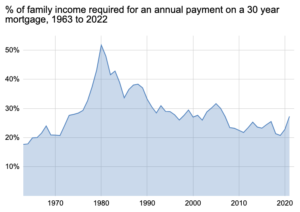

When were U.S. home prices at their worst?

That of course is only one metric, and it focuses on flows rather than homes as an asset. It nonetheless puts a number of matters in perspective. Here it is in words:

1981 was the most unaffordable year for those who need a mortgage, with annual payments consuming a whopping 52% of their income. For comparison, in 2022 mortgage payments require 27% and the absolute lowest point is back in 1963 when only 18% was required. In 2006 (at the peak of the housing bubble), families would need 30% of their income. Thus we can confidently say that 2022 is so far not the worst year in history for those who can’t afford to buy a house without a loan.

Canada and New Zealand seem to be the truly scary places. Here is the full essay by Nikita Sokolsky.