

SlateStarCodex, whose 2017 post on the cost disease was one of the motivations for our investigation, says Why Are the Prices so D*mn High (now available in print, ePub, and PDF) is “the best thing I’ve heard all year. It restores my faith in humanity.” I wouldn’t go that far.

SSC does have some lingering doubts and points to certain areas where the data isn’t clear and where we could have been clearer. I think this is inevitable. A lot has happened in the post World War II era. In dealing with very long run trends so much else is going on that answers will never be conclusive. It’s hard to see the signal in the noise. I think of the Baumol effect as something analogous to global warming. The tides come and go but the sea level is slowly rising.

In contrast, my friend Bryan Caplan is not happy. Bryan’s basic point is to argue, ‘look around at all the stupid ways in which the government prevents health care and education prices from falling. Of course, government is the explanation for higher prices.’ In point of fact, I agree with many of Bryan’s points. Bryan says, for example, that immigration would lower health care prices. Indeed it would. (Aside: it does seem odd for Bryan to argue that if K-12 education were privately funded schools would not continue their insane practice of requiring primary school teachers to have B.A.s when in fact, as Bryan knows, credentialism has occurred throughout the economy)

The problem with Bryan’s critiques is that they miss what we are trying to explain which is why some prices have risen while others have fallen. Immigration would indeed lower health care prices but it would also lower the price of automobiles leaving the net difference unexplained. Bryan, the armchair economist, has a simple syllogism, regulation increases prices, education is regulated, therefore regulation explains higher education prices. The problem is that most industries are regulated. Think about the regulations that govern the manufacture of automobiles. Why do all modern automobiles look the same? As Car and Driver puts it:

In our hyperregulated modern world, the government dictates nearly every aspect of car design, from the size and color of the exterior lighting elements to how sharp the creases stamped into sheet metal can be.

(See Jeffrey Tucker for more). And that’s just design regulation. There are also environmental regulations (e.g. ethanol, catalytic converters, CAFE etc.), engine regulations, made in America regulations, not to mention all the regulations on the inputs like steel and coal. The government even regulates how cars can be sold, preventing Tesla from selling direct to the public! When you put all these regulations together it’s not at all obvious that there is more regulation in education than in auto manufacturing. Indeed, since the major increase in regulation since the 1970s has been in environmental regulation, which impacts manufacturing more than services, it seems plausible that regulation has increased more for auto manufacturing.

As an empirical economist, I am interested in testable hypotheses. A testable hypothesis is that the industries with the biggest increases in regulation have seen the biggest increases in prices over time. Yet, when we test that hypothesis as best we can it appears to be false. Remember, this does not mean that regulation doesn’t increase prices! It can and probably does it’s just that regulation is not the explanation for the differences in prices we see across industries. (Note also that Bryan argues that you don’t need increasing regulation to explain increasing prices, which is true, but I still need a testable hypotheses not an unfalsifiable claim.)

So by all means let’s deregulate, but don’t expect 70+ year price trends to reverse until robots and AI start improving productivity in services faster than in manufacturing.

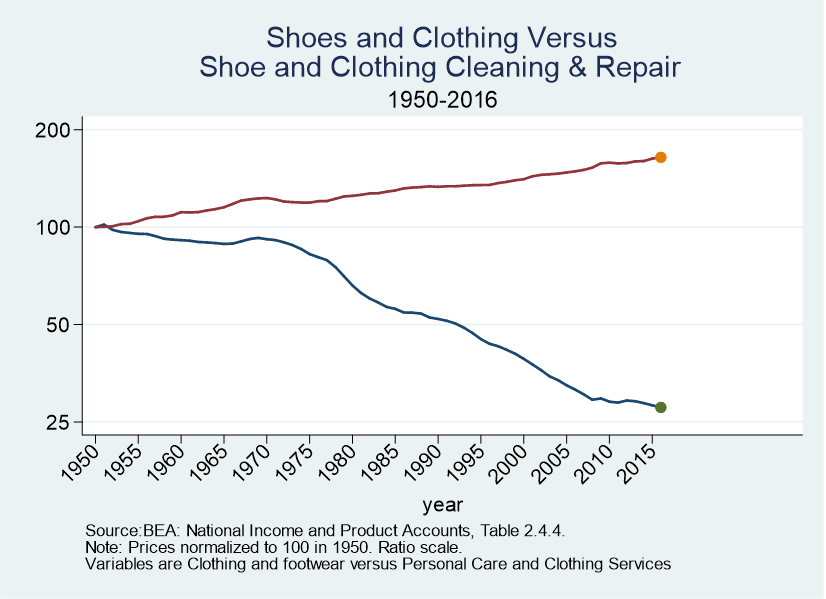

Let me close with this. What I found most convincing about the Baumol effect is consilience. Here, for example, are two figures which did not make the book. The first shows car prices versus car repair prices. The second shows shoe and clothing prices versus shoe repair, tailors, dry cleaners and hair styling. In both cases, the goods price is way down and the service price is up. The Baumol effect offers a unifying account of trends such as this across many different industries. Other theories tend to be ad hoc, false, or unfalsifiable.

Addendum: Other posts in this series.