Category: Economics

Crowds are wiser than you think

I’m reading James Surowiecki’s The Wisdom of Crowds – so far, it’s very good! Steve Sailer posted the following comment on the book:

…he doesn’t really explain why pseudo-markets like the Iowa Election Market tend to be more accurate than traditional predictive tools like the Gallup Poll, although the answer is obvious: because they piggyback off traditional sources of information like Gallup. For example, participants in the IEM look at not just the Gallup Poll but a dozen others. Without these pollsters spending large amounts of money to generate information, however, the market players would be pretty clueless. Similarly, if the crowd takes the average of the 11pm weather forecasts of the weatherguys on Channels 2, 4, and 7, they may well beat the best individual forecast, but that doesn’t mean the crowd could beat the professional weathermen — unless the pros first tell them what they think the weather is going to be.

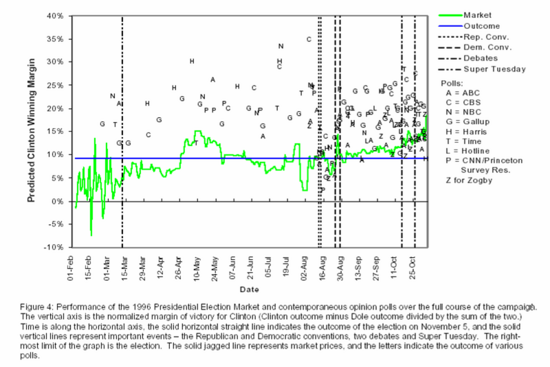

Clearly, there is some truth to this – Hayek said markets are “marvelous” he didn’t say “miraculous.” But a lot more goes on in information markets than averaging. The green line in the figure below (click to expand) shows the Iowa market prediction for the 1996 Presidential election. The blue line is what actually occured. The spots are various polls. Now notice that from February through August every single poll overpredicted Clinton’s victory and every single poll, with but one exception, was above the market prediction. This means that the market prediction could not possibly be an average of the polls.

Surowiecki gives a number of other examples where the wisdom of the crowds cannot be explained by averaging of expert opinion even though averaging is an important reason why crowds can be wise.

A basket for weaker currencies?

Mr [Barry] Eichengreen spells out…an ingenious plan…he proposes the creation of a market for lending and borrowing in a synthetic unit of account, a weighted basket of emerging-market currencies. Such bonds would be popular with investors, since the currency would be more stable than the sum of its parts and, at first at least, carry attractive yields. Importantly, such a market, if it could be established, would eventually let emerging-market economies tap foreign capital without currency mismatches. This is because those, such as the World Bank, that issued such bonds would be keen to reduce their exposure to the basket by lending to the countries in that basket in their own currencies.

The idea is to prevent a mismatch between assets and liabilities:

…some countries’ financial fragility results simply from their need for foreign investment. In the most susceptible countries, firms and banks borrow heavily in dollars, while lending in local currencies. If the value of the local currency wobbles, this mismatch between domestic assets and foreign liabilities is cruelly exposed.

Why are the assets and liabilities of emerging markets so ill matched?…International investors are very choosy about currencies. Most consider only bonds denominated in dollars, yen, euros, pounds or Swiss francs. This select club of international currencies is locked in for deep historical and structural reasons. Thus, poor countries that want to borrow abroad must bear currency mismatches through no fault of their own.

I have no problem with trying the idea, but what can we expect?

First, it remains a puzzle why lenders are reluctant to denominate international loans in anything but the five major currencies (dollar, Euro, yen, sterling, and Swiss franc). So it is hard to know whether another unit of account could join this exclusive club. Perhaps investors would find the basket hard to evaluate or simply unwieldy. They might not want the basket any more than they would lend in Brazilian real, which is the original source of the problem.

Second, say that the basket did become widely used and relatively stable. Underdeveloped countries would then have their liabilities in a stable unit of account but their assets would still fluctuate in value. We would return to a version of the original problem. Now one might hope that the basket-denominated debts would be swapped back into the local currency. But I don’t see any particular reason why such swaps would increase in ease.

Third, if the basket becomes more liquid than its underlying components, the system may be vulnerable to arbitrage and speculation opportunities. Whether these would be stabilizing remains an open question. In essence the price of the basket would tell you where the underlying components are headed. We would have a new version of the “stale pricing” problem.

The Eichengreen proposal represents an old dream, and one that I have been taken with myself: improve risk-sharing simply by creating a new nominal value. This may sound like economic alchemy, but hey, it worked with stock index futures. That being said, in this arena the number of failures far outweighs the number of successes.

Here is one summary of the plan. Here is a useful summary by Eichengreen and Haussman.

Thanks to Chris Danford for the pointer.

Zimbabwe

Zimbabwe continues its short march into barbarism. Here’s is a quote from land minister John Nkomo – sadly reminiscient of early twentieth century history.

Ultimately, all land shall be resettled as state property. It will now be the state which will enable the utilization of the land for national prosperity.

Of course, he was quoted in the government controlled newspaper. And get this, it’s not good enough that the government take the land:

Mr. Nkomo urged farmers to volunteer their land to the state rather than wait for an order, saying, “The state should not be made to waste time and money on acquisitions.”

The people of Zimbabwe are starving because of land “redistribution” could a better example of Robert Lucas’s dictum be found?

China facts

1. Chinese per capita income in 2003 is roughly seven times higher than in 1978.

2. In 2002, in purchasing power parity terms, China accounted for twelve percent of global gdp.

3. The figure drops to only four percent, if we calculate real gdp by exchange rates rather than purchasing power parity.

4. In 1952, Communist China claimed to comprise five percent of global gdp.

2. China accounted for one-third of world economic product in 1820. The figure is from work by Angus Maddison.

These facts are drawn from Tuesday’s Financial Times, an Op-Ed entitled “China is Not Racing Ahead, Just Catching Up.”

Addendum: Bruce Bartlett refers me to Maddison’s data.

Are casinos good for the economy?

People who live near casinos are going broke faster than people who don’t, a new study found.

The growth rate of personal bankruptcies in counties with casinos was more than double that of similar counties without them during the 1990s, according to the study by Creighton University.

On the other hand, the rate of business bankruptcies was significantly lower in counties with casinos, the study showed.

Here are the exact numbers:

The study compared roughly 250 counties across the country with commercial or tribal casinos with non-casino counties with similar demographics. It found the cumulative growth rate on personal bankruptcies in casino counties to be more than 100 percent higher than the non-casino counties between 1990 and 1999.

It also found business bankruptcy rates in casino counties to be 35.4 percent lower than non-casino counties.

Here is one brief summary. Here is the original research.

The more surprising and puzzling result is that business bankruptcy rates are lower when gambling is present, even after adjusting for the quality of the county’s economy. Note that tribal casinos are most frequent in poorer regions. These regions may have fewer local businesses altogether, and thus perhaps those casinos induce personal rather than business bankruptcy. The businesses are owned by outsiders in any case. And if they are chains, perhaps they go bankrupt at lower rates.

I’m all for legalizing (zoned) gambling. The real question is whether we should tax gambling at higher rates than other economic activities.

Addendum: Jeff Smith points my attention to the following NBER paper, of direct interest.

Abolish the FCC

Declan McCullogh is correct.

It’s time to abolish the Federal Communications Commission.

The reason is simple. The venerable FCC, created in 1934, is no longer necessary.

Its justification for existence was weak 70 years ago, but advances in technology since then have eliminated whatever arguments remained. Central planning didn’t work for the Soviet Union, and it’s not working for us. The FCC is now an agency that does more harm than good.

Consider some examples of bureaucratic malfeasance that the FCC, with the complicity of the U.S. Congress, has committed. The FCC rejected long-distance telephone service competition in 1968, banned Americans from buying their own non-Bell telephones in 1956, dragged its feet in the 1970s when considering whether video telephones would be allowed and did not grant modern cellular telephone licenses until 1981–about four decades after Bell Labs invented the technology. Along the way, the FCC has preserved monopolistic practices that would have otherwise been illegal under antitrust law.

These technologically backward decisions have cost Americans tens of billions of dollars….

Read it all here.

Bagel Theft

Twenty years ago an economist got tired of his regular job and started selling bagels. In the morning, he would leave his bagels at offices alongside an honor-box. In the afternoon, he would pick up the leftovers and the payments. Being an economist he kept volumes of data on bagels eaten and payments made allowing him to deduce when and where people were the most dishonest.

Steve Levitt and journalist Steve Dubner write about “Paul F.’s” findings in the New York Times Magazine. Some of the results:

Theft declined 15 percent after 9/11.

People are more honest when the weather is especially good and more dishonest when the weather especially bad.

Smaller offices have lower crime rates, just like smaller cities.

Theft is high near Christmas.

Here’s the byline to the article:

Stephen J. Dubner, an author and journalist in New York City, and Steven D. Levitt, an economist at the University of Chicago, are writing a book about the economics of baby names, cheating, crack dealing and real estate.

Which leads me to wonder, what do these things have in common!

Alex the Statist?

It seems doubtful. Believe it or not, Brad DeLong rises to Alex’s defense and in the process makes a number of excellent points about the market for economists and the economics of predatory pricing.

Two perspectives on the American dollar

Shortly I am headed back from Poland to France, for one more day in Europe. I cannot help but wince at the especially high prices in France, compared to the United States. You may recall my mention of the five dollar chocolate bar; at home I could get the same for less than three dollars.

So a microeconomist might conclude that the U.S. dollar should rise over time. Arbitrage will cause people to buy more in the United States, helping out the dollar.

Or look at interest rates. You can pick and choose various comparisons, but overall they are not bearish for the dollar. That is investors do not expect the dollar to fall. Nominal interest rates on the dollar are low, but people are still holding dollars. So those investors presumably expect the dollar to appreciate.

Let’s bring the macroeconomist into the picture. He tells us that the United States has unsustainably high trade and budget deficits. The only way to clear these deficits, he says, is for the dollar to fall at least thirty percent. We will sell more exports, our trade balance will be restored, and our consumption binge will be checked. Long-run accounts will balance.

Could the macroeconomist be wrong? After all, someone has to be wrong.

If we are comparing the dollar and the Euro, I wonder whether the U.S. is really in a deficit position, all things considered. Even if our measured fiscal position is poorer (this depends who you compare us to), isn’t the American economic future brighter? We have better demographics, a more entrepreneurial culture, and arguably a more robust ability to reform and regenerate ourselves. The optimism of a population counts, though it doesn’t fully reveal itself on this year’s balance sheets.

So will the dollar rise or fall? Should we believe the microeconomists or the macroeconomists?

The nice thing about economics, of course, is that someday we will know. The problem with economics, of course, is that we don’t know now.

For an overview, here is a simple essay by Hal Varian on exchange rates. Niall Ferguson, a dollar pessimist, offers political commentary.

I am indebted to conversations with John Nye for some of the ideas in this post.

Average vs. marginal tax rates

Not long ago I asked whether the marginal or the average tax rate had more influence on economic behavior. Too often economists take the measured marginal rate as the true trade-offs faced by the individual.

The ever-insightful Randall Parker recently emailed me the following, in support of the point:

1) People in conventional regular jobs do not have total control over how many hours they work or their income. For lots of jobs it is all or nothing. Either you work full time or you don’t work at all. You are on a salary. What you make is what you make. The marginal tax rate for the next dollar doesn’t matter to you since you don’t have much control over whether you get a raise.

You can’t boost or lower your income much in a given year. The alternatives that would give you more control are too risky or lower in income per hour worked or unappealing in some other way.2) People in entrepreneurial pursuits often have far less predictability of income. It is hard to work harder or less hard in a given year as a reaction to marginal tax rates because you just do not know how many of the deals you are working on will close by the end of the year or when various billables out there will generate a check in your in-box. Believe me on this one if you haven’t been in this position. It is a real situation for lots of people.

3) You can’t predict in advance what your tax burden will be. Hey, only the tax expert can figure it out. How much will you get to keep? You’ll find out when he tells you. Kinda hard to behave during the work year as if you are responding to a known marginal tax rate at any given point.

4) Customers won’t let you respond to a known marginal tax rate. Again, this is a variation on the theme of a lack of control. You make deals early in the tax year and earn income at a low marginal tax rate. Then as the year goes along you keep a smaller fraction of what you earn. What to do about it? Laze off. Take a trip. Oh wait, your customers won’t let you. Still want them to be there in January when the marginal tax rate drops again? Well, you have to work hard to service their needs in the last 6 months of one year to get the lower tax rate income of the first six months of the following year. This means you have to work at a high marginal rate to get the low marginal rate income. Thinking of your tax rate as an average then makes more sense, doesn’t it?

5) On an even longer time scale people choose their careers at the beginning in part based on what they will make. If an economy has a high marginal tax rate then that can be an incentive to choose a less demanding and lower income career path. In that scenario it may make more sense to go for high job security since you could be faced with a tax schedule where you get more after-tax income making say, $50,000 for two years in a row than making $200,000 one year and $0 the next year.

I’d expect a shift toward lower marginal tax rates to most heavily impact career choices. So the impact would gradually increase as more people managed to retrain for higher income careers.

The bottom line: If you want to encourage private economic activity, don’t focus obsessively on measured marginal tax rates. True marginal rates tend to move closely with the size of government more generally. I’ve said it before and I’ll say it again: government spending is a better measure of our fiscal burden than marginal tax rates.

My thanks again to Randall for writing. And while you are at it, read Randall’s post on how trade protectionism makes us fatter and less healthy.

Addendum: Here is a useful recent piece on what the Laffer curve was all about, by Laffer himself.

Markets in everything, for the newspaper fanatic

I usually read six newspapers a day, and enjoy every one of them (can you guess which six?). But what to do on vacation, especially when traveling abroad? I hate reading papers on-line, plus I left all my passwords at home. And Polish newsstands are of varying quality.

Try NewspaperDirect.com, which delivers print-on-demand copies of your favorite paper directly to your hotel. Here is Poland I am enjoying the American edition of USA Today, and reading about the NBA Playoffs in depth. But hey, if the Lichtensteiner Volksblatt is your thing, you can get that too.

Mourning in America

Reagan was the first, and so far the only, politician who I have ever found inspiring. I came of political age during the Reagan years when I was a high school student in Canada. In political science class we learned that the essence of the Canadian philosophy of government could be remembered with the mnemonic POGG – peace, order, and good government. I preferred life, liberty, and the pursuit of happiness and hearing Reagan speak was always a thrill for me.

The record, of course, is never as glorious as the rhetoric but a number of important accomplishments occured under Reagan’s watch. In the economic sphere, the reduction in marginal tax rates was a great and lasting achievement. It’s hard to believe today that top marginal rates used to approach 70%.

Reagan also deserves great credit for standing up to the air traffic controllers thereby sending a strong signal that the country would not be taken hostage by the labor unions as had happened and continues to happen in much of Europe.

Inflation was also brought under control under Reagan – the 1982 recession was second only to that of the Great Depression but it’s hard to see how that pain could have been avoided. Reagan had the fortitude to take the political heat of the downturn and stay the course thereby laying the groundwork for growth in the following decades.

Deregulation began under Carter but continued under Reagan, leading to innovation in previously moribund industries.

In foreign policy of course, Reagan saw further than anyone else. Only Reagan predicted that communism would end up on the dustbin of history and at critical moments he took the actions necessary to make it happen.

Not all was positive of course but the rest can wait for another day.

The benefits of corruption

Increases in the price of rice are making a bad situation worse in Haiti. The problem, however, is not solely due to increases in the world price but also because, believe it or not, Haiti has customs duties on rice even though most people can afford nothing else for their one meal a day.

[Under Aristide] an Aristide crony received a near exclusive concession on rice imports and evaded customs duties. That evasion allowed the rice concessionaire to cut about $3 a bag off the market price, pass some of the savings on to the market and pocket the rest.

The new government is apparently less corrupt or at least the lines of corruption have not yet been formed, and as a result the price of rice has risen.

Exchange rates

Imagine living in a world where you had to have yen to buy a TV, renminbi to buy toys, and dollars to buy food. Think how complicated life would be.

Surprise. That’s the world we live in. Most TV’s we buy are manufactured in Japan, most toys come from China, and most of our food is produced in the United States. And by and large, the workers who produce those goods want to be paid in their domestic currency.

Luckily, this complexity is hidden from consumers; those nice currency traders handle all the grungy details.

That’s the introduction to an admirably clear introduction to exchange rates by Hal Varian writing in the Times.

Retail gas pricing

“Zone pricing,” is what the gasoline industry calls price discrimination – wholesalers charge less to stations in zones with many stations and more to stations in zones with few stations. Legislators take one look at “zone pricing” and assume that they can lower prices by requiring wholesalers to sell to everyone at the same, “non-discriminatory,” price.

Let’s assume that the legislators are succesful in lowering prices in high-price zones. Do you think that the retailers in these zones will pass the price reductions on to their customers? Of course, not. The reason prices are high in zones with few stations is that stations in these zones have greater market power. It’s this fundamental fact that makes prices higher in these zones – all price discrimination at the wholesale level does is change who gets the profits. With price discrimination the wholesalers get the profits, with uniform pricing the retailers get the profits.

So consumers in high-price zones don’t benefit from ending zone pricing but what about consumers in the low-price areas? If forced to charge a single price do you think that wholesalers will charge the lowest of their zone prices? Of course not – they will charge an average of their zone prices. As a result, consumers in highly competitive zones will face higher prices under uniform pricing.

Thus uniform pricing makes retailers better off at the expense of wholesalers and consumers.

Not sure if the analysis is right? Our colleague, Bart Wilson, is the author (with Cary Deck) of an excellent new paper on retail gasoline pricing. Wilson and Deck setup an experimental market with retailers, refiners and gasoline customers (the latter are computer agents) and find exactly these results. The Wilson and Deck paper is powerful evidence because an experimental market is a real market – it just happens to be a real market under the careful control of an experimenter.

Wilson and Deck also analyze divorcement (requiring wholesalers to divest themselves of retail stations – very bad for consumers because of the double monopoly problem) and the puzzling phenomena called “rockets and feathers” – the tendency of prices to rise faster with costs than to fall with costs. The full paper is here but they have also published a very good “executive summary” in Regulation, one of my favourite journals.