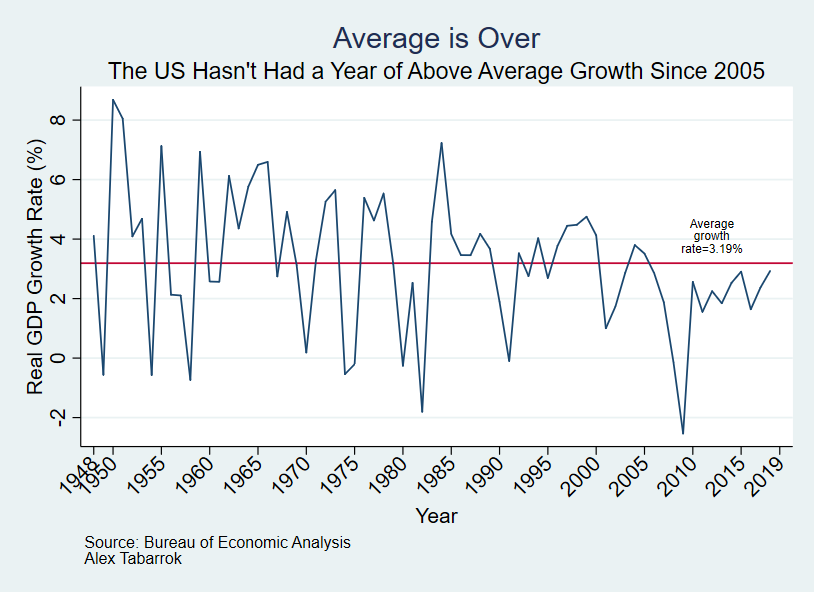

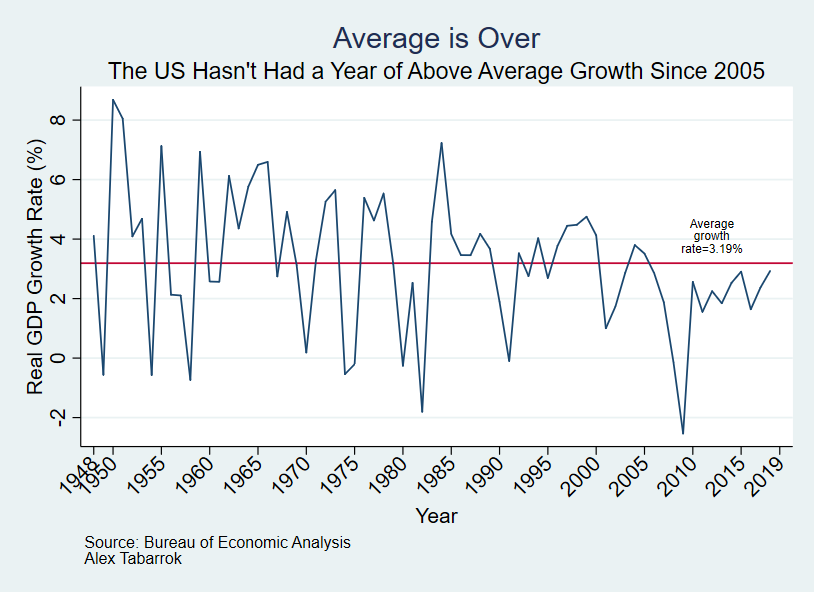

Average is Over: GDP Edition

The United States hasn’t had a year of above-average growth since 2005.

Addendum: With a smoothed series we haven’t had an above average year of growth in the entire 21st century.

The United States hasn’t had a year of above-average growth since 2005.

Addendum: With a smoothed series we haven’t had an above average year of growth in the entire 21st century.