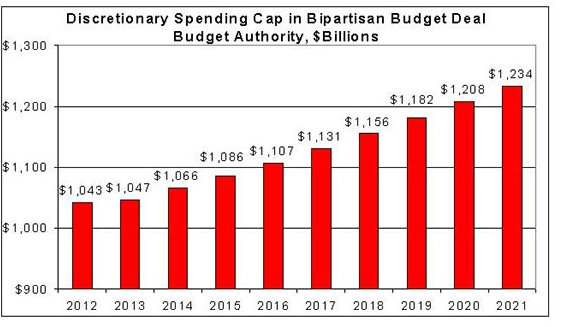

Discretionary spending over the next ten years

Drawing on Chris Edwards, Will Wilkinson relays the picture:

Believe it or not, some people are flipping out over this outcome. Do read Will’s entire post. And for Tea Partiers out there: is this the best the nuclear option can get you? I’d say rethink your theory of public opinion.

For those who want it, a rescaled graph is here, it still goes up!